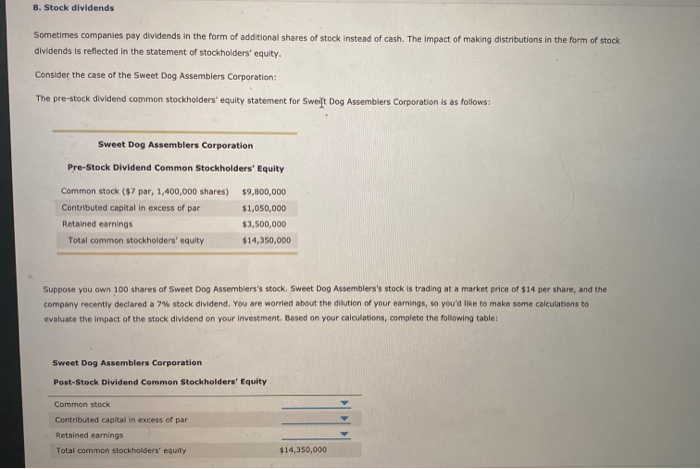

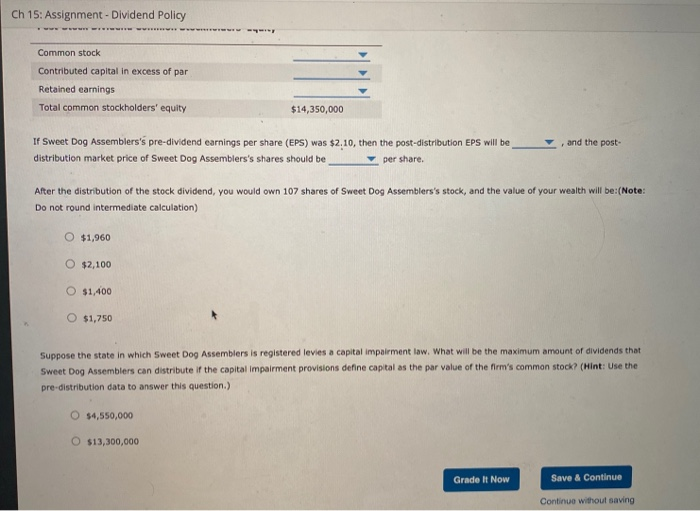

8. Stock dividends Sometimes companies pay dividends in the form of additional shares of stock instead of cash. The impact of making distributions in the form of stock dividends is reflected in the statement of stockholders' equity, Consider the case of the Sweet Dog Assemblers Corporation: The pre-stock dividend common stockholders' equity statement for Swet Dog Assemblers Corporation is as follows: Sweet Dog Assemblers Corporation Pre-Stock Dividend Common Stockholders' Equity Common stock ($7 par, 1,400,000 shares) Contributed capital in excess of par Retained earnings Total common stockholders' equity $9,800,000 $1,050,000 $3,500,000 $14,350,000 Suppose you own 100 shares of Sweet Dog Assemblers's stock. Sweet Dog Assemblers's stock is trading at a market price of $14 per share, and the company recently declared a 7% stock dividend. You are worried about the dilution of your earnings, so you'd like to make some calculations to evaluate the impact of the stock dividend on your investment. Based on your calculations, complete the following table: Sweet Dog Assemblers Corporation Post-Stock Dividend Common Stockholders' Equity Common stock Contributed capital in excess of par Retained earnings Total common stockholders' equity $14,350,000 Ch 15: Assignment - Dividend Policy Common stock Contributed capital in excess of par Retained earnings Total common stockholders' equity $14,350,000 and the post- If Sweet Dog Assemblers's pre-dividend earnings per share (EPS) was $2.10, then the post-distribution Eps will be distribution market price of Sweet Dog Assemblers's shares should be per share. After the distribution of the stock dividend, you would own 107 shares of Sweet Dog Assemblers's stock, and the value of your wealth will be:(Note: Do not round intermediate calculation) O $1,960 O $2,100 O $1,400 O $1,750 Suppose the state in which Sweet Dog Assemblers is registered levies a capital impairment law. What will be the maximum amount of dividends that Sweet Dog Assemblers can distribute if the capital impairment provisions define capital as the par value of the firm's common stock? (Hint: Use the pre-distribution data to answer this question.) O $4,550,000 O $13,300,000 Grade It Now Save & Continue Continue without saving