Answered step by step

Verified Expert Solution

Question

1 Approved Answer

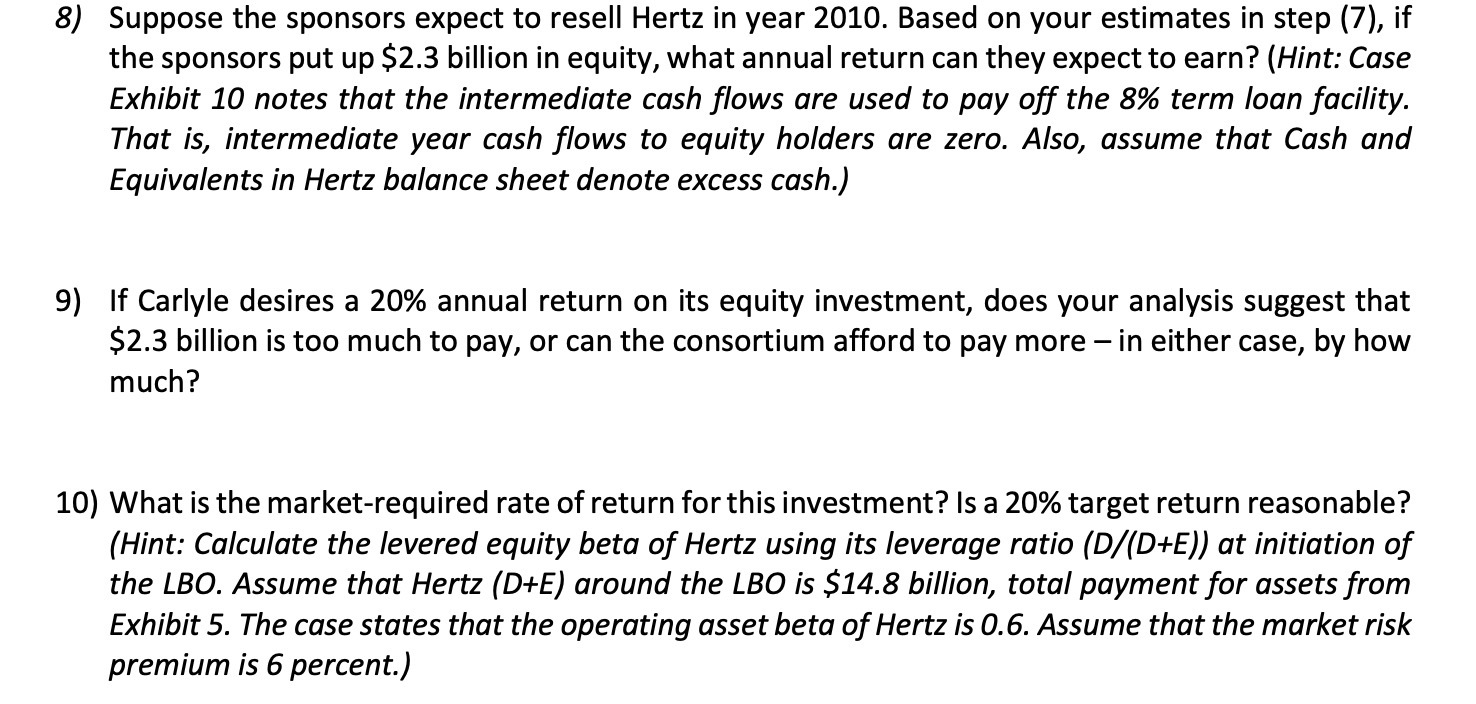

8) Suppose the sponsors expect to resell Hertz in year 2010. Based on your estimates in step (7), if the sponsors put up $2.3

8) Suppose the sponsors expect to resell Hertz in year 2010. Based on your estimates in step (7), if the sponsors put up $2.3 billion in equity, what annual return can they expect to earn? (Hint: Case Exhibit 10 notes that the intermediate cash flows are used to pay off the 8% term loan facility. That is, intermediate year cash flows to equity holders are zero. Also, assume that Cash and Equivalents in Hertz balance sheet denote excess cash.) 9) If Carlyle desires a 20% annual return on its equity investment, does your analysis suggest that $2.3 billion is too much to pay, or can the consortium afford to pay more - in either case, by how much? 10) What is the market-required rate of return for this investment? Is a 20% target return reasonable? (Hint: Calculate the levered equity beta of Hertz using its leverage ratio (D/(D+E)) at initiation of the LBO. Assume that Hertz (D+E) around the LBO is $14.8 billion, total payment for assets from Exhibit 5. The case states that the operating asset beta of Hertz is 0.6. Assume that the market risk premium is 6 percent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing Potential Return and Investment Feasibility for Hertz LBO 8 Annual Return for Sponsors Unfortunately the information provided is insufficien...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started