Answered step by step

Verified Expert Solution

Question

1 Approved Answer

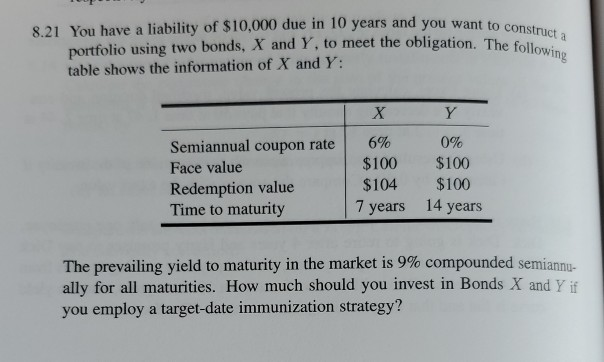

8.21 You have a liability of $10,000 due in 10 years and you want to construct a portfolio using two bonds, X and Y, to

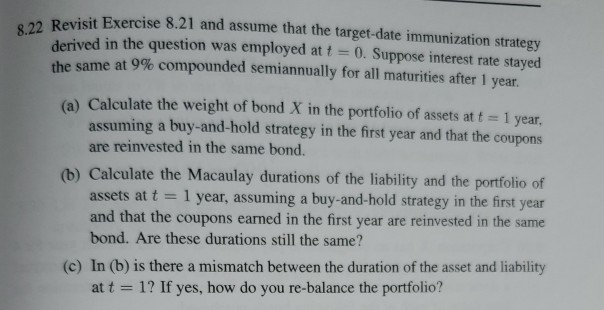

8.21 You have a liability of $10,000 due in 10 years and you want to construct a portfolio using two bonds, X and Y, to meet the obligation. The following table shows the information of X and Y: Y Semiannual coupon rate Face value Redemption value Time to maturity 6% $100 $104 7 years 0% $100 $100 14 years The prevailing yield to maturity in the market is 9% compounded semiannu- ally for all maturities. How much should you invest in Bonds X and Y if you employ a target-date immunization strategy? 0. Suppose interest rate stayed 8.22 Revisit Exercise 8.21 and assume that the target-date immunization strategy derived in the question was employed at t = the same at 9% compounded semiannually for all maturities after 1 year (a) Calculate the weight of bond X in the portfolio of assets at t = 1 year, assuming a buy-and-hold strategy in the first year and that the coupons are reinvested in the same bond. (b) Calculate the Macaulay durations of the liability and the portfolio of assets at t= 1 year, assuming a buy-and-hold strategy in the first year and that the coupons earned in the first year are reinvested in the same bond. Are these durations still the same? (c) In (b) is there a mismatch between the duration of the asset and liability at t = 1? If yes, how do you re-balance the portfolio? 8.21 You have a liability of $10,000 due in 10 years and you want to construct a portfolio using two bonds, X and Y, to meet the obligation. The following table shows the information of X and Y: Y Semiannual coupon rate Face value Redemption value Time to maturity 6% $100 $104 7 years 0% $100 $100 14 years The prevailing yield to maturity in the market is 9% compounded semiannu- ally for all maturities. How much should you invest in Bonds X and Y if you employ a target-date immunization strategy? 0. Suppose interest rate stayed 8.22 Revisit Exercise 8.21 and assume that the target-date immunization strategy derived in the question was employed at t = the same at 9% compounded semiannually for all maturities after 1 year (a) Calculate the weight of bond X in the portfolio of assets at t = 1 year, assuming a buy-and-hold strategy in the first year and that the coupons are reinvested in the same bond. (b) Calculate the Macaulay durations of the liability and the portfolio of assets at t= 1 year, assuming a buy-and-hold strategy in the first year and that the coupons earned in the first year are reinvested in the same bond. Are these durations still the same? (c) In (b) is there a mismatch between the duration of the asset and liability at t = 1? If yes, how do you re-balance the portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started