Answered step by step

Verified Expert Solution

Question

1 Approved Answer

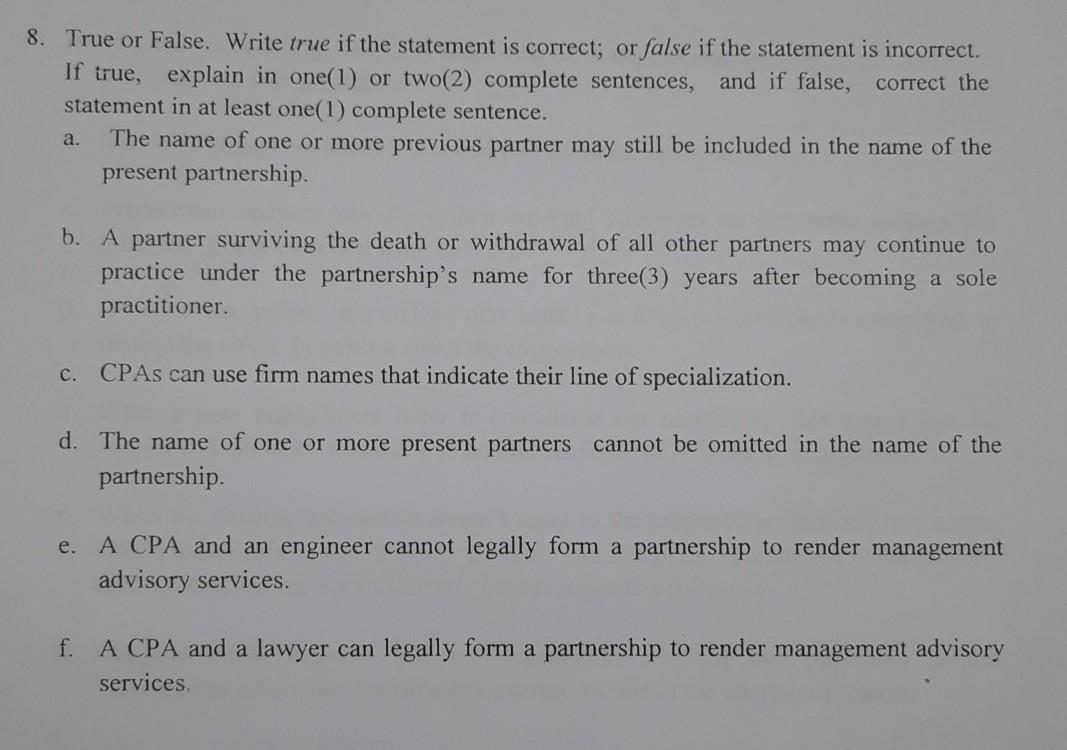

8. True or False. Write true if the statement is correct; or false if the statement is incorrect. If true, explain in one(1) or two(2)

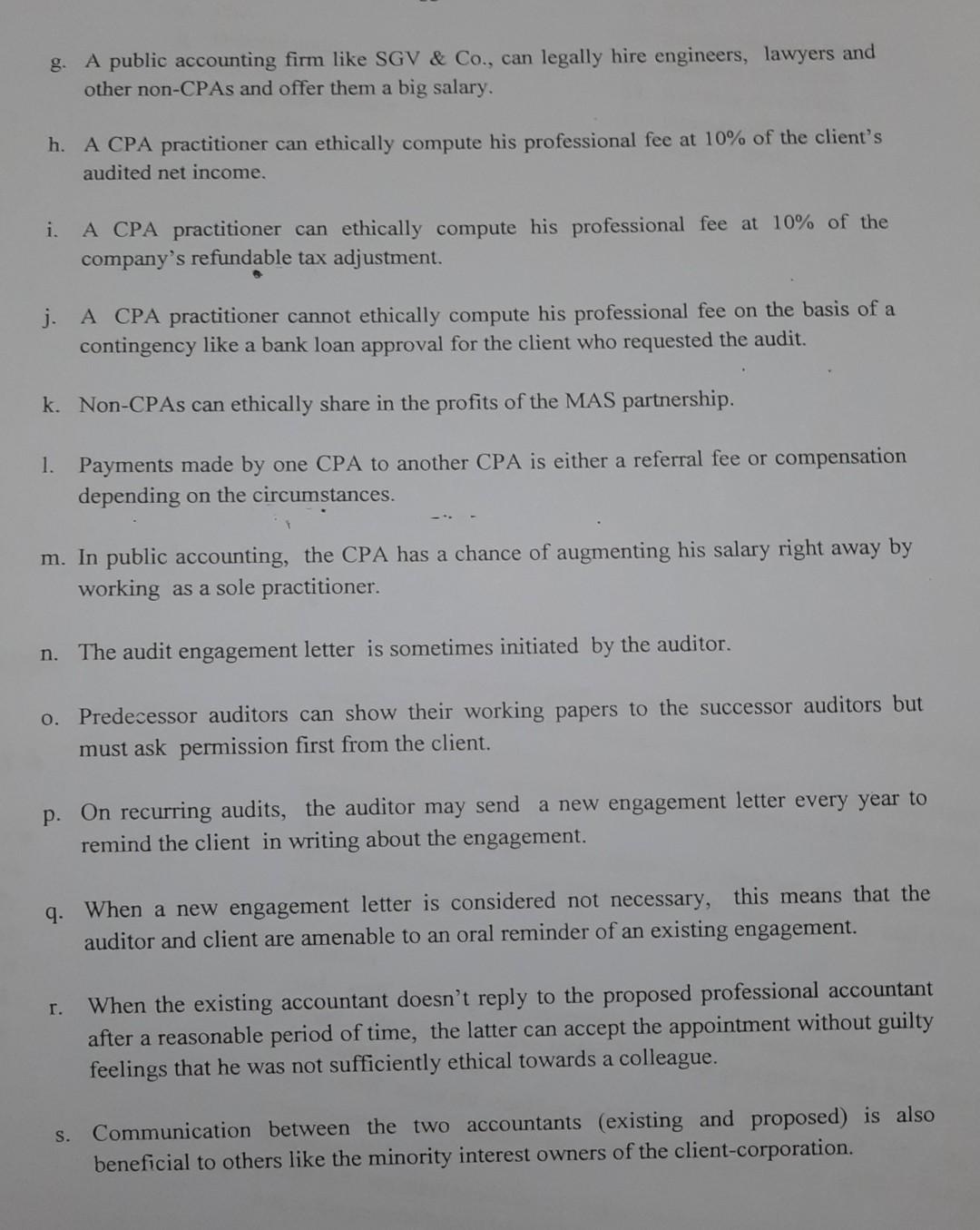

8. True or False. Write true if the statement is correct; or false if the statement is incorrect. If true, explain in one(1) or two(2) complete sentences, and if false, correct the statement in at least one(1) complete sentence. The name of one or more previous partner may still be included in the name of the present partnership. a. b. A partner surviving the death or withdrawal of all other partners may continue to practice under the partnership's name for three(3) years after becoming a sole practitioner c. CPAs can use firm names that indicate their line of specialization. d. The name of one or more present partners cannot be omitted in the name of the partnership e. A CPA and an engineer cannot legally form a partnership to render management advisory services f. A CPA and a lawyer can legally form a partnership to render management advisory services g. A public accounting firm like SGV & Co., can legally hire engineers, lawyers and other non-CPAs and offer them a big salary. h. A CPA practitioner can ethically compute his professional fee at 10% of the client's audited net income. i. A CPA practitioner can ethically compute his professional fee at 10% of the company's refundable tax adjustment. j. A CPA practitioner cannot ethically compute his professional fee on the basis of a contingency like a bank loan approval for the client who requested the audit. k. Non-CPAs can ethically share in the profits of the MAS partnership. 1. Payments made by one CPA to another CPA is either a referral fee or compensation depending on the circumstances. m. In public accounting, the CPA has a chance of augmenting his salary right away by working as a sole practitioner. n. The audit engagement letter is sometimes initiated by the auditor. o. Predecessor auditors can show their working papers to the successor auditors but must ask permission first from the client. p. On recurring audits, the auditor may send a new engagement letter every year to remind the client in writing about the engagement. q. When a new engagement letter is considered not necessary, this means that the auditor and client are amenable to an oral reminder of an existing engagement. r. When the existing accountant doesn't reply to the proposed professional accountant after a reasonable period of time, the latter can accept the appointment without guilty feelings that he was not sufficiently ethical towards a colleague. S. Communication between the two accountants (existing and proposed) is also beneficial to others like the minority interest owners of the client-corporation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started