Answered step by step

Verified Expert Solution

Question

1 Approved Answer

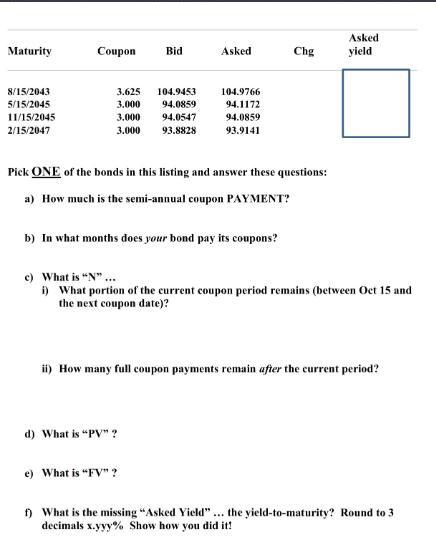

Maturity 8/15/2043 5/15/2045 11/15/2045 2/15/2047 Coupon Bid 3.625 104.9453 3.000 3.000 3.000 94.0859 94.0547 93.8828 Asked 104.9766 94.1172 94.0859 93.9141 Pick ONE of the

Maturity 8/15/2043 5/15/2045 11/15/2045 2/15/2047 Coupon Bid 3.625 104.9453 3.000 3.000 3.000 94.0859 94.0547 93.8828 Asked 104.9766 94.1172 94.0859 93.9141 Pick ONE of the bonds in this listing and answer these questions: a) How much is the semi-annual coupon PAYMENT? b) In what months does your bond pay its coupons? d) What is "PV"? e) What is "FV"? Chg c) What is "N"... i) What portion of the current coupon period remains (between Oct 15 and the next coupon date)? Asked yield ii) How many full coupon payments remain after the current period? f) What is the missing "Asked Yield" ... the yield-to-maturity? Round to 3 decimals x.yyy Show how you did it!

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

For the 8152043 bond a The semiannual coupon payment is 3625 b The bond pays its coupons i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started