Answered step by step

Verified Expert Solution

Question

1 Approved Answer

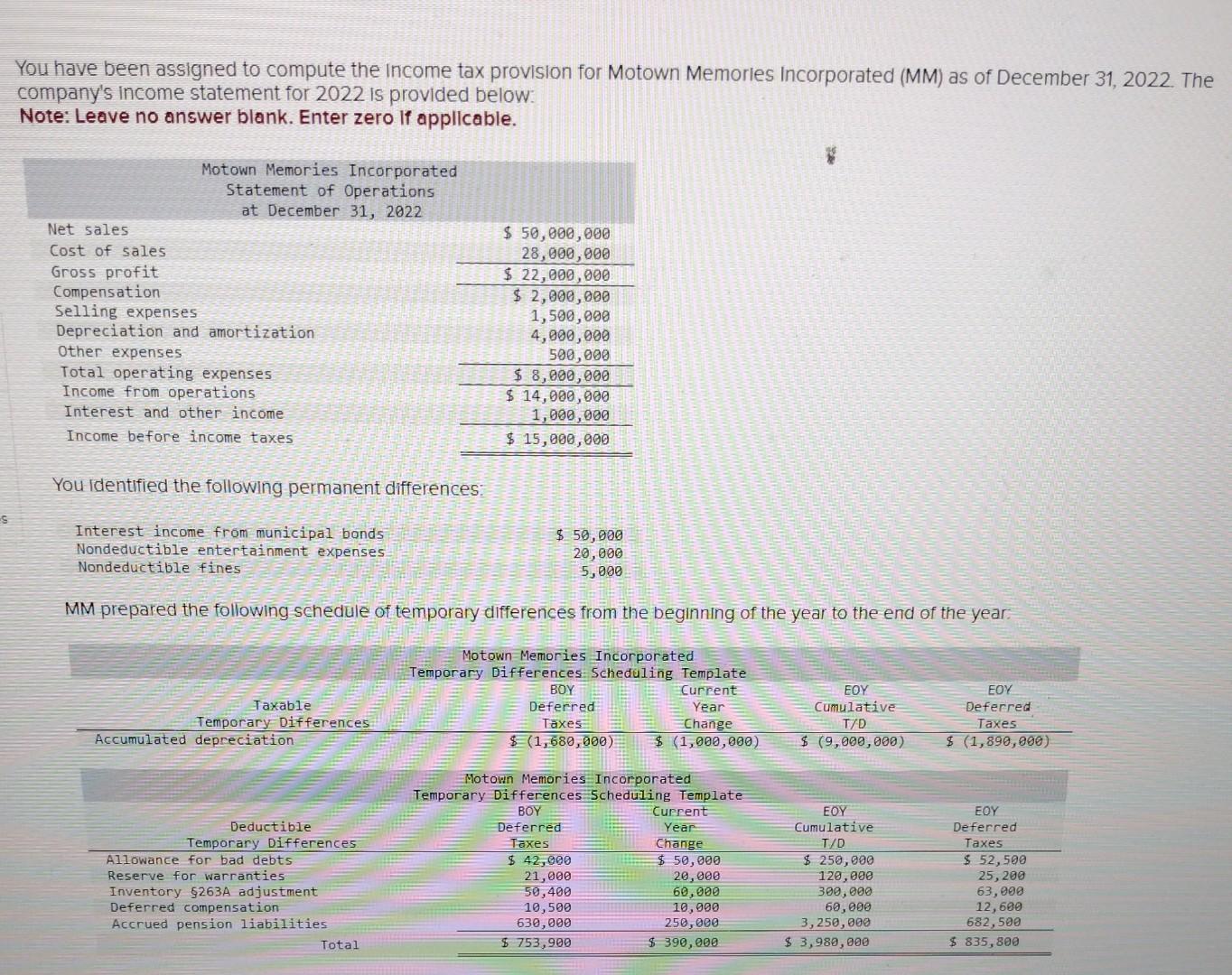

8 You have been assigned to compute the income tax provision for Motown Memorles Incorporated (MM) as of December 31,2022 . The company's income statement

8

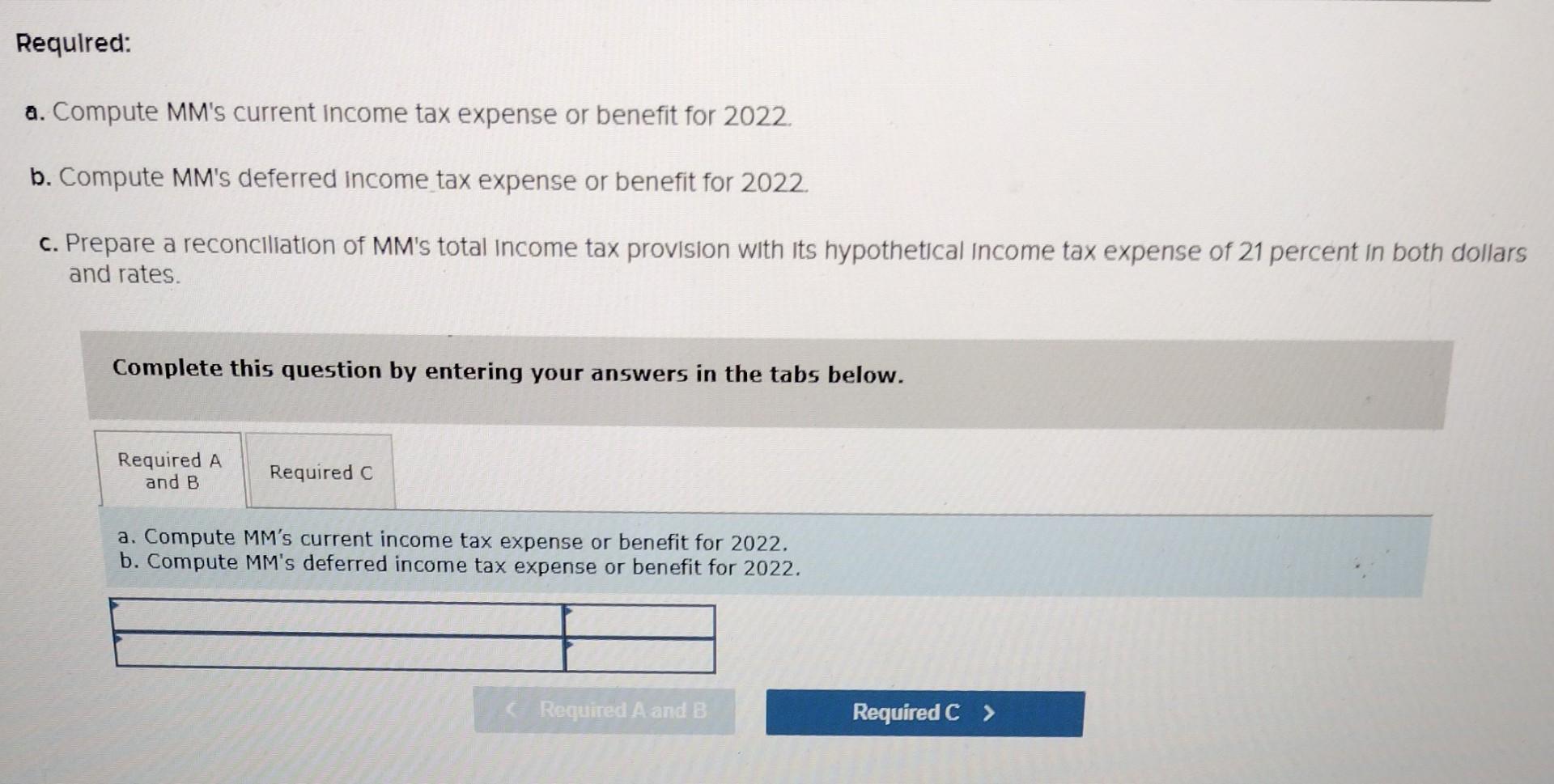

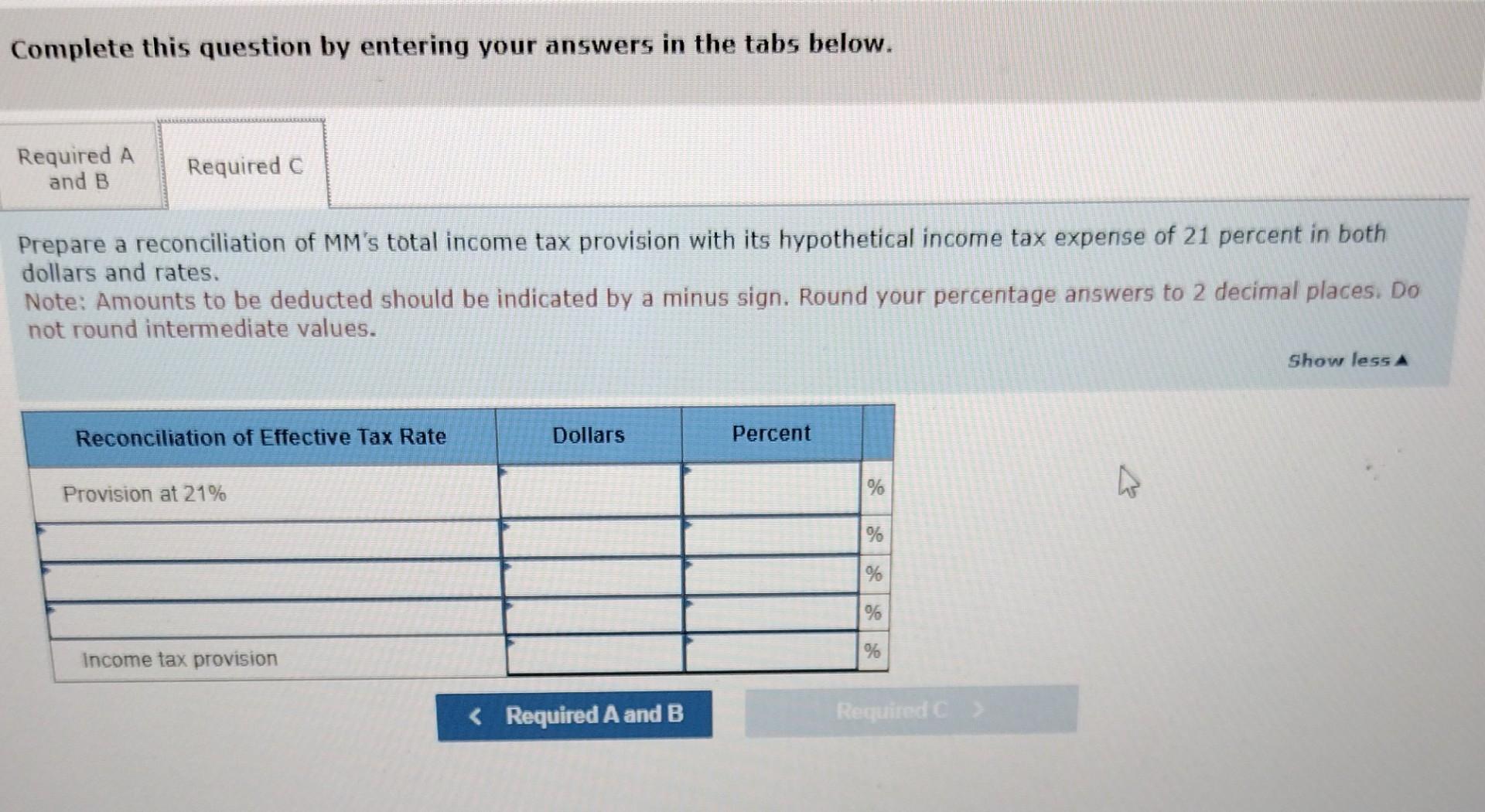

You have been assigned to compute the income tax provision for Motown Memorles Incorporated (MM) as of December 31,2022 . The company's income statement for 2022 is provided below: Note: Leave no answer blank. Enter zero If applicable. You identified the following permanent differences: MM prepared the following schedule of temporary differences from the beginning of the year to the end of the year: equired: 9. Compute MM's current Income tax expense or benefit for 2022. b. Compute MM's deferred income tax expense or benefit for 2022 c. Prepare a reconciliation of MM's total Income tax provision with its hypothetical Income tax expense of 21 percent in both dollars and rates. Complete this question by entering your answers in the tabs below. a. Compute MM's current income tax expense or benefit for 2022. b. Compute MM's deferred income tax expense or benefit for 2022 . Complete this question by entering your answers in the tabs below. Prepare a reconciliation of MM's total income tax provision with its hypothetical income tax expense of 21 percent in both dollars and rates. Note: Amounts to be deducted should be indicated by a minus sign. Round your percentage answers to 2 decimal places. Do not round intermediate valuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started