8. These items are taken from financial statements of Wildhorse Co. at December 31,2022

8. These items are taken from financial statements of Wildhorse Co. at December 31,2022

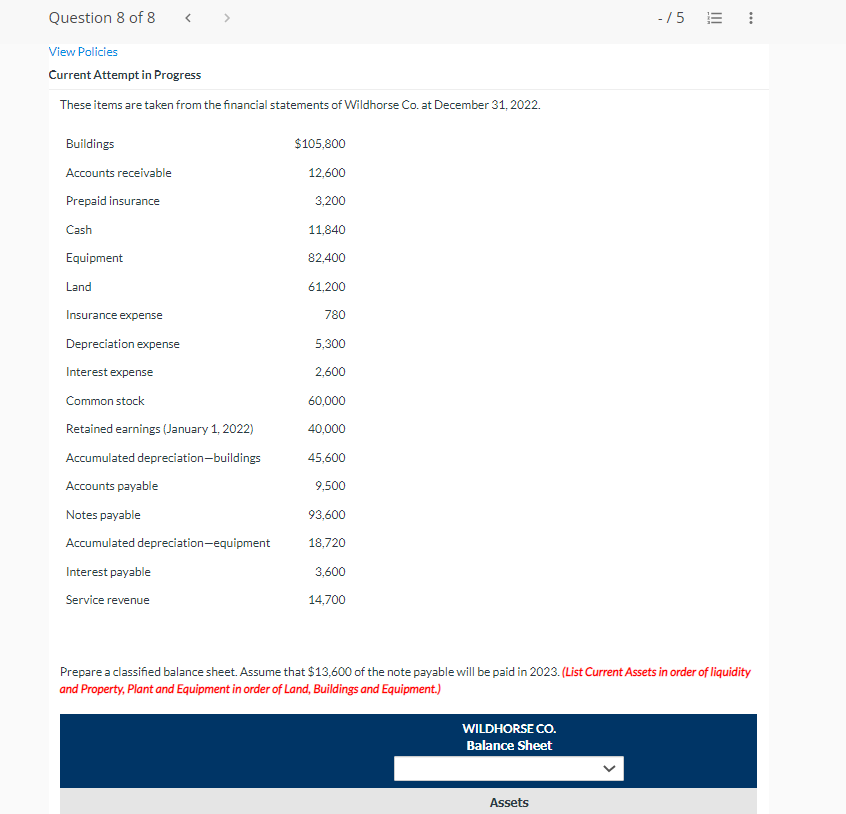

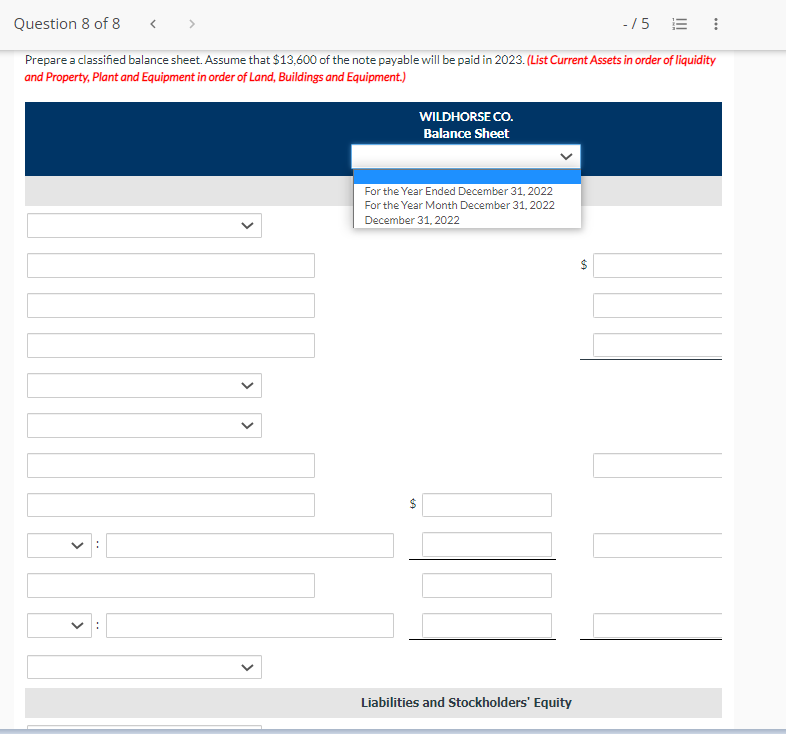

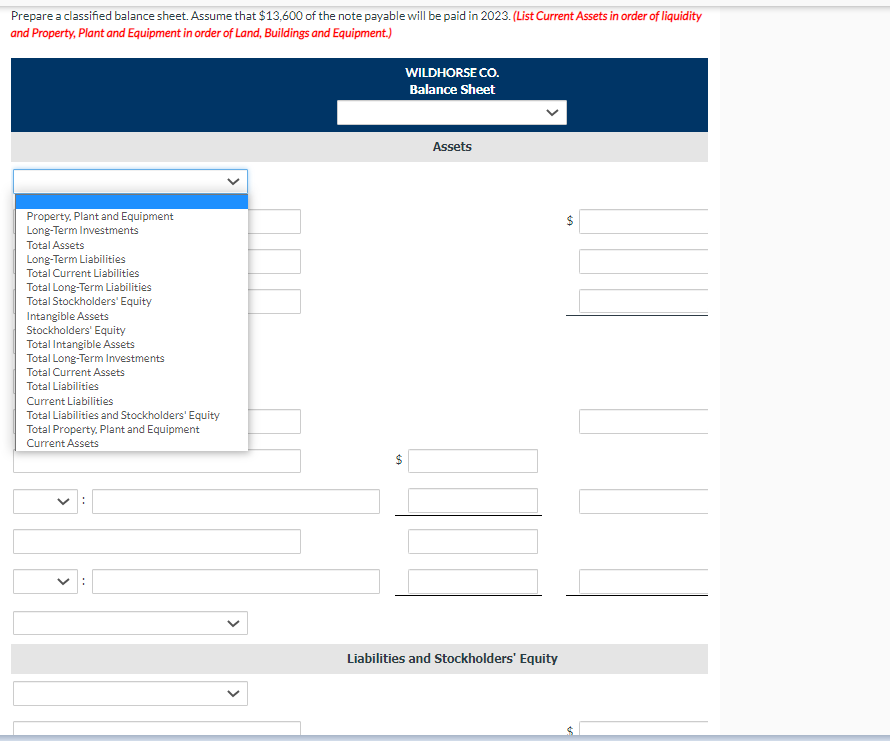

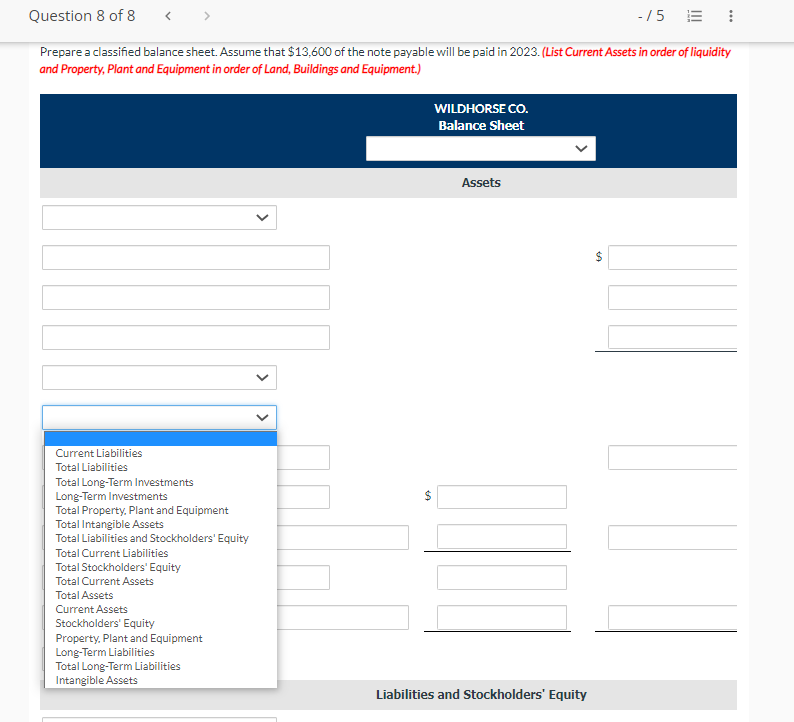

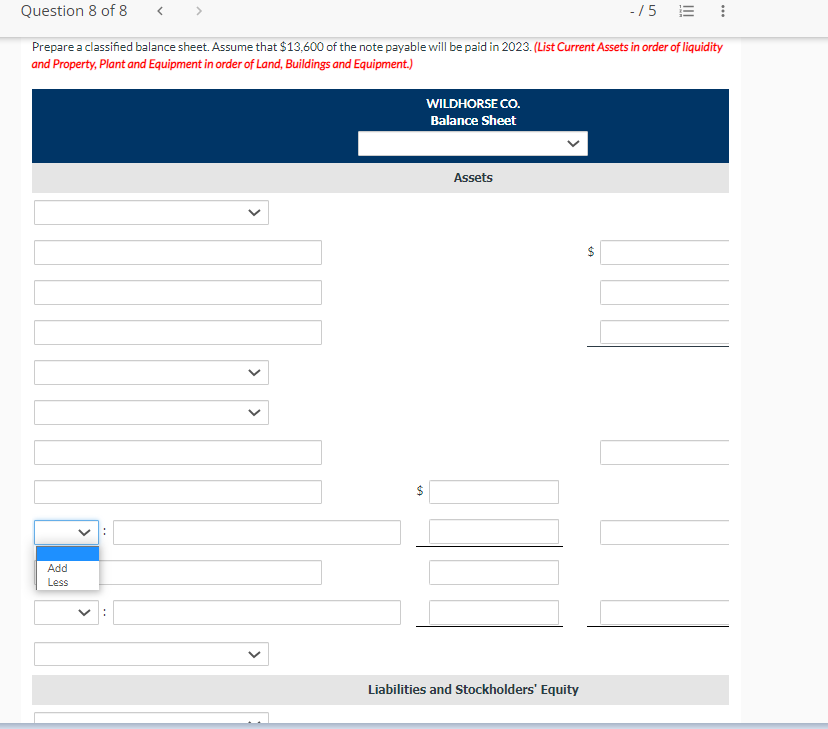

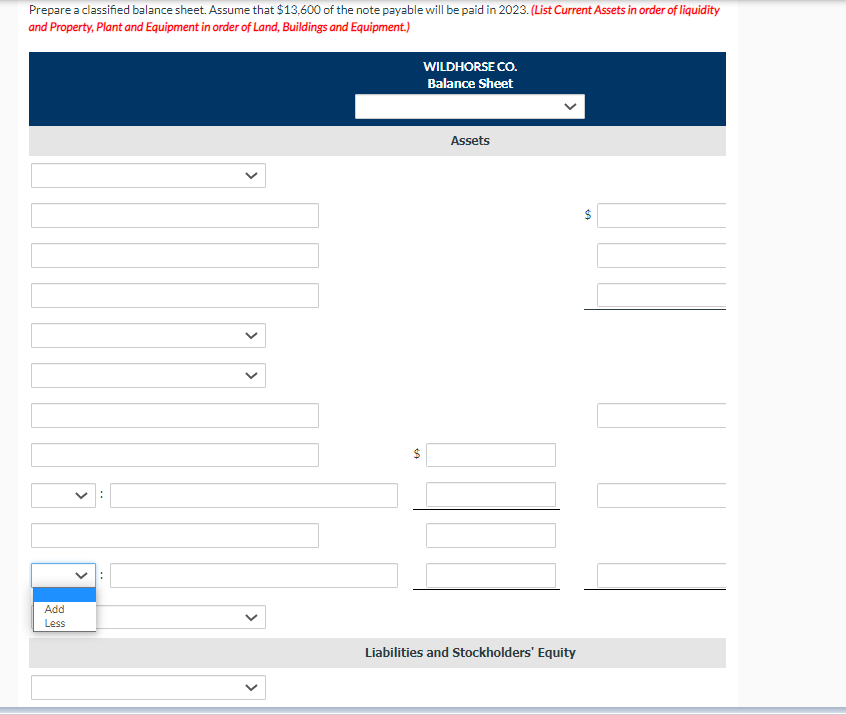

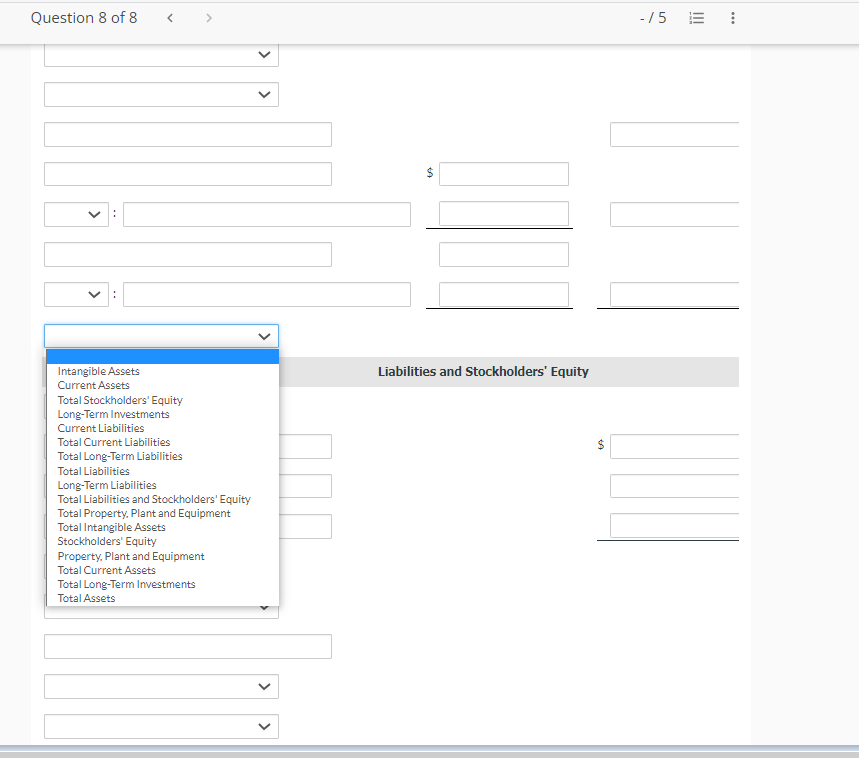

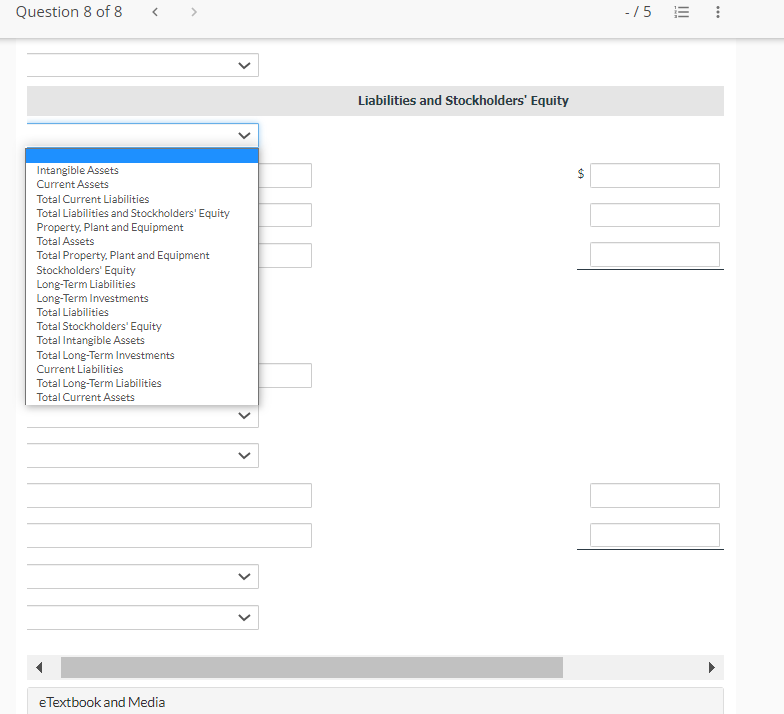

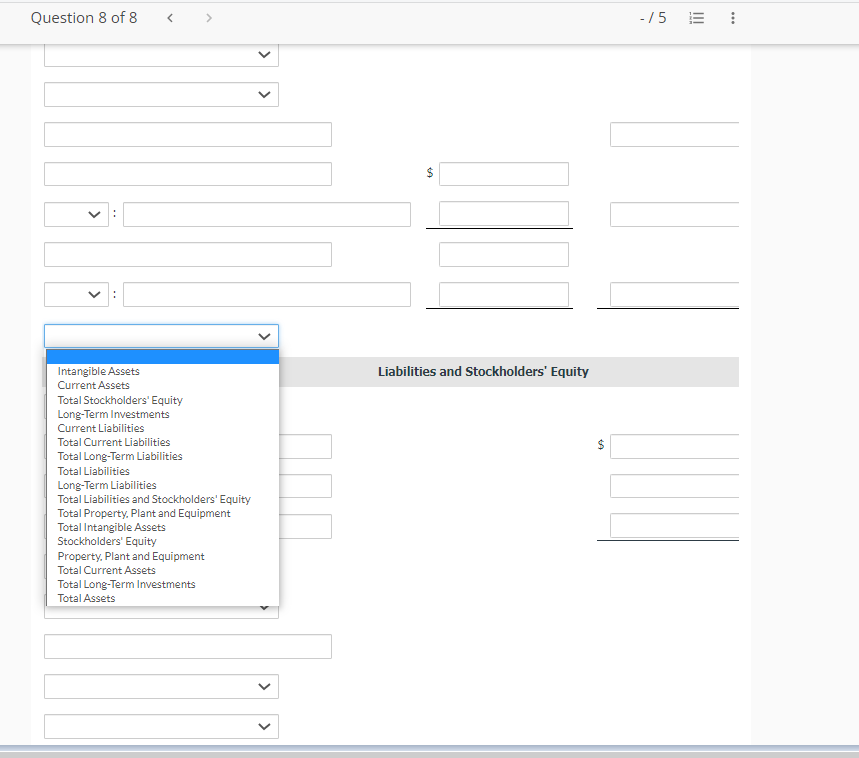

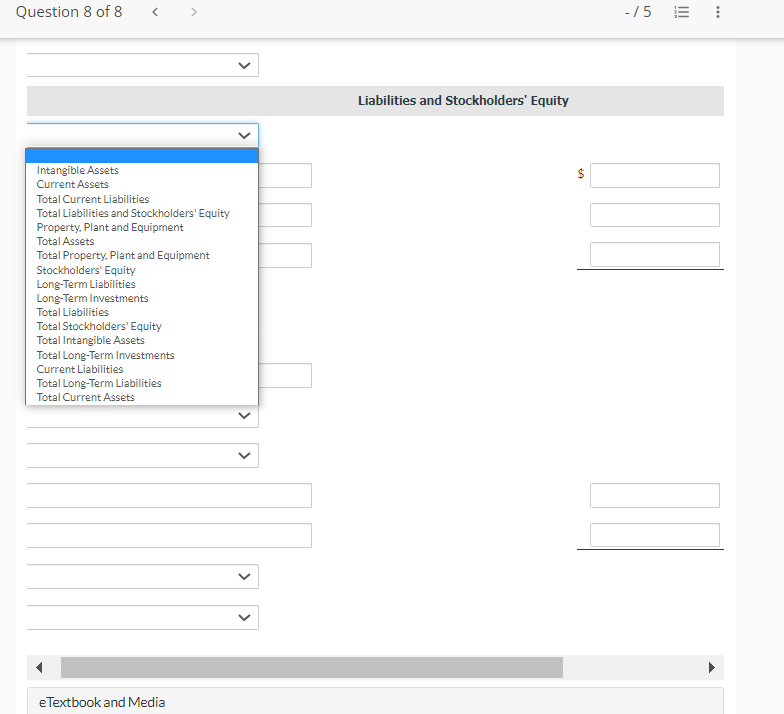

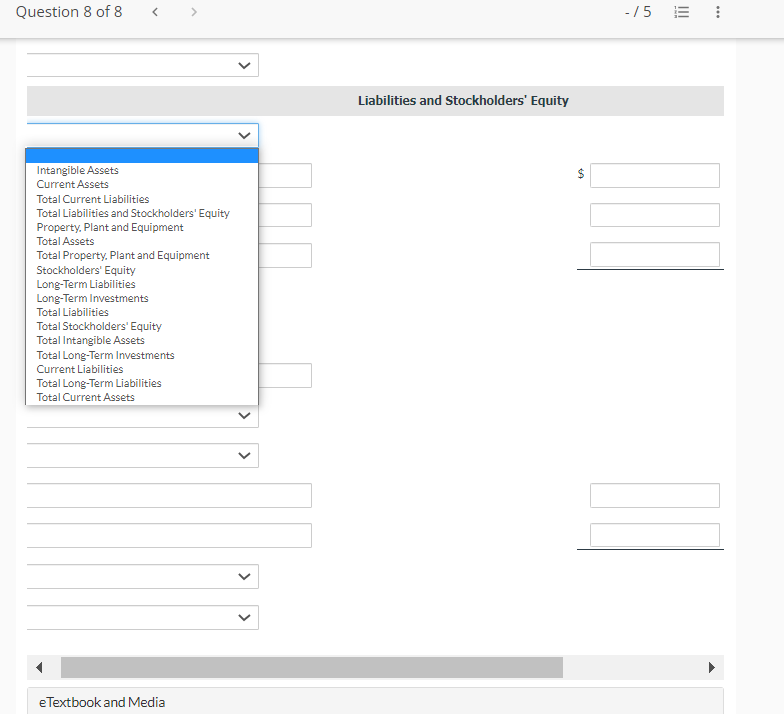

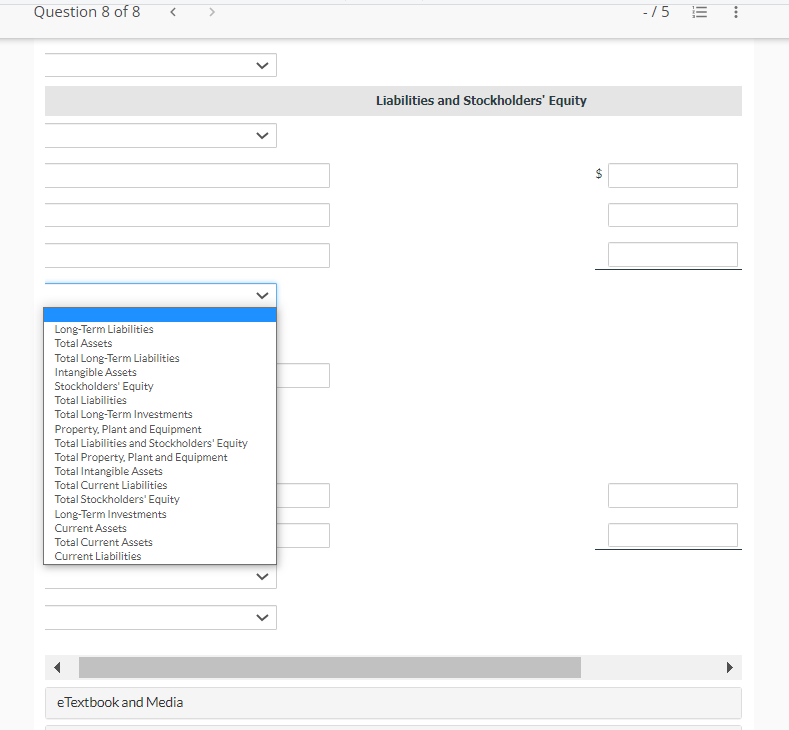

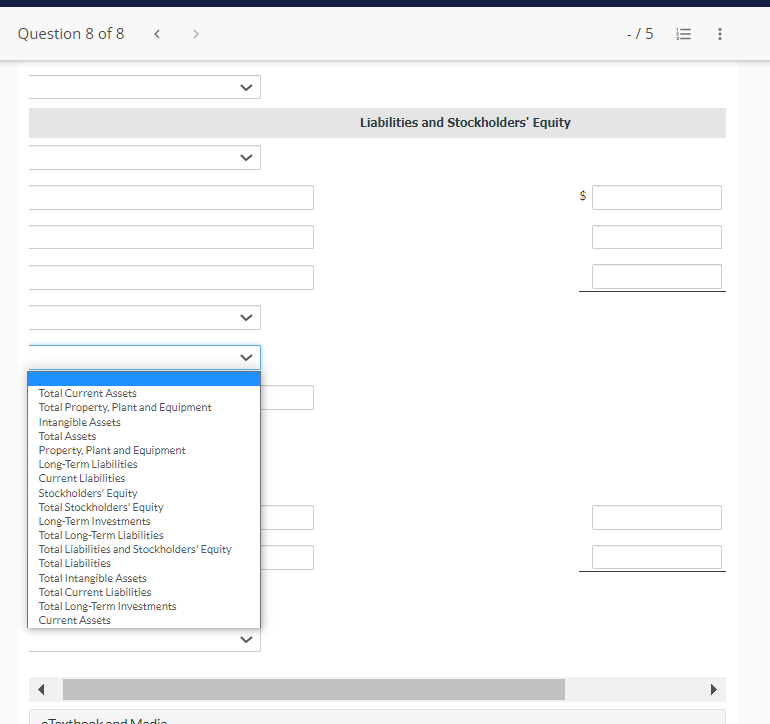

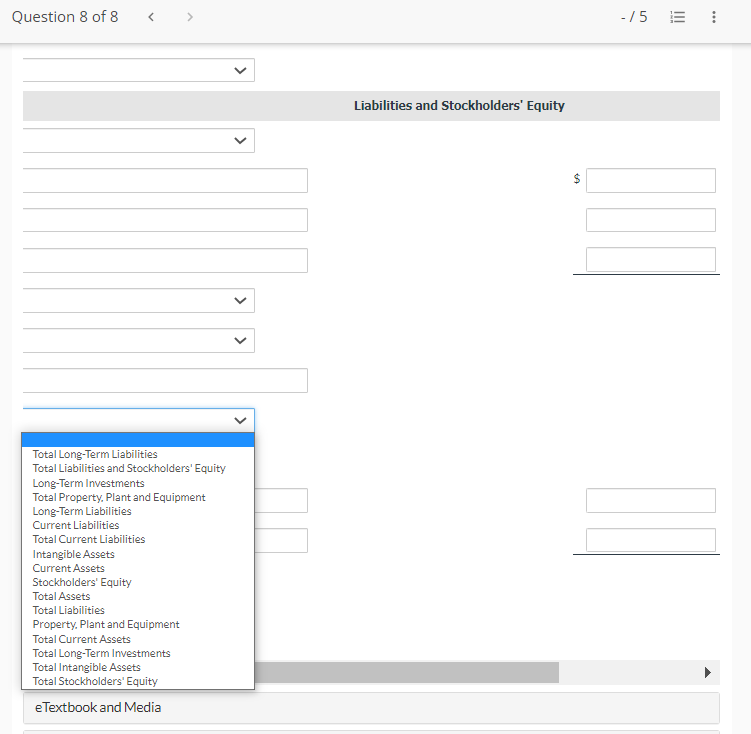

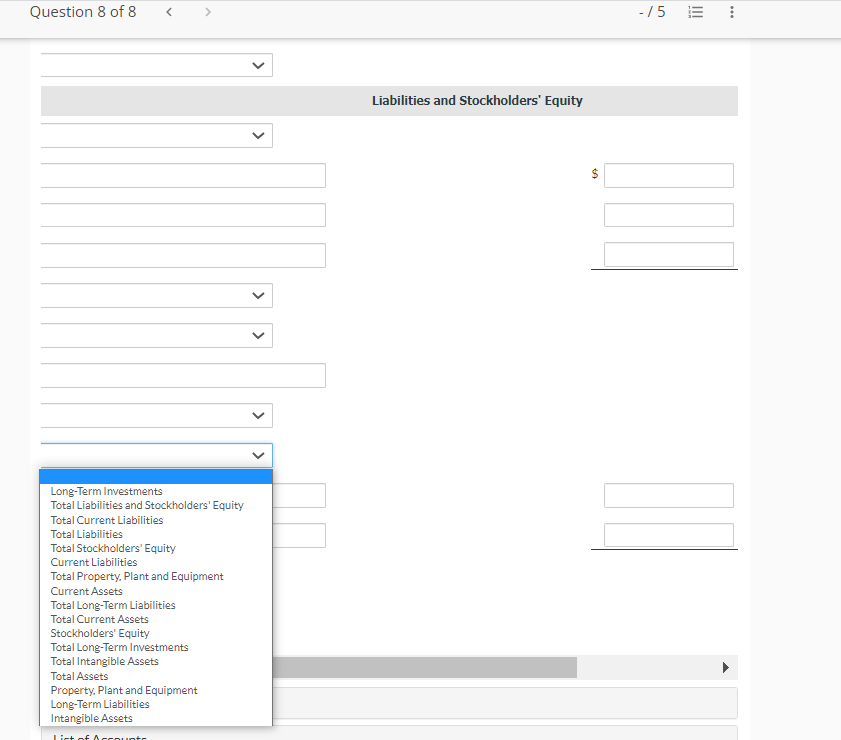

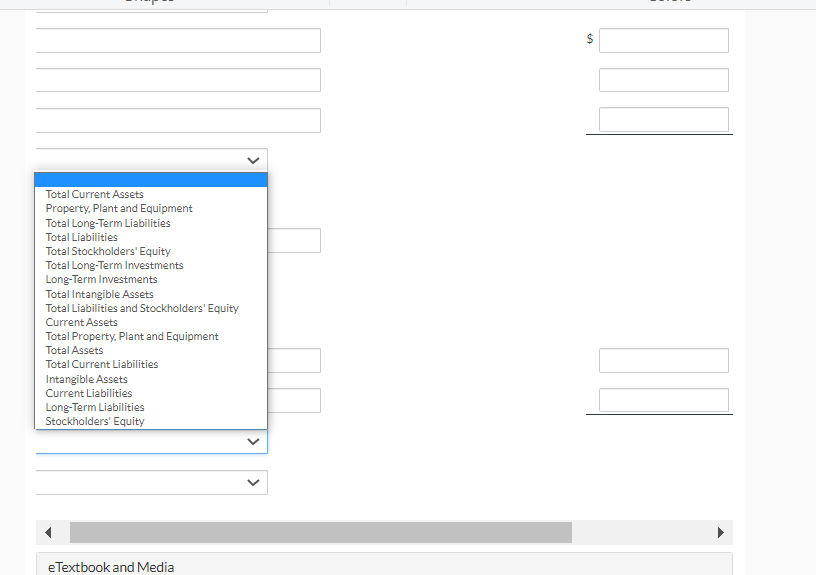

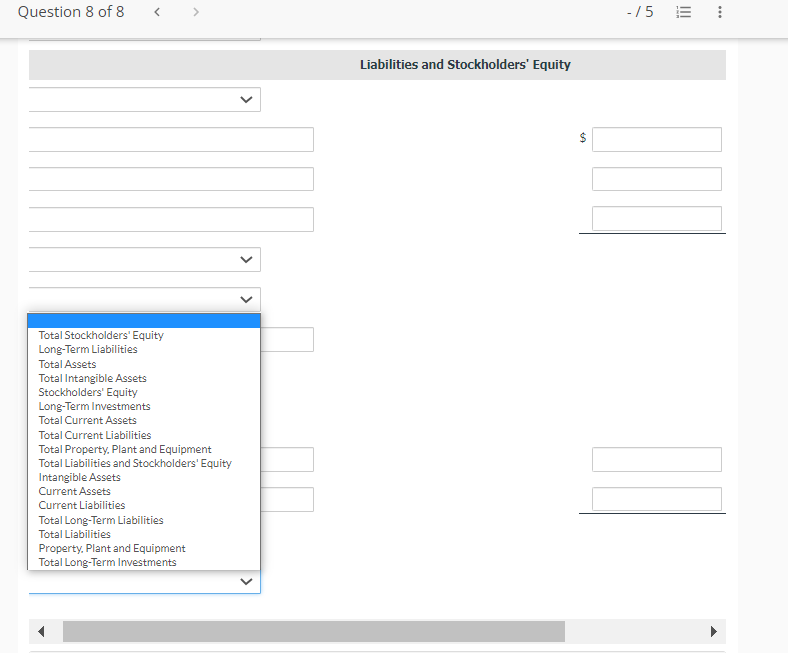

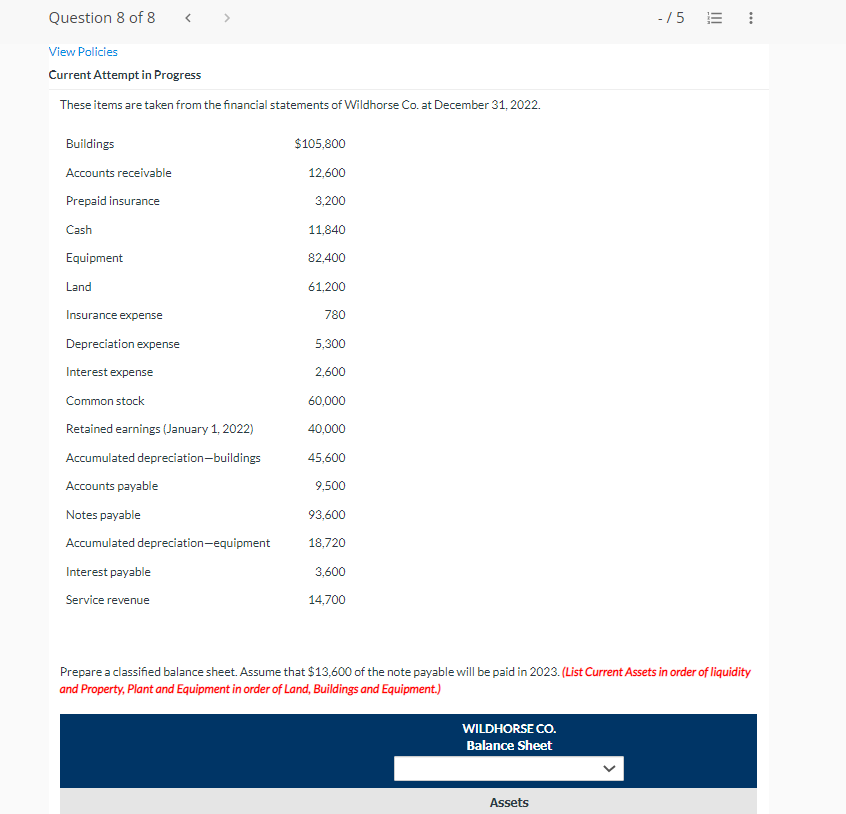

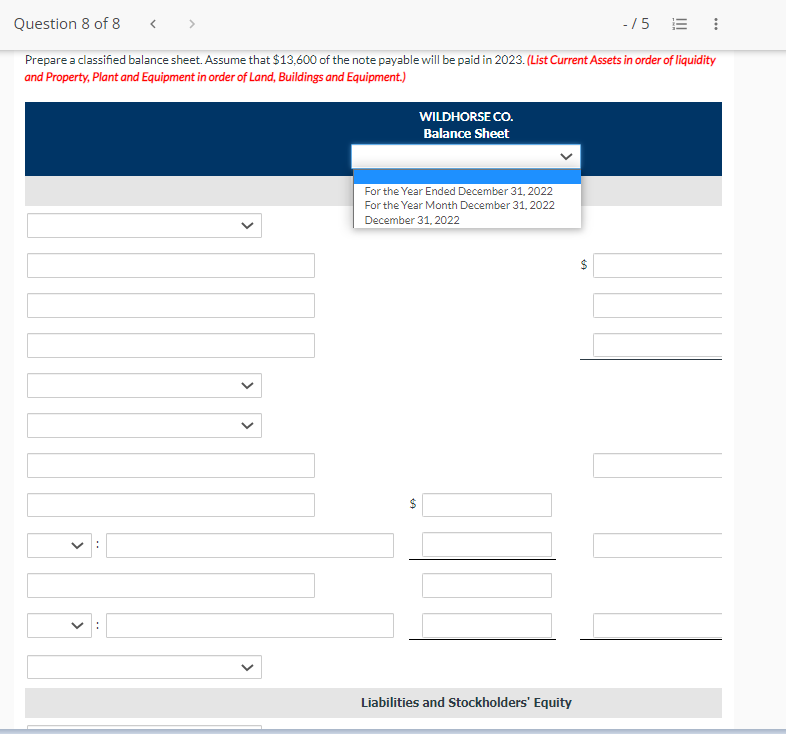

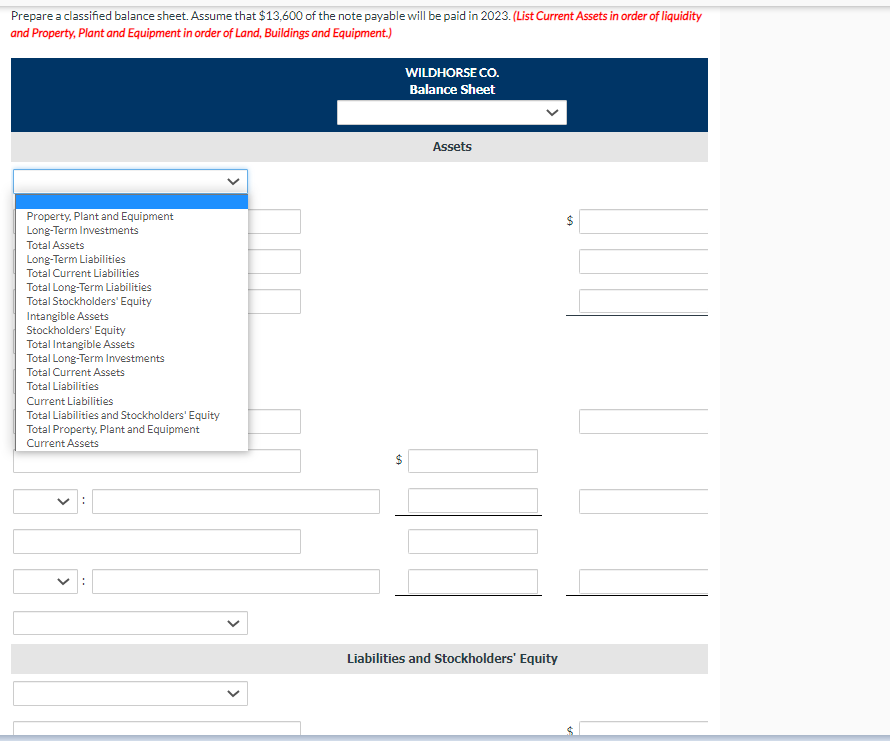

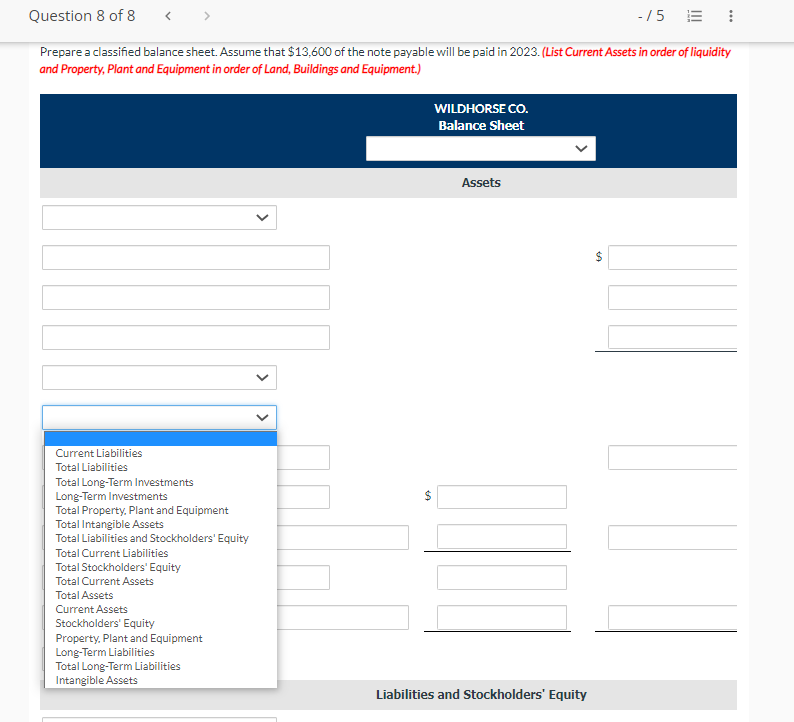

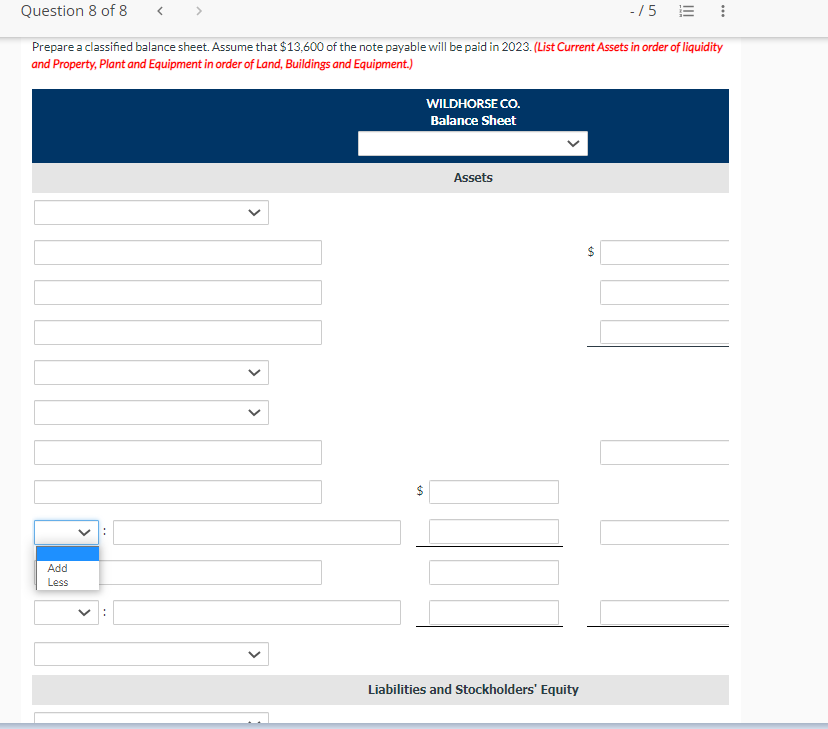

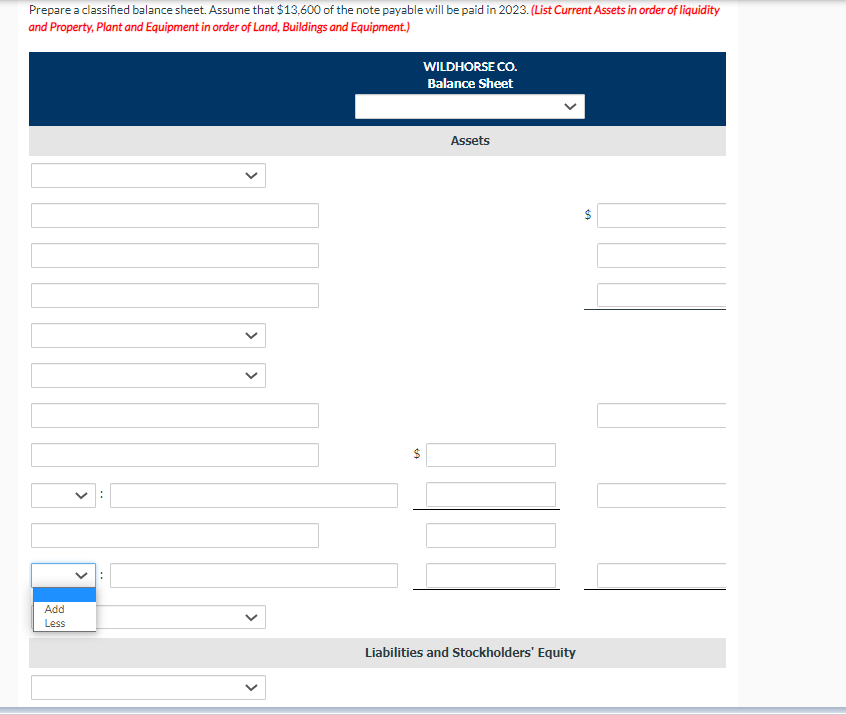

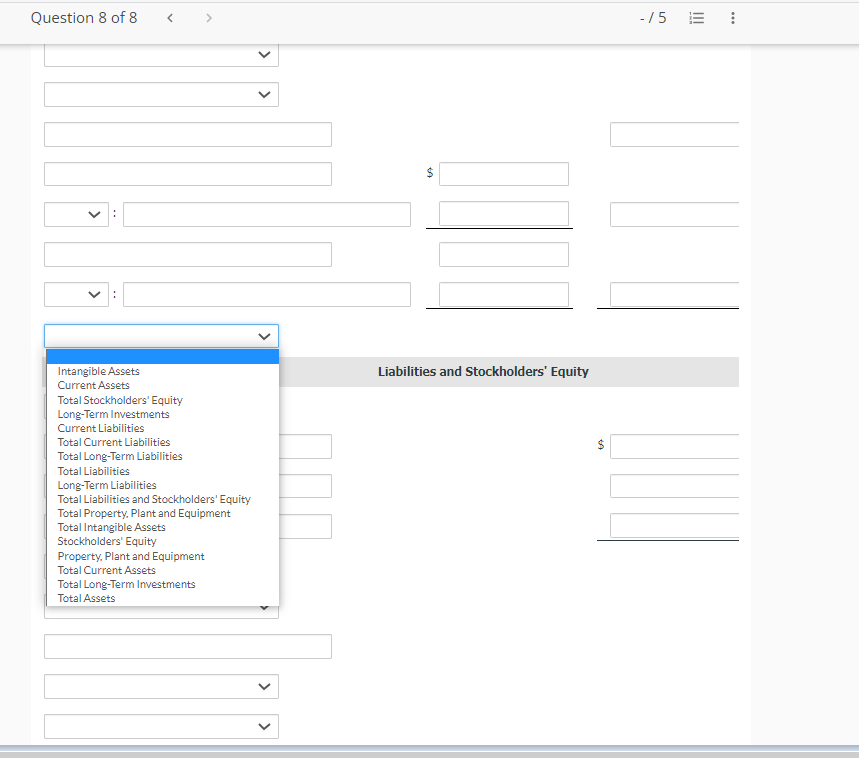

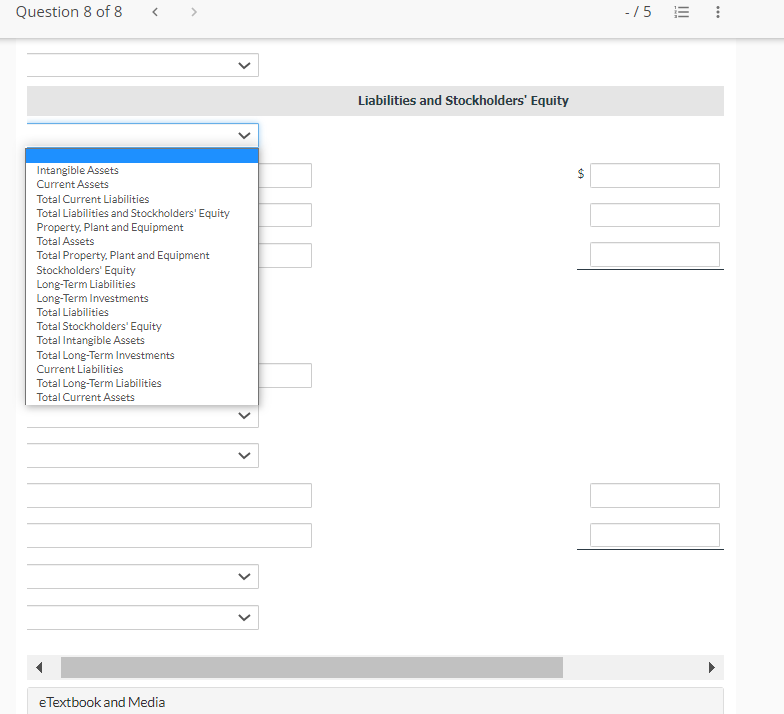

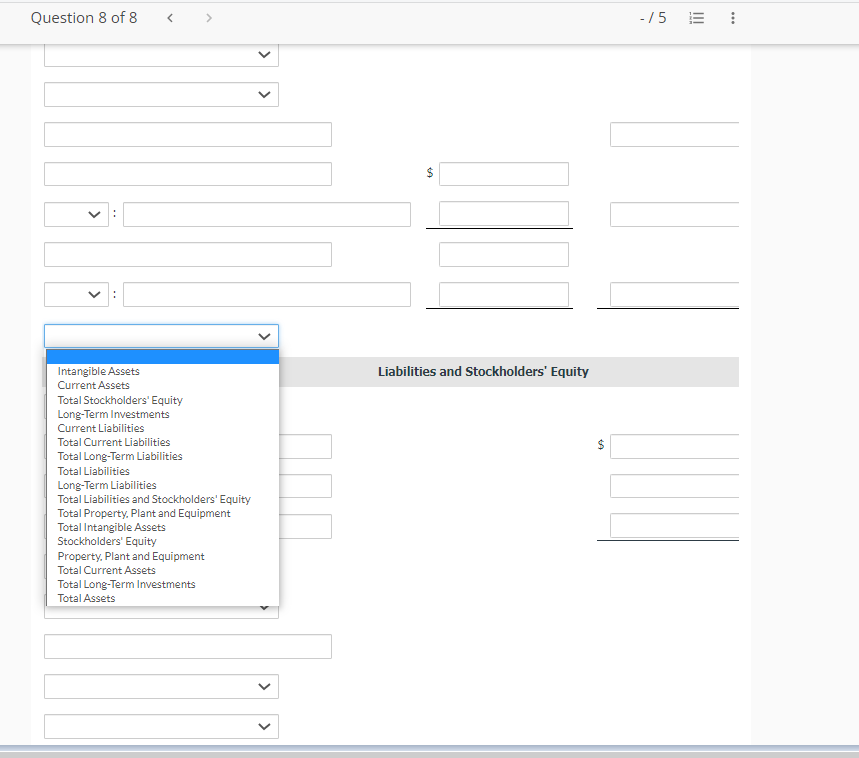

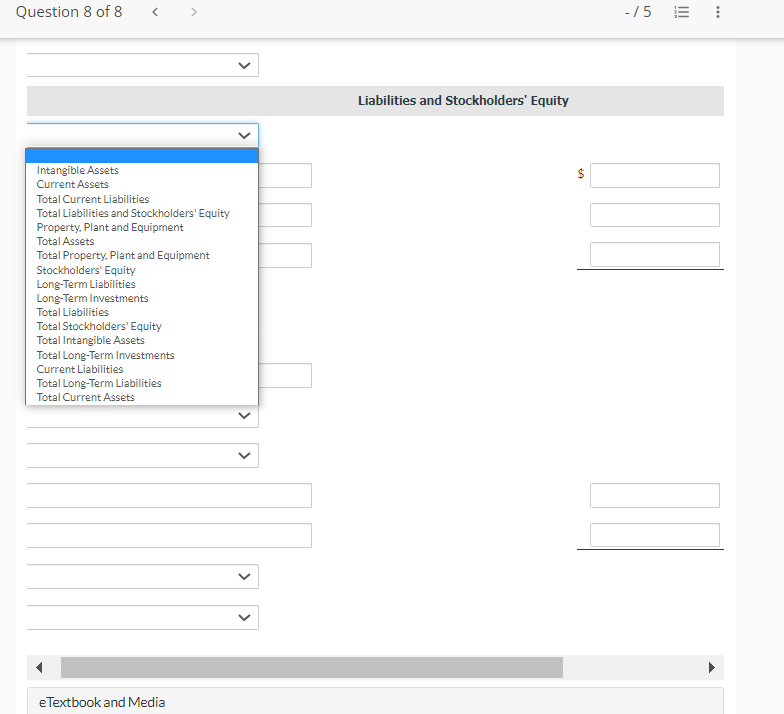

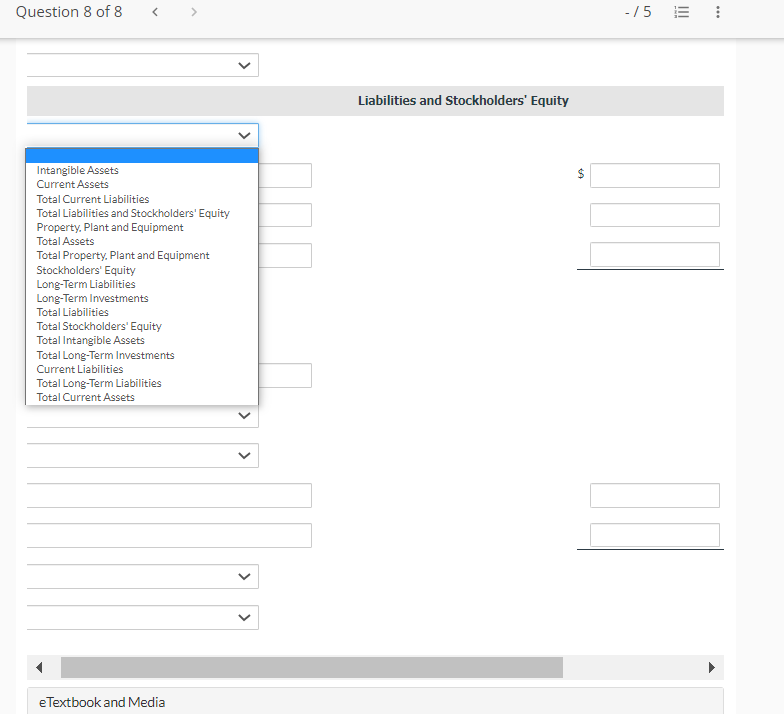

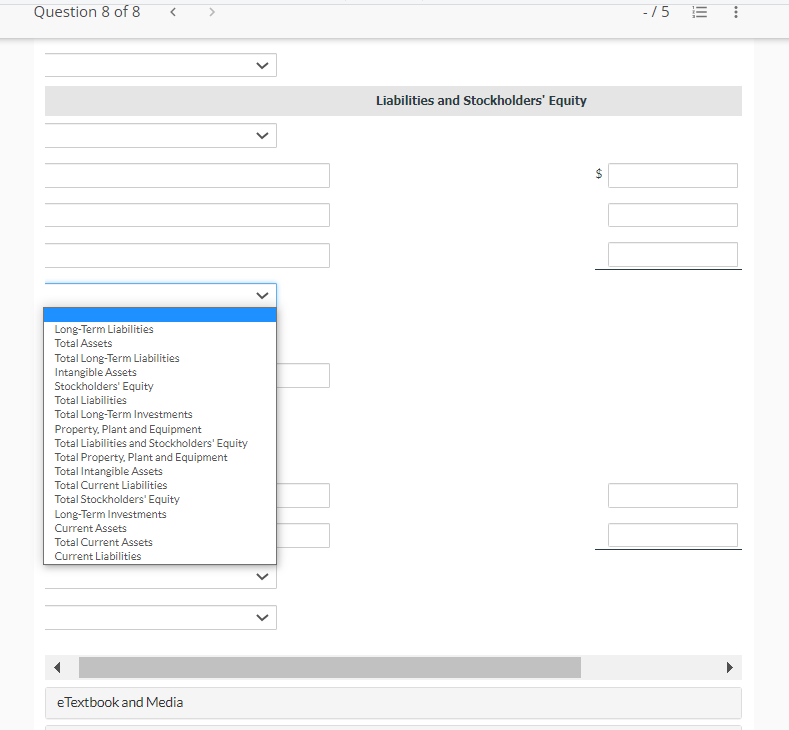

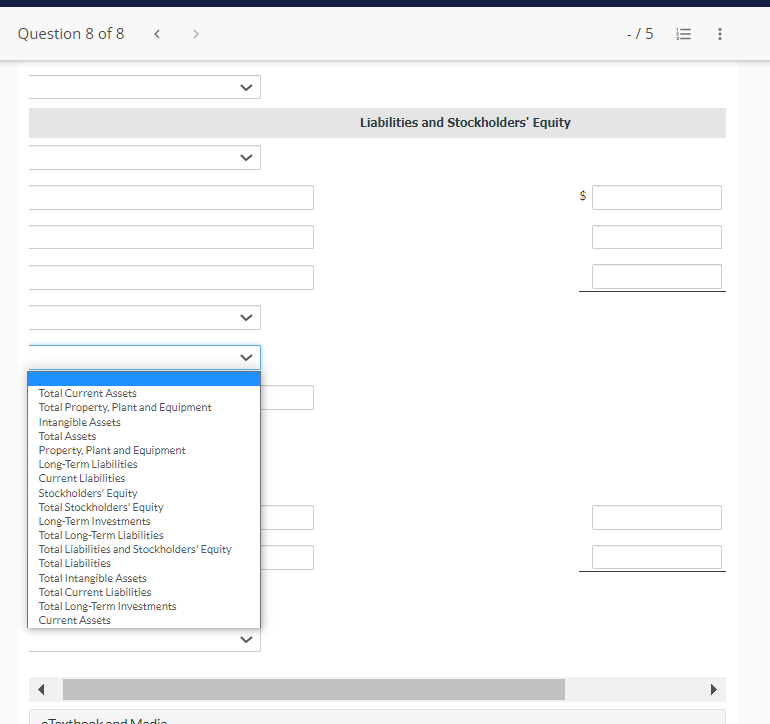

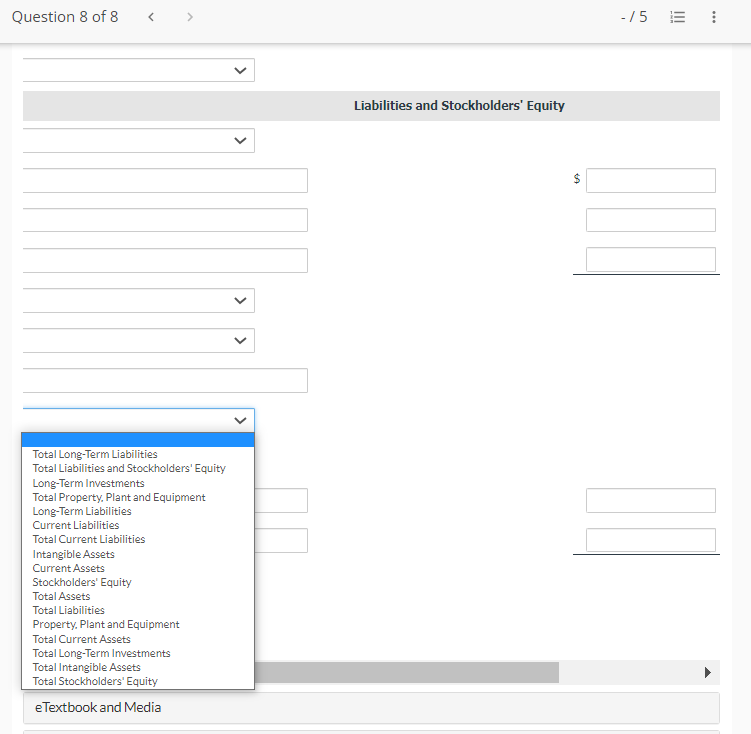

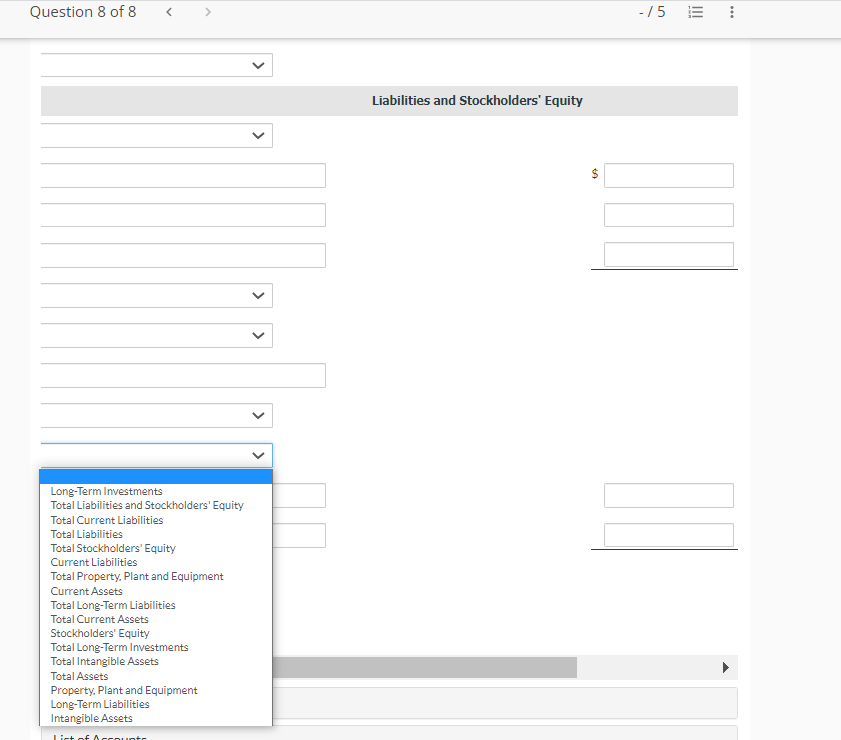

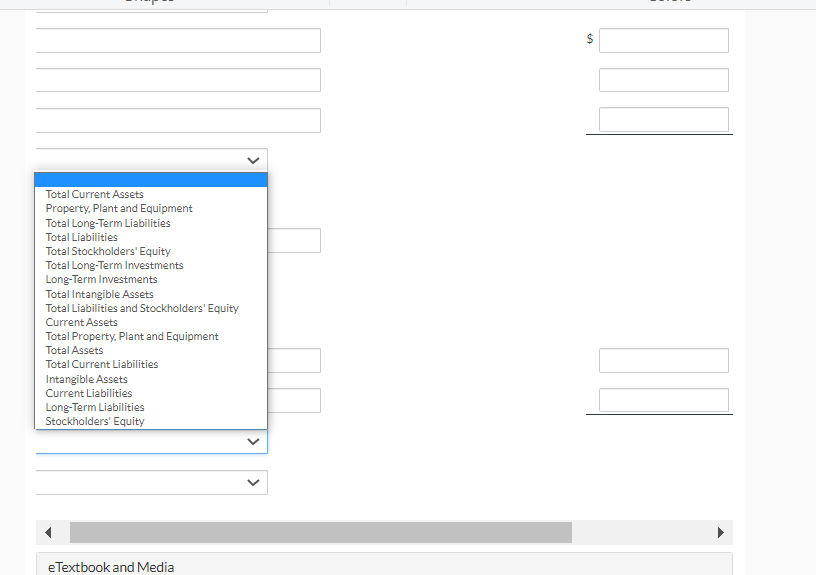

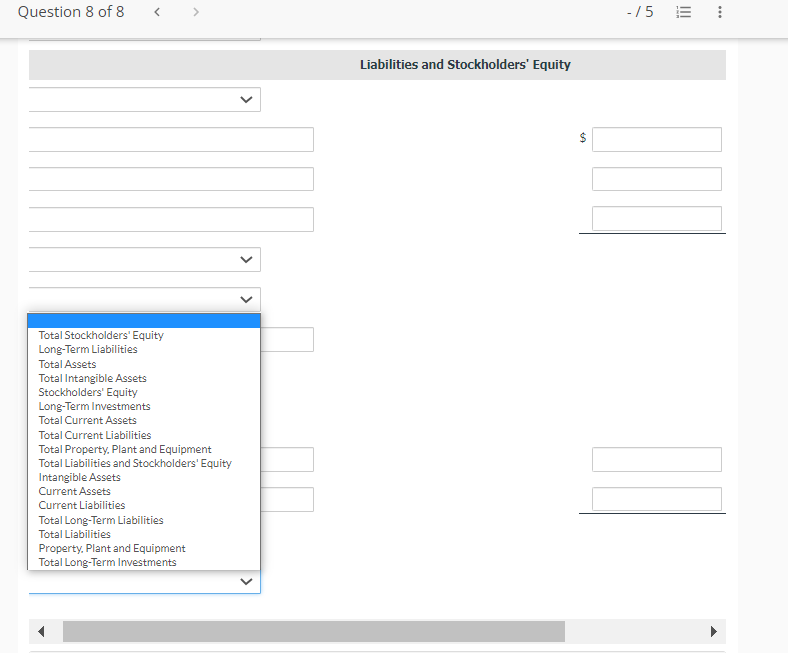

View Policies Current Attempt in Progress These items are taken from the financial statements of Wildhorse Co. at December 31, 2022. Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid in 2023 . (List Current Assets in order of liquidity and Property, Plant and Equipment in order of Land, Buildings and Equipment.) Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid in 2023 . (List Current Assets in order of liquidity and Probertv. Plant and Eauioment in order of Land. Buildings and Eauioment.) Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid in 2023 . (List Current Assets in order of liquidity and Property, Plant and Equipment in order of Land, Buildings and Equipment.) Property, Plant and Equipment Long-Term Investments Total Assets Long-Term Liabilities Total Current Liabilities Total Long-Term Liabilities Total Stockholders' Equity Intangible Assets Stockholders' Equity Total Intangible Assets Total Long-Term Investments Total Current Assets Total Liabilities Current Liabilities Total Liabilities and Stockholders' Equity Total Property, Plant and Equipment Current Assets Liabilities and Stockholders' Equity $ Question 8 of 8> 15 Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid in 2023 . (List Current Assets in order of liquidity and Property, Plant and Equipment in order of Land, Buildings and Equipment.) WILDHORSE CO. Balance Sheet Assets Current Liabilities Total Liabilities Total Long-Term Investments Long-Term Investments Total Property, Plant and Equipment Total Intangible Assets Total Liabilities and Stockholders' Equity Total Current Liabilities Total Stockholders' Equity Total Current Assets Total Assets Current Assets Stockholders' Equity Property, Plant and Equipment Long-Term Liabilities Total Long-Term Liabilities Intangible Assets Liabilities and Stockholders' Equity Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid in 2023 . (List Current Assets in order of liquidity Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid in 2023 . (List Current Assets in order of liquidity Question 8 of 8 $ \begin{tabular}{l} \hline Intangible Assets \\ Current Assets \end{tabular} Total Stockholders' Equity Long-Term Investments Current Liabilities Total Current Liabilities Total Long-Term Liabilities Total Liabilities Long-Term Liabilities Total Liabilities and Stockholders' Equity Total Property, Plant and Equipment Total Intangible Assets Stockholders' Equity Property, Plant and Equipment Total Current Assets Total Long-Term Investments Total Assets Question 8 of 8\langle angle Liabilities and Stockholders' Equity eTextbook and Media Question 8 of 8 $ \begin{tabular}{l} \hline Intangible Assets \\ Current Assets \end{tabular} Total Stockholders' Equity Long-Term Investments Current Liabilities Total Current Liabilities Total Long-Term Liabilities Total Liabilities Long-Term Liabilities Total Liabilities and Stockholders' Equity Total Property, Plant and Equipment Total Intangible Assets Stockholders' Equity Property, Plant and Equipment Total Current Assets Total Long-Term Investments Total Assets Question 8 of 8\langle angle Liabilities and Stockholders' Equity eTextbook and Media Question 8 of 8\langle angle Liabilities and Stockholders' Equity eTextbook and Media Question 8 of 8\langle angle Liabilities and Stockholders' Equity $ eTextbook and Media Question 8 of 8 Liabilities and Stockholders' Equity $ Question 8 of 8 Liabilities and Stockholders' Equity $ Total Long-Term Liabilities Total Liabilities and Stockholders' Equity Long-Term Investments Total Property, Plant and Equipment Long-Term Liabilities Current Liabilities Total Current Liabilities Currentasiensets Stockholders' Equity Total Assets Total Liabilities Property, Plant and Equipment Total Current Assets Total Long-Term Investments Total Intangible Assets Total Stockholders' Equity eTextbook and Media Question 8 of 8> Liabilities and Stockholders' Equity $ Long-Term Investments Total Liabilities and Stockholders' Equity Total Current Liabilities Total Liabilities Total Stockholders' Equity Current Liabilities Total Property, Plant and Equipment Current Assets Total Long-Term Liabilities Total Current Assets Stockholders' Equity Total Long-Term Investments Total Intangible Assets Total Assets Property, Plant and Equipment Long-Term Liabilities Intangible Assets $ Total Current Assets Property, Plant and Equipment Total Long-Term Liabilities Total Liabilities Total Stockholders' Equity Total Long-Term Investments Long-Term Investments Total Intangible Assets Total Liabilities and Stockholders' Equity Current Assets Total Property, Plant and Equipment Total Assets Total Current Liabilities Intangible Assets Current Liabilities Long-Term Liabilities Stockholders' Equity eTextbook and Media Question 8 of 8 Liabilities and Stockholders' Equity $ Total Stockholders' Equity Long-Term Liabilities Total Assets Total Intangible Assets Stockholders' Equity Long-Term Investments Total Current Assets Total Current Liabilities Total Property, Plant and Equipment Total Liabilities and Stockholders' Equity Intangible Assets Current Assets Current Liabilities Total Long-Term Liabilities Total Liabilities Property, Plant and Equipment Total Long-Term Investments

8. These items are taken from financial statements of Wildhorse Co. at December 31,2022

8. These items are taken from financial statements of Wildhorse Co. at December 31,2022