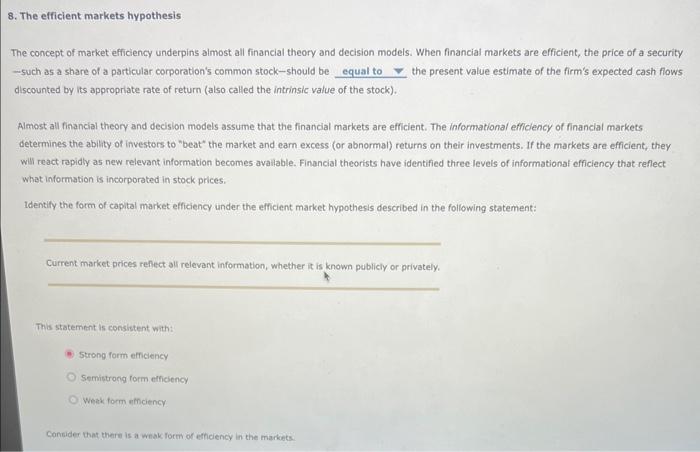

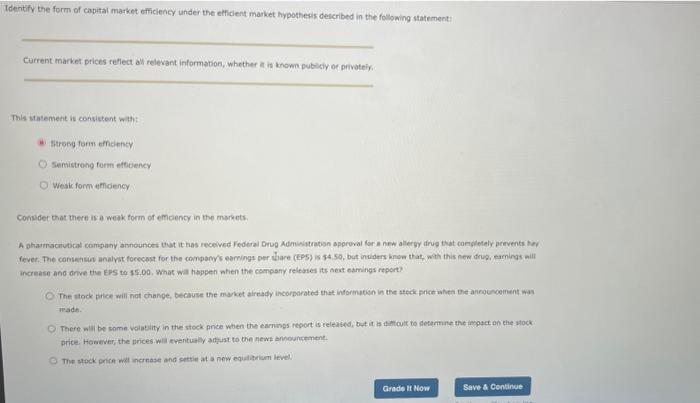

8. The efficient markets hypothesis The concept of market efficiency underpins almost all financial theory and decision models. When financial markets are efficient, the price of a security - such as a share of a particular corporation's common stock-should be the present value estimate of the firm's expected cash fiows discounted by its appropriate rate of return (also called the intrinsic value of the stock). Almost all financial theory and decision models assume that the financial markets are efficient. The informational efficiency of financial markets determines the ability of investors to "beat" the market and earn excess (or abnormal) returns on their investments. If the markets are efficient, they will react rapidly as new relevant information becomes avallable. Financial theorists have identified three levels of informational efficiency that reflect what information is incorporated in stock prices. Identify the form of capital market efficiency under the efficient market hypothesis described in the following statement: Current market prices refect all relevant information, whether it is known publicly or privately. This statement is consistent with: 5 trong form efficency Semistrong form efficiency Weak form effiency Consider that there is a wrak form of efficiency in the markets. Current market prices reflect all relevant information, whether a is known publify or privotely. This statement is consistent with: titrong form efficiency Semistrong form efticiency Weak form effidency Consider that there is a weak form of emoency in the markets. A pharmschutical company anhounces that it has received federal Drug Admisitration approval for a new allergy drug thot coengletaly pervents her increase and drve the EPS to 15.00. What wal happen afien the compony relenses its seat eamings repert? The stock pirice will nat change, because the market already incorporated that informucion in the steck priat whes bee announcement was made. There will be somn volatily in the stock pnce when the earnings report is releaspes, but it is diffoult to fetermine the impact on the stock. price. However, the prices will eventualiy adfust to the news arnouncement. The stock price wat increase and settin at a now equalizrium itsel