Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Show that a term structure model with flat yield curves and parallel yield curve shifts contains arbitrage opportunities using the following model: At

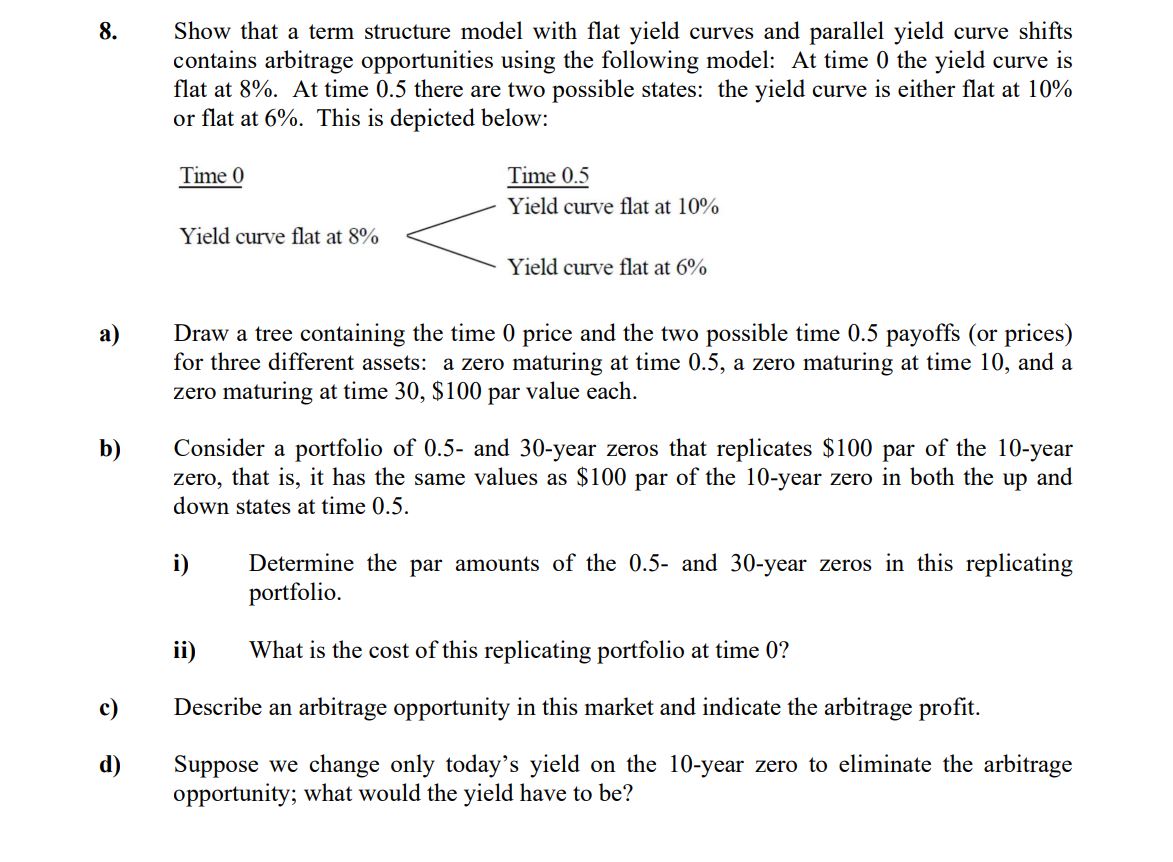

8. Show that a term structure model with flat yield curves and parallel yield curve shifts contains arbitrage opportunities using the following model: At time 0 the yield curve is flat at 8%. At time 0.5 there are two possible states: the yield curve is either flat at 10% or flat at 6%. This is depicted below: Time 0 Yield curve flat at 8% Time 0.5 Yield curve flat at 10% Yield curve flat at 6% a) b) Draw a tree containing the time 0 price and the two possible time 0.5 payoffs (or prices) for three different assets: a zero maturing at time 0.5, a zero maturing at time 10, and a zero maturing at time 30, $100 par value each. Consider a portfolio of 0.5- and 30-year zeros that replicates $100 par of the 10-year zero, that is, it has the same values as $100 par of the 10-year zero in both the up and down states at time 0.5. i) Determine the par amounts of the 0.5- and 30-year zeros in this replicating portfolio. ii) What is the cost of this replicating portfolio at time 0? c) Describe an arbitrage opportunity in this market and indicate the arbitrage profit. d) Suppose we change only today's yield on the 10-year zero to eliminate the arbitrage opportunity; what would the yield have to be?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Here is the tree showing the prices of the 3 bonds Time 0 05year zero 9808 10year zero 8640 30year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started