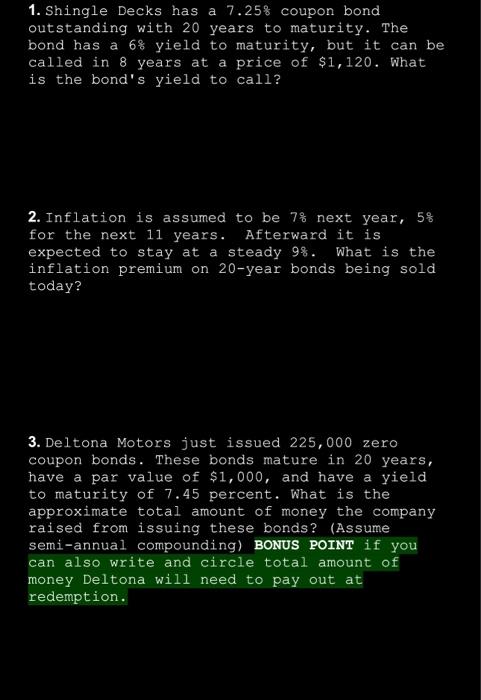

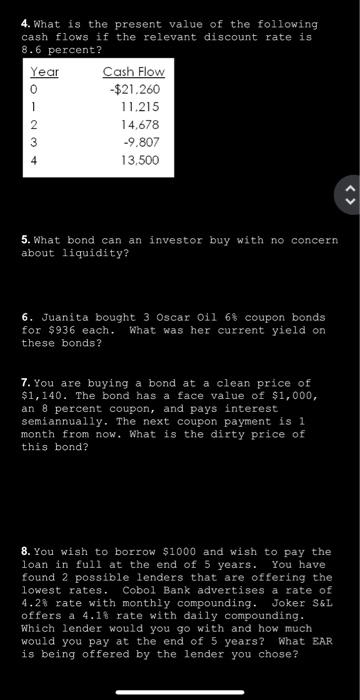

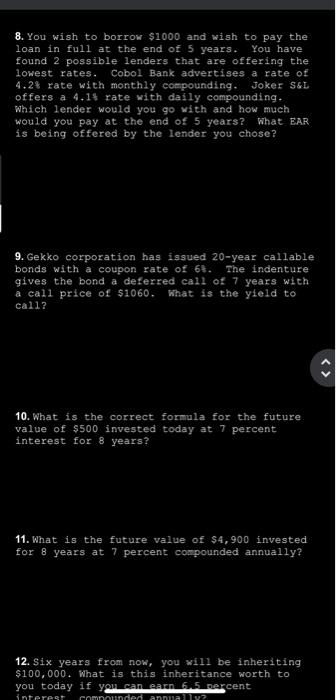

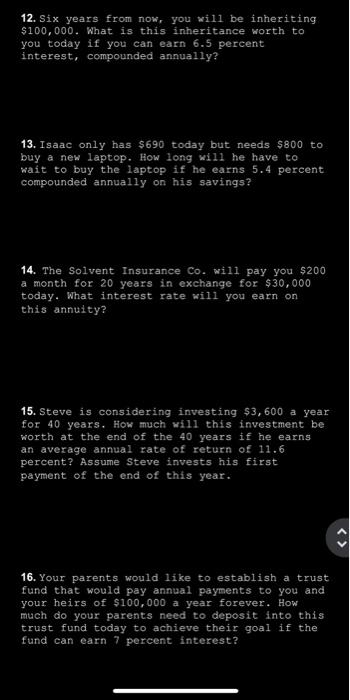

8. You wish to borrow $1000 and wish to pay the loan in full at the end of 5 years. You have found 2 possible lenders that are offering the lowest rates. Cobol Bank advertises a rate of 4.24 rate with monthly compounding. Joker SsL offers a 4.18 rate with daily compounding. Which lender would you go with and how much would you pay at the end of 5 years? What EAR is being offered by the lender you chose? 9. Gekko corporation has issued 20-year callable bonds with a coupon rate of 68 . The indenture gives the bond a deferred call of 7 years with a call price of $1060. What is the yield to call? 10. What is the correct formula for the future value of $500 invested today at 7 percent interest for 8 years? 11. What is the future value of $4,900 invested for 8 years at 7 percent compounded annually? 12. Six years from now, you will be inheriting $100,000. What is this inheritance worth to you today if you can earn. 6.5 nercent 4. What is the present value of the following cash flows if the relevant discount rate is 8.6 percent? 5. What bond can an investor buy with no concern about liquidity? 6. Juanita bought 3 Oscar 011 68 coupon bonds for $936 each. What was her current yield on these bonds? 7. You are buying a bond at a clean price of $1,140. The bond has a face value of $1,000, an 8 percent coupon, and pays interest semiannually. The next coupon payment is 1 month from now. What is the dirty price of this bond? 8. You wish to borrow $1000 and wish to pay the loan in full at the end of 5 years. You have found 2 possible lenders that are offering the lowest rates. Cobol Bank advertises a rate of 4.28 rate with monthly compounding. Joker S\&L offers a 4.18 rate with daily compounding. Which lender would you go with and how much would you pay at the end of 5 years? What BAR is being offered by the lender you chose? 12. Six years from now, you will be inheriting $100,000. What is this inheritance worth to you today if you can earn 6.5 percent interest, compounded annually? 13. Isaac only has $690 today but needs $800 to buy a new laptop. How long will he have to wait to buy the laptop if he earns 5.4 percent compounded annually on his savings? 14. The Solvent Insurance Co. will pay you $200 a month for 20 years in exchange for $30,000 today. What interest rate will you earn on this annuity? 15. Steve is considering investing $3,600 a year for 40 years. How much will this investment be worth at the end of the 40 years if he earns an average annual rate of return of 11.6 percent? Assume Steve invests his first payment of the end of this year. 16. Your parents would like to establish a trust fund that would pay annual payments to you and your heirs of $100,000 a year forever. How much do your parents need to deposit into this trust fund today to achieve their goal if the fund can earn 7 percent interest? 1. Shingle Decks has a 7.25% coupon bond outstanding with 20 years to maturity. The bond has a 6% yield to maturity, but it can be called in 8 years at a price of $1,120. What is the bond's yield to call? 2. Inflation is assumed to be 7% next year, 5% for the next 11 years. Afterward it is expected to stay at a steady 98 . What is the inflation premium on 20-year bonds being sold today? 3. Deltona Motors just issued 225,000 zero coupon bonds. These bonds mature in 20 years, have a par value of $1,000, and have a yield to maturity of 7.45 percent. What is the approximate total amount of money the company raised from issuing these bonds? (Assume semi-annual compounding) BONUS POINT if you can also write and circle total amount of money Deltona will need to pay out at redemption