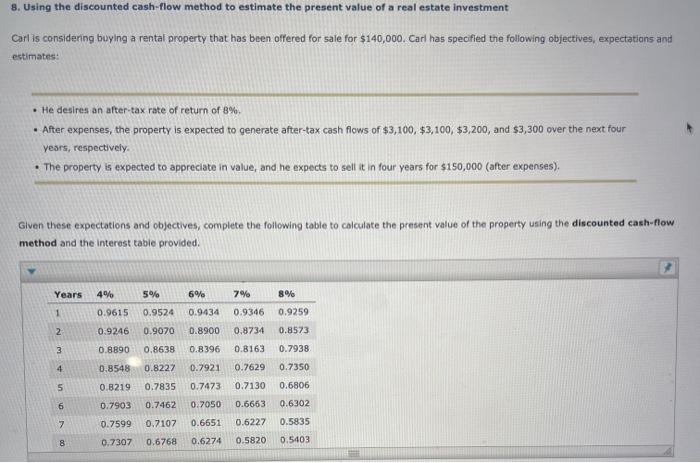

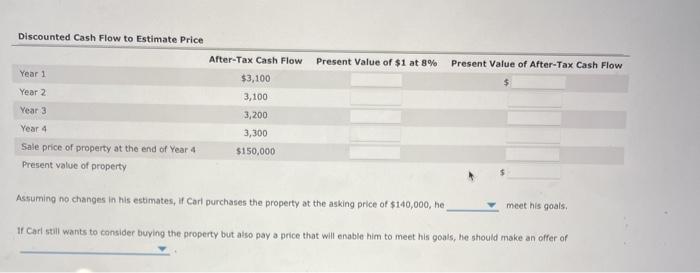

8. Using the discounted cash-flow method to estimate the present value of a real estate investment Carl is considering buying a rental property that has been offered for sale for $140,000. Carl has specified the following objectives, expectations and estimates: He desires an alter-tax rate of return of 8%. After expenses, the property is expected to generate after-tax cash flows of $3,100, $3,100 $3,200, and $3,300 over the next four years, respectively The property is expected to appreciate in value, and he expects to sell it in four years for $150,000 (after expenses). Given these expectations and objectives, complete the following table to calculate the present value of the property using the discounted cash-flow method and the interest table provided. Years 4% 6% 7% 8% 5% 0.9524 1 0.9615 0.9434 0.8900 0.9346 0.8734 0.9259 0.8573 2 0.9246 0.9070 3 0.8890 0.8638 0.8396 0.8163 4 0.8227 0.7921 0.8548 0.8219 0.7629 0.7130 0.7938 0.7350 0.6806 5 0.7835 0.7473 on 0.7903 0.7462 0.6302 7 0.7599 0.7107 0.7050 0.6651 0.6274 0.6663 0.6227 0.5820 0.5835 8 0.7307 0.6768 0.5403 Discounted Cash Flow to Estimate Price Present Value of $1 at 8% Present Value of After-Tax Cash Flow After-Tax Cash Flow $3,100 Year 1 Year 2 3,100 Year 3 3,200 Year 4 Sale price of property at the end of Year 4 Present value of property 3,300 $150,000 Assuming no changes in his estimates, if Carl purchases the property at the asking price of $140,000, he meet his goals. 11 Carl still wants to consider buying the property but also pay a price that will enable him to meet his goals, he should make an offer of 8. Using the discounted cash-flow method to estimate the present value of a real estate investment Carl is considering buying a rental property that has been offered for sale for $140,000. Carl has specified the following objectives, expectations and estimates: He desires an alter-tax rate of return of 8%. After expenses, the property is expected to generate after-tax cash flows of $3,100, $3,100 $3,200, and $3,300 over the next four years, respectively The property is expected to appreciate in value, and he expects to sell it in four years for $150,000 (after expenses). Given these expectations and objectives, complete the following table to calculate the present value of the property using the discounted cash-flow method and the interest table provided. Years 4% 6% 7% 8% 5% 0.9524 1 0.9615 0.9434 0.8900 0.9346 0.8734 0.9259 0.8573 2 0.9246 0.9070 3 0.8890 0.8638 0.8396 0.8163 4 0.8227 0.7921 0.8548 0.8219 0.7629 0.7130 0.7938 0.7350 0.6806 5 0.7835 0.7473 on 0.7903 0.7462 0.6302 7 0.7599 0.7107 0.7050 0.6651 0.6274 0.6663 0.6227 0.5820 0.5835 8 0.7307 0.6768 0.5403 Discounted Cash Flow to Estimate Price Present Value of $1 at 8% Present Value of After-Tax Cash Flow After-Tax Cash Flow $3,100 Year 1 Year 2 3,100 Year 3 3,200 Year 4 Sale price of property at the end of Year 4 Present value of property 3,300 $150,000 Assuming no changes in his estimates, if Carl purchases the property at the asking price of $140,000, he meet his goals. 11 Carl still wants to consider buying the property but also pay a price that will enable him to meet his goals, he should make an offer of