Answered step by step

Verified Expert Solution

Question

1 Approved Answer

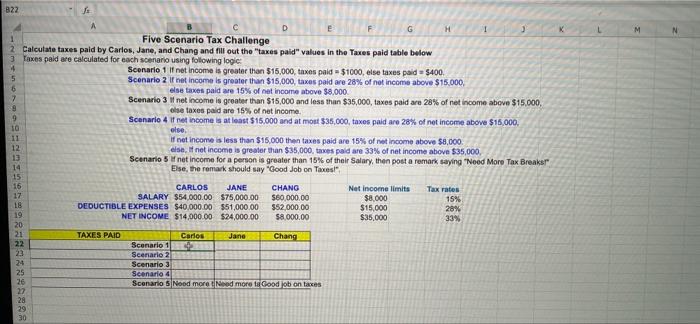

822 1 Five Scenario Tax Challenge D E G H 2 Calculate taxes paid by Carlos, Jane, and Chang and fill out the taxes

822 1 Five Scenario Tax Challenge D E G H 2 Calculate taxes paid by Carlos, Jane, and Chang and fill out the "taxes paid" values in the Taxes paid table below 3 Taxes paid are calculated for each scenario using following logic: 4 5 6 7 8 9 10 11 12 13. 14 Scenario 1 If net income is greater than $15,000, taxes paid $1000, else taxes paid $400. Scenario 2 If net income is greater than $15,000, taxes paid are 28% of not income above $15,000, else taxes paid are 15% of net income above $8,000. Scenario 3 If net income is greater than $15,000 and less than $35,000, taxes paid are 28% of net income above $15,000, else taxes paid are 15% of net income. Scenario 4 if net income is at least $15,000 and at most $35,000, taxes paid are 28% of net income above $15,000. else If net income is less than $15,000 then taxes paid are 15% of net income above $8,000. else, If net income is greater than $35,000, taxes paid are 33% of net income above $35,000, Scenario 5 if net income for a person is greater than 15% of their Salary, then post a remark saying "Need More Tax Breaks Else, the remark should say "Good Job on Taxes!" CARLOS JANE SALARY $54,000.00 $75,000.00 DEDUCTIBLE EXPENSES $40,000.00 $51,000.00 NET INCOME $14,000.00 $24,000.00 CHANG $60,000.00 $52,000.00 15 16 17 18 19 $8,000.00 20 21 TAXES PAID 22 Scenario 1 Carlos 4 Jane Chang 23 Scenario 2 24 Scenario 3 25 26 Scenario 4 Scenario 5 Nood more t Need more ta Good job on taxes 27 28 29 30 Net income limits $8,000 $15,000 Tax rates 15% 28% $35,000 33% M N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started