Answered step by step

Verified Expert Solution

Question

1 Approved Answer

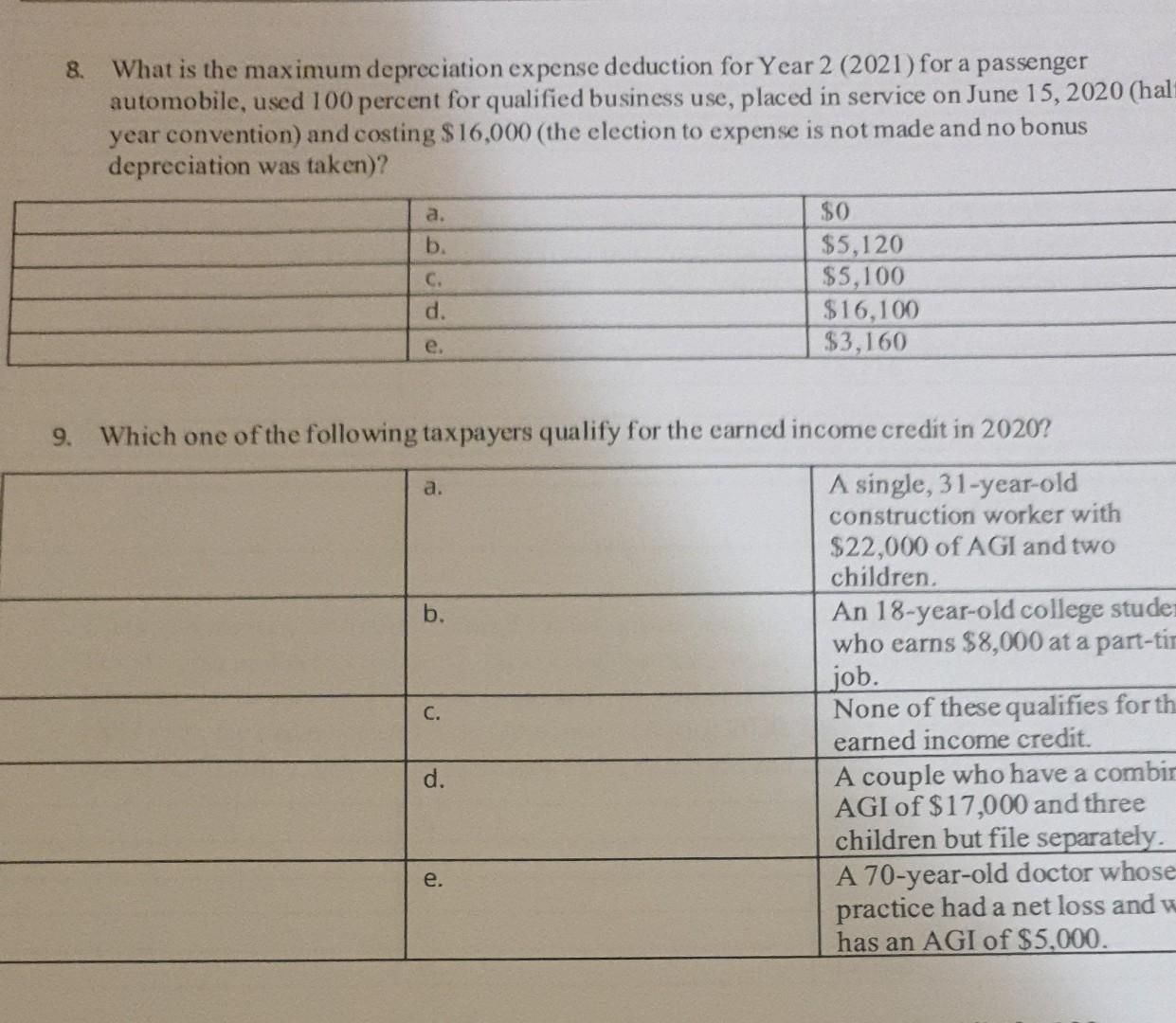

8. What is the maximum depreciation expense deduction for Year 2 (2021) for a passenger automobile, used 100 percent for qualified business use, placed in

8. What is the maximum depreciation expense deduction for Year 2 (2021) for a passenger automobile, used 100 percent for qualified business use, placed in service on June 15, 2020 (halt year convention) and costing $ 16,000 (the election to expense is not made and no bonus depreciation was taken)? a. b. $0 $5,120 $5,100 $16,100 $3,160 d. e. 9. Which one of the following taxpayers qualify for the carned income credit in 2020? a. b. C. A single, 31-year-old construction worker with $22,000 of AGI and two children An 18-year-old college stude who earns $8,000 at a part-tir job. None of these qualifies forth earned income credit. A couple who have a combir AGI of $17,000 and three children but file separately. A 70-year-old doctor whose practice had a net loss and w has an AGI of $5,000. d. e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started