Answered step by step

Verified Expert Solution

Question

1 Approved Answer

# 8 Sandra deposited $605 each month into her retirement, starting her senior year at FIT. She diversified her portfolio, so the interest rate

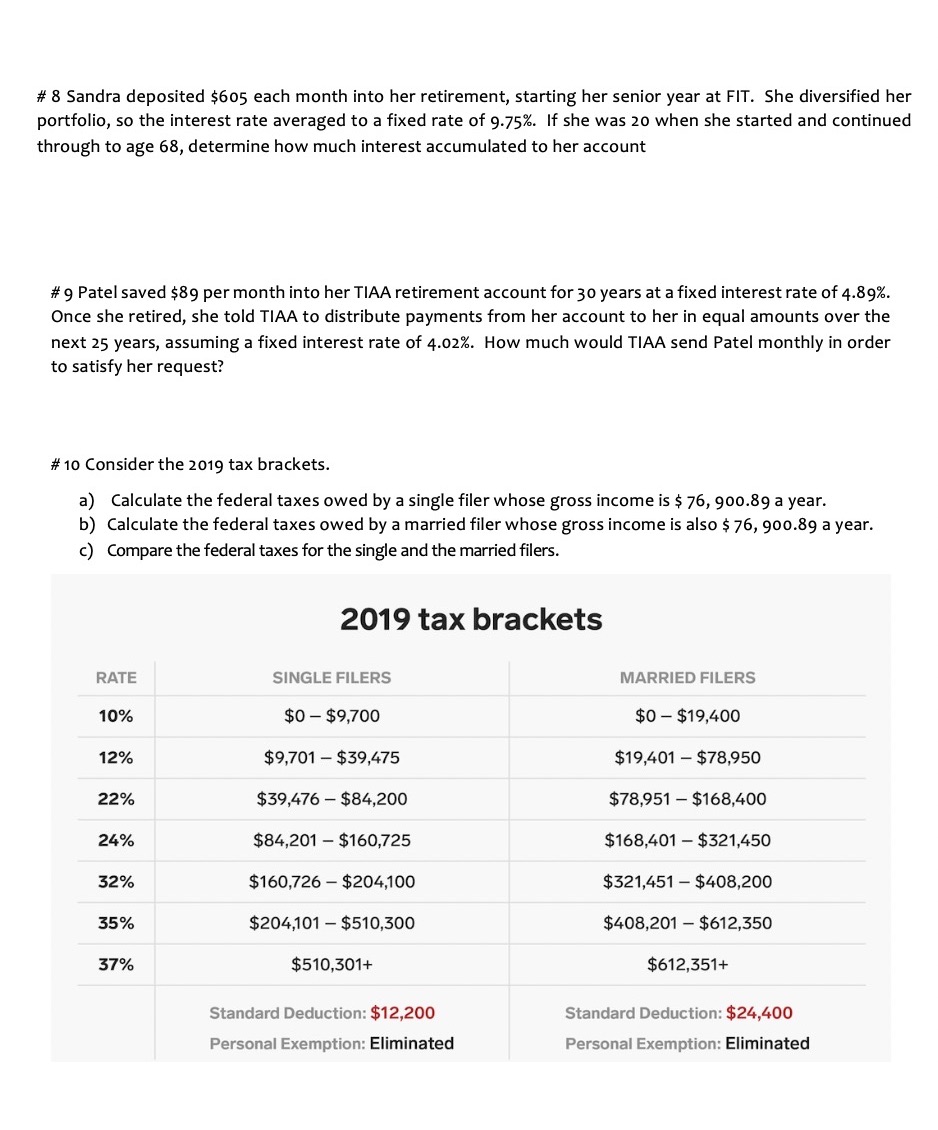

# 8 Sandra deposited $605 each month into her retirement, starting her senior year at FIT. She diversified her portfolio, so the interest rate averaged to a fixed rate of 9.75%. If she was 20 when she started and continued through to age 68, determine how much interest accumulated to her account #9 Patel saved $89 per month into her TIAA retirement account for 30 years at a fixed interest rate of 4.89%. Once she retired, she told TIAA to distribute payments from her account to her in equal amounts over the next 25 years, assuming a fixed interest rate of 4.02%. How much would TIAA send Patel monthly in order to satisfy her request? #10 Consider the 2019 tax brackets. a) Calculate the federal taxes owed by a single filer whose gross income is $ 76, 900.89 a year. b) Calculate the federal taxes owed by a married filer whose gross income is also $ 76, 900.89 a year. c) Compare the federal taxes for the single and the married filers. 2019 tax brackets RATE SINGLE FILERS 10% $0 - $9,700 12% $9,701 - $39,475 22% $39,476 $84,200 24% - $84,201 $160,725 32% $160,726 $204,100 35% $204,101 $510,300 37% $510,301+ Standard Deduction: $12,200 Personal Exemption: Eliminated MARRIED FILERS $0 - $19,400 $19,401-$78,950 $78,951-$168,400 $168,401-$321,450 $321,451 $408,200 $408,201-$612,350 $612,351+ Standard Deduction: $24,400 Personal Exemption: Eliminated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine how much interest accumulated in Sandras retirement account we can use the formula for compound interest A P1 rnnt P Where A Total amount accumulated P Monthly deposit r Annual interest r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started