Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8)11. A, B and C were partners in a firm. On 1st April, 2012 their capitals stood as Rs. 5,00,000; Rs. 2,50,000 and Rs. 2,50,000

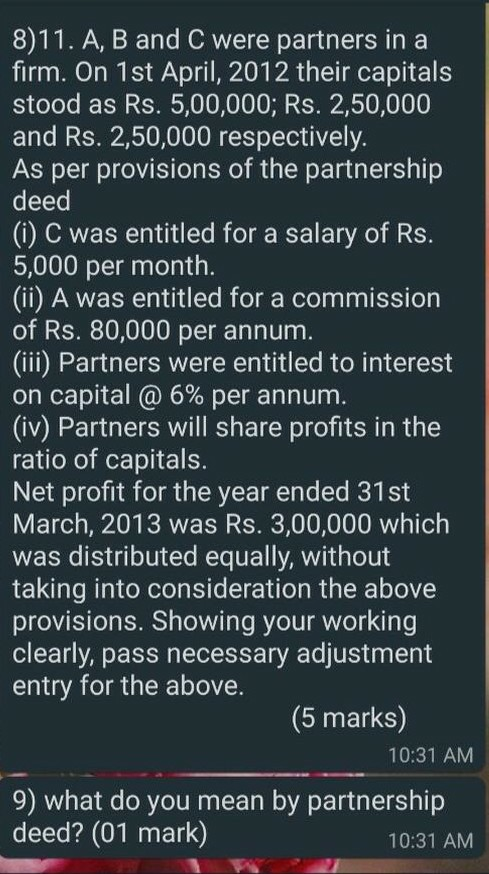

8)11. A, B and C were partners in a firm. On 1st April, 2012 their capitals stood as Rs. 5,00,000; Rs. 2,50,000 and Rs. 2,50,000 respectively. As per provisions of the partnership deed (i) C was entitled for a salary of Rs. 5,000 per month. (ii) A was entitled for a commission of Rs. 80,000 per annum. (iii) Partners were entitled to interest on capital @ 6% per annum. (iv) Partners will share profits in the ratio of capitals. Net profit for the year ended 31st March, 2013 was Rs. 3,00,000 which was distributed equally, without taking into consideration the above provisions. Showing your working clearly, pass necessary adjustment entry for the above. (5 marks) 10:31 AM 9) what do you mean by partnership deed? (01 mark) 10:31 AM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started