Question

8. The following data for September were taken from the cost records of the Mixing Department of a company which uses the average costing

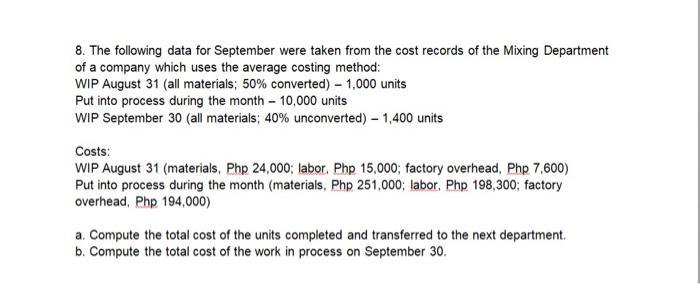

8. The following data for September were taken from the cost records of the Mixing Department of a company which uses the average costing method: WIP August 31 (all materials; 50% converted) 1,000 units Put into process during the month - 10,000 units WIP September 30 (all materials; 40% unconverted)-1,400 units Costs: WIP August 31 (materials, Php 24,000; labor. Php 15,000; factory overhead, Php 7,600) Put into process during the month (materials, Php 251,000; labor. Php 198,300; factory overhead, Php 194,000) a. Compute the total cost of the units completed and transferred to the next department. b. Compute the total cost of the work in process on September 30.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Cost of units completed and transferred out b Cost of work in process September 30 632031 57869 No...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Accounting

Authors: Tracie L. Miller nobles, Brenda L. Mattison, Ella Mae Matsumura

12th edition

9780134487151, 013448715X, 978-0134674681

Students also viewed these Organizational Behavior questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App