Answered step by step

Verified Expert Solution

Question

1 Approved Answer

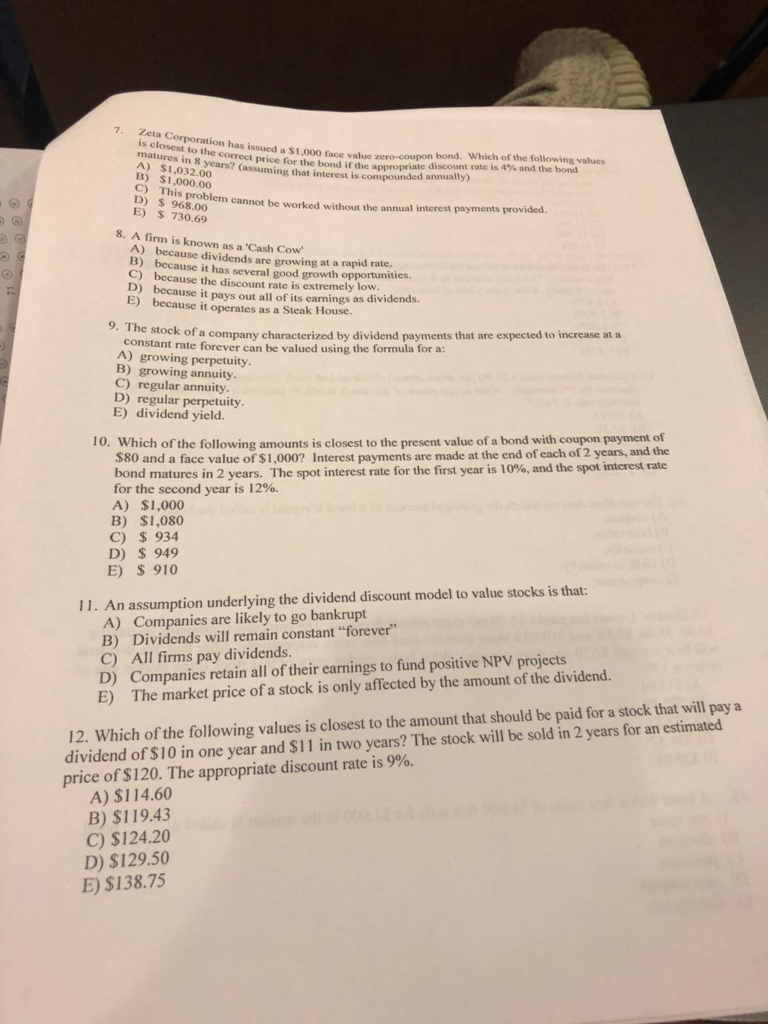

8-12 THX!!!!!!!! 7. Zetua s closest to the correct ion B032.00(asuming that htond if the appropriate discount rahe ih af the following values B) $1,000.00

8-12 THX!!!!!!!!

7. Zetua s closest to the correct ion B032.00(asuming that htond if the appropriate discount rahe ih af the following values B) $1,000.00 is closest to the correct price for the bond if the appropriae n has issued a $1,000 face value a (eupice for the bond irdeo coupon bond. Which of A) $1,032.00 appropriate discount rate is 4% and the bond s compounded annually) s problem cannot be worked without the annual interest payments provided. D) $ 968.00 E) $ 730.69 8. A firm is known as a 'Cash Cow A) B) because dividends are growing at a rapid rate. because it has several good growth opportunities. C) D) E) because the discount rate is extremely low because it pays out all of its earnings as dividends. because it operates as a Steak House. ck o a company characterized by dividend payments that are expected to increase at a constant rate forever can be valued using the formula for a: A) growing perpetuity growing annuity. C) regular annuity D) regular perpetuity E) dividend yield. 10. Which of the following amounts is closest to the present value of a bond with coupon payment of 580 and a face value of s1,000? Interest payments are made at the end of each of 2 years, and the 2 years. for the second year is 12%. A) $1,000 B) $1,080 C) $934 D) $ 949 E) S 910 11. An assumption underlying the dividend discount model to value stocks is that: A) Companies are likely to go bankrupt B) Dividends will remain constant "forever" C) All firms pay dividends. D) Companies retain all of their earnings to fund positive NPV projects E) The market price of a stock is only affected by the amount of the dividend 12. Which of the following values is closest to the amount that should be paid for a stock that will pay a dividend of $10 in one year and S11 in two years? The stock will be sold in 2 years for an estimated price of$ 120, The appropriate discount rate is 9%. A) $114.60 B) $119.43 C) $124.20 D) $129.50 E) $138.75Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started