Answered step by step

Verified Expert Solution

Question

1 Approved Answer

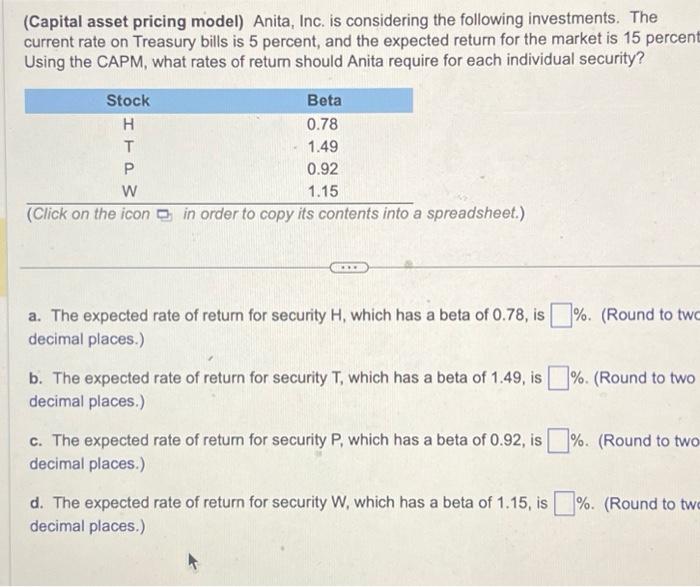

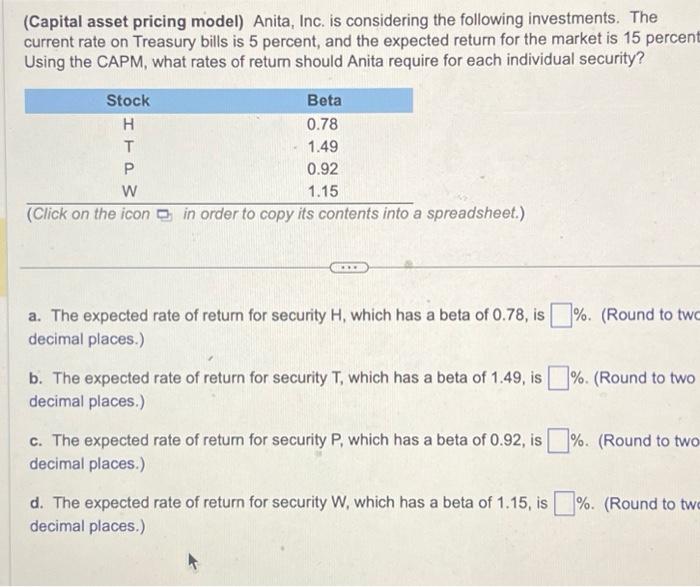

8.11 (Capital asset pricing model) Anita, Inc. is considering the following investments. The current rate on Treasury bills is 5 percent, and the expected return

8.11

(Capital asset pricing model) Anita, Inc. is considering the following investments. The current rate on Treasury bills is 5 percent, and the expected return for the market is 15 percent Using the CAPM, what rates of retum should Anita require for each individual security? (Click on the icon in order to copy its contents into a spreadsheet.) a. The expected rate of return for security H, which has a beta of 0.78 , is \%. (Round to twc decimal places.) b. The expected rate of return for security T, which has a beta of 1.49 , is %. (Round to two decimal places.) c. The expected rate of retum for security P, which has a beta of 0.92 , is \%. (Round to two decimal places.) d. The expected rate of return for security W, which has a beta of 1.15 , is %. (Round to tw decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started