Answered step by step

Verified Expert Solution

Question

1 Approved Answer

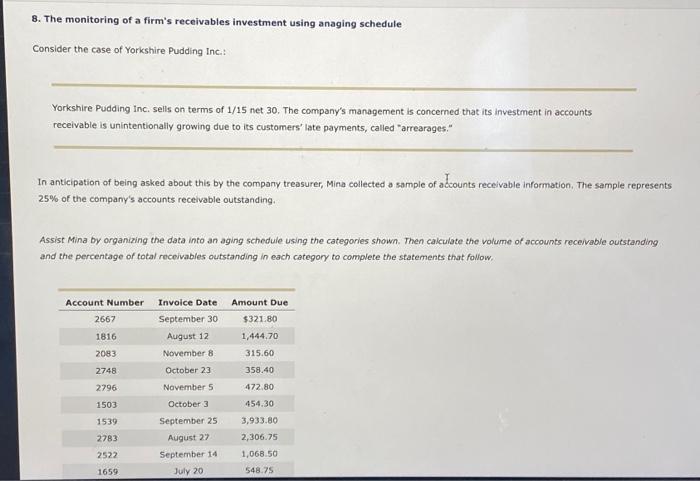

8. The monitoring of a firm's receivables investment using anaging schedule Consider the case of Yorkshire Pudding Inc.: Yorkshire Pudding Inc. sells on terms

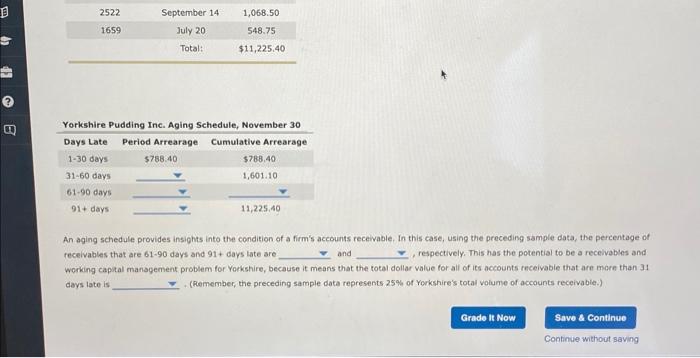

8. The monitoring of a firm's receivables investment using anaging schedule Consider the case of Yorkshire Pudding Inc.: Yorkshire Pudding Inc. sells on terms of 1/15 net 30. The company's management is concerned that its investment in accounts receivable is unintentionally growing due to its customers' late payments, called "arrearages." In anticipation of being asked about this by the company treasurer, Mina collected a sample of accounts receivable information. The sample represents 25% of the company's accounts receivable outstanding. Assist Mina by organizing the data into an aging schedule using the categories shown. Then calculate the volume of accounts receivable outstanding and the percentage of total receivables outstanding in each category to complete the statements that follow. Account Number 2667 1816 2083 2748 2796 1503 1539 2783 2522 1659 Invoice Date Amount Due September 30 August 12 November 8 October 23 November 5 October 3 September 25 August 27 September 14 July 20 $321.80 1,444.70 315.60 358.40 472.80 454.30 3,933.80 2,306.75 1,068.50 548.75 D 8 2522 1659 September 14 July 201 Total: $788.40 1,068.50 548.75 $11,225.40 Yorkshire Pudding Inc. Aging Schedule, November 30 Days Late Period Arrearage Cumulative Arrearage 1-30 days 31-60 days 61-90 days 91+ days $788.40 1,601.10. 11,225,40 An aging schedule provides insights into the condition of a firm's accounts receivable. In this case, using the preceding sample data, the percentage of receivables that are 61-90 days and 91+ days late are and respectively. This has the potential to be a receivables and working capital management problem for Yorkshire, because it means that the total dollar value for all of its accounts receivable that are more than 31 days late is (Remember, the preceding sample data represents 25% of Yorkshire's total volume of accounts receivable.) Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Step: 1

You have provided images that involve preparing an aging schedule for Yorkshire Pudding Incs accounts receivable The aging schedule helps a company manage its accounts receivable by showing the amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started