Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. The local government's water enterprise fund utilizes the because it is run like a business. (2 points) basis of accounting 9. Under the

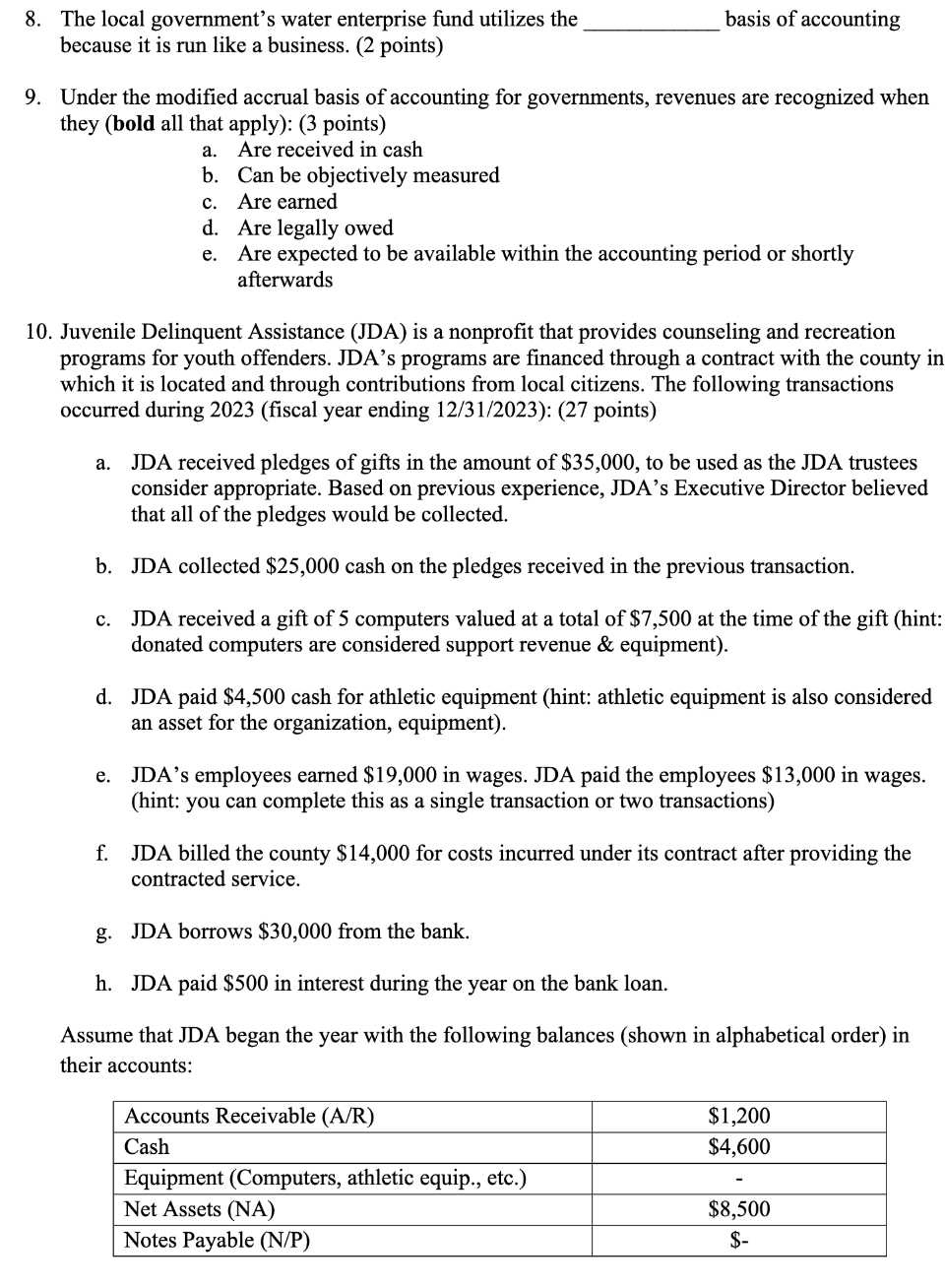

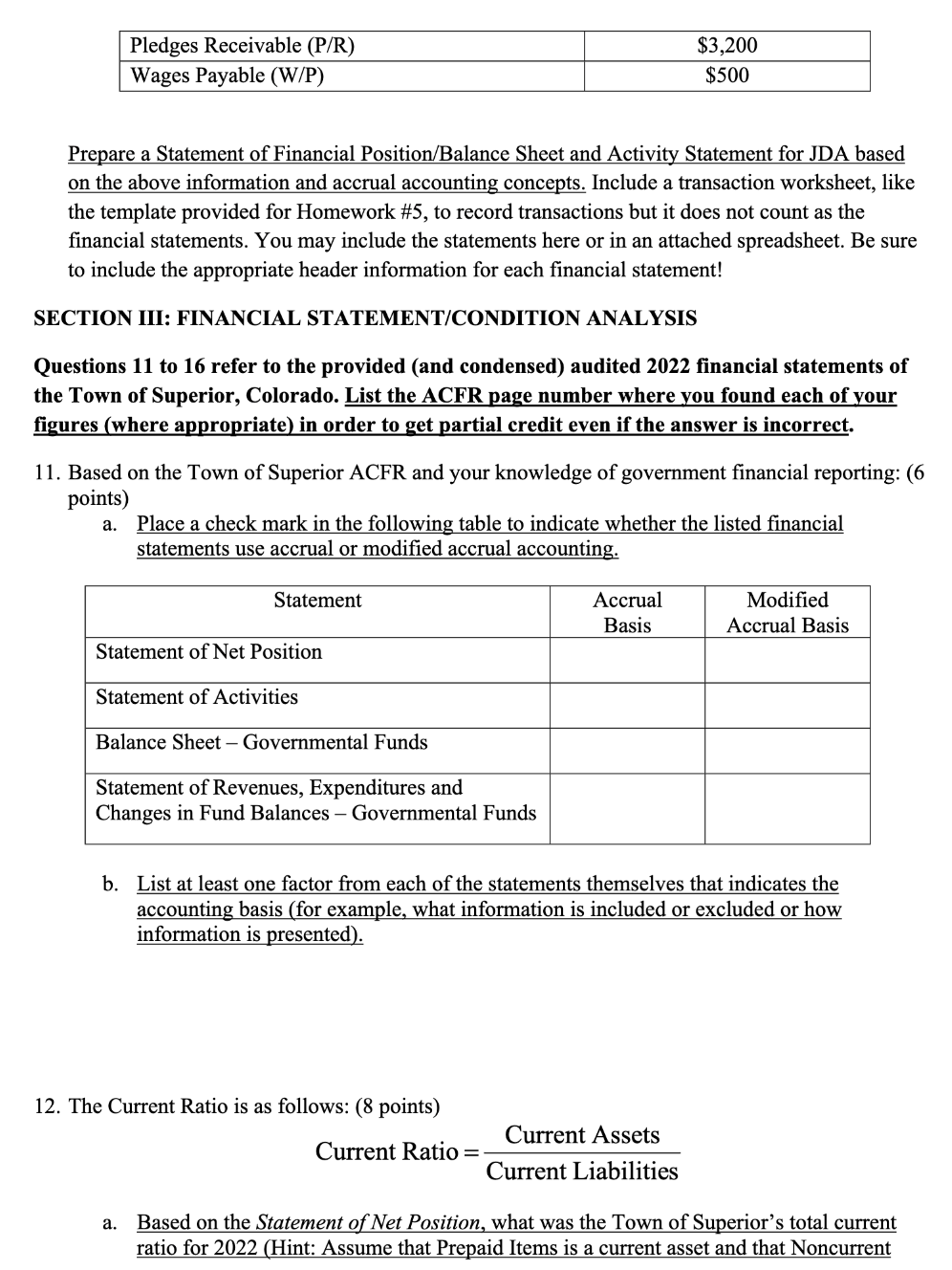

8. The local government's water enterprise fund utilizes the because it is run like a business. (2 points) basis of accounting 9. Under the modified accrual basis of accounting for governments, revenues are recognized when they (bold all that apply): (3 points) a. Are received in cash b. Can be objectively measured c. Are earned d. Are legally owed e. Are expected to be available within the accounting period or shortly afterwards 10. Juvenile Delinquent Assistance (JDA) is a nonprofit that provides counseling and recreation programs for youth offenders. JDA's programs are financed through a contract with the county in which it is located and through contributions from local citizens. The following transactions occurred during 2023 (fiscal year ending 12/31/2023): (27 points) a. JDA received pledges of gifts in the amount of $35,000, to be used as the JDA trustees consider appropriate. Based on previous experience, JDA's Executive Director believed that all of the pledges would be collected. b. JDA collected $25,000 cash on the pledges received in the previous transaction. c. JDA received a gift of 5 computers valued at a total of $7,500 at the time of the gift (hint: donated computers are considered support revenue & equipment). d. JDA paid $4,500 cash for athletic equipment (hint: athletic equipment is also considered an asset for the organization, equipment). e. JDA's employees earned $19,000 in wages. JDA paid the employees $13,000 in wages. (hint: you can complete this as a single transaction or two transactions) f. JDA billed the county $14,000 for costs incurred under its contract after providing the contracted service. g. JDA borrows $30,000 from the bank. h. JDA paid $500 in interest during the year on the bank loan. Assume that JDA began the year with the following balances (shown in alphabetical order) in their accounts: Accounts Receivable (A/R) $1,200 Cash $4,600 Equipment (Computers, athletic equip., etc.) Net Assets (NA) $8,500 Notes Payable (N/P) $- Pledges Receivable (P/R) Wages Payable (W/P) $3,200 $500 Prepare a Statement of Financial Position/Balance Sheet and Activity Statement for JDA based on the above information and accrual accounting concepts. Include a transaction worksheet, like the template provided for Homework #5, to record transactions but it does not count as the financial statements. You may include the statements here or in an attached spreadsheet. Be sure to include the appropriate header information for each financial statement! SECTION III: FINANCIAL STATEMENT/CONDITION ANALYSIS Questions 11 to 16 refer to the provided (and condensed) audited 2022 financial statements of the Town of Superior, Colorado. List the ACFR page number where you found each of your figures (where appropriate) in order to get partial credit even if the answer is incorrect. 11. Based on the Town of Superior ACFR and your knowledge of government financial reporting: (6 points) Place a check mark in the following table to indicate whether the listed financial statements use accrual or modified accrual accounting. Statement Statement of Net Position Statement of Activities Accrual Basis Modified Accrual Basis Balance Sheet - Governmental Funds Statement of Revenues, Expenditures and Changes in Fund Balances - Governmental Funds b. List at least one factor from each of the statements themselves that indicates the accounting basis (for example, what information is included or excluded or how information is presented). 12. The Current Ratio is as follows: (8 points) Current Ratio= Current Assets Current Liabilities a. Based on the Statement of Net Position, what was the Town of Superior's total current ratio for 2022 (Hint: Assume that Prepaid Items is a current asset and that Noncurrent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started