Question

8.15 Analyzing Disclosures Regarding Fixed Assets. Exhibit 8.21 presents selected financial statement data for three chemical companies: Monsanto Company , Olin Corporation , and NewMarket

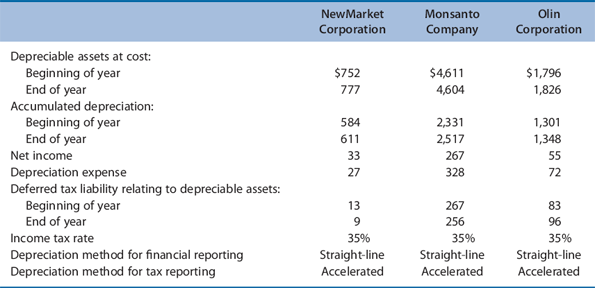

8.15 Analyzing Disclosures Regarding Fixed Assets. Exhibit 8.21 presents selected financial statement data for three chemical companies: Monsanto Company, Olin Corporation, and NewMarket Corporation. (NewMarket was formed from a merger of Ethyl Corporation and Afton Chemical Corporation.)

Exhibit 8.21Three Chemical Companies Selected Financial Statement Data on Depreciable Assets (amounts in millions) (Problem 8.15)

Sources: NewMarket Corporation, Form 10-K for the Fiscal Year ended December 31, 2004; Monsanto Company, Form 10-K for the Fiscal Year ended August 31, 2004; and Olin Corporation, Form 10-K for the Fiscal Year ended December 31, 2004.

Required

-

Compute the average total depreciable life of assets in use for each firm.

-

Compute the average age to date of depreciable assets in use for each firm at the end of the year.

-

Compute the amount of depreciation expense recognized for tax purposes for each firm for the year using the amount of the deferred taxes liability related to depreciation timing differences.

-

Compute the amount of net income for the year for each firm assuming that depreciation expense for financial reporting equals the amount computed in Requirement c for tax reporting.

-

Compute the amount each company would report for property, plant, and equipment (net) at the end of the year if it had used accelerated (tax reporting) depreciation instead of straight-line depreciation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started