Answered step by step

Verified Expert Solution

Question

1 Approved Answer

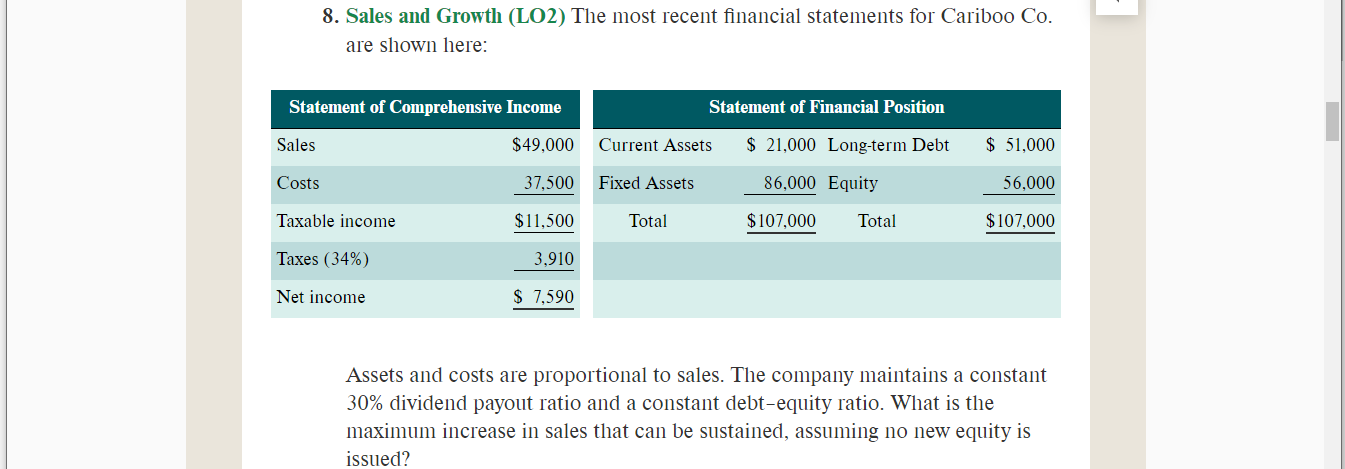

8. Sales and Growth (LO2) The most recent financial statements for Cariboo Co. are shown here: Statement of Comprehensive Income Statement of Financial Position

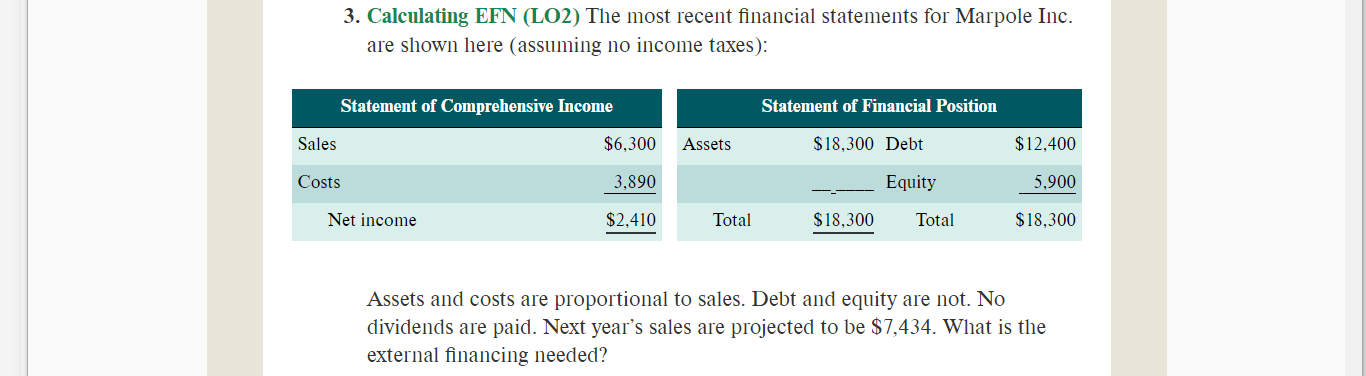

8. Sales and Growth (LO2) The most recent financial statements for Cariboo Co. are shown here: Statement of Comprehensive Income Statement of Financial Position Sales $49,000 Current Assets $ 21,000 Long-term Debt $ 51,000 Costs 37,500 Fixed Assets Taxable income $11,500 Total 86,000 Equity $107,000 56,000 Total $107,000 Taxes (34%) 3,910 Net income $ 7,590 Assets and costs are proportional to sales. The company maintains a constant 30% dividend payout ratio and a constant debt-equity ratio. What is the maximum increase in sales that can be sustained, assuming no new equity is issued? 3. Calculating EFN (LO2) The most recent financial statements for Marpole Inc. are shown here (assuming no income taxes): Statement of Comprehensive Income Statement of Financial Position Sales $6,300 Assets $18,300 Debt $12,400 Costs 3,890 Equity 5,900 Net income $2,410 Total $18,300 Total $18,300 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $7,434. What is the external financing needed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Retention Ratio can be computed as 1 payout 1 30 70 Return on Equity can be computed as Net Income E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e80475e302_880865.pdf

180 KBs PDF File

661e80475e302_880865.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started