8.22 & 8.24

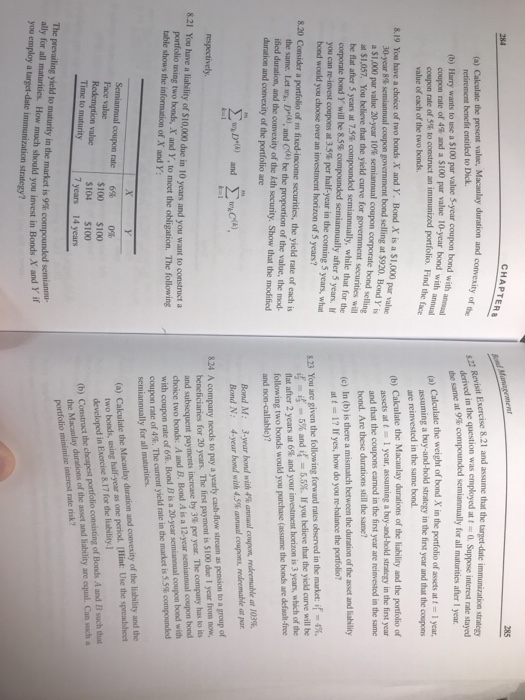

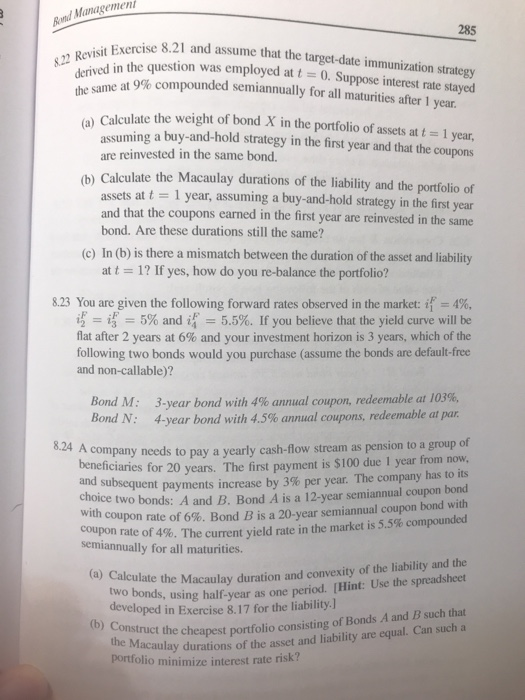

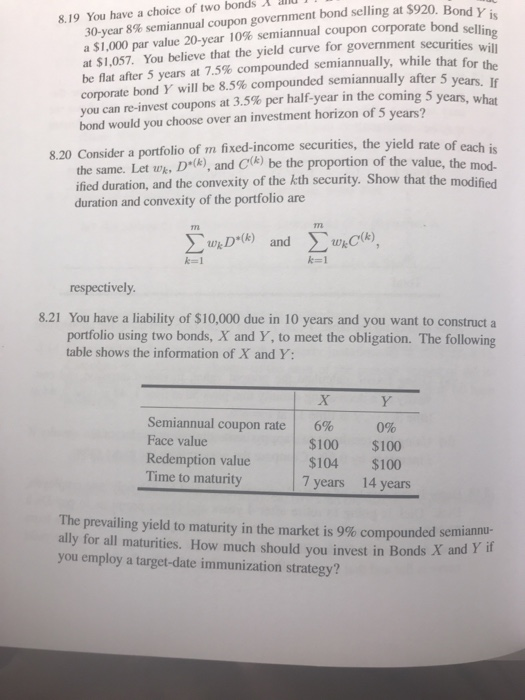

CHAPTER 285 tion and convexity of the & Revisit Exer Exercise 8.21 and assume that the farget-date immunization strategy in the question was employed at . Suppose interest rate stayed met 99 compunded semiannually for all maturities after 1 year derived in the questi (a) Calculate the present value, Macaulay duration and convexi retirement benefit entitled to Dick. (b) Harry wants to use a $100 par value 5-year coupon bond with coupon rate of 4 and a 100 par value 10-year bond with coupon rate of to construct an immunized portfolio. Find th value of each of the two bonds. bond with a folie. Find the face 8.19 You have a choice of two bonds X and Y. Bond X is a $1,000 per 30-year 86 semiannual coupon government bond selling at $920 Bondy a $1,000 par value 20-year 10% semiannual coupon corporate bond selling a $1057. You believe that the yield curve for government securities will be flat after 5 years at 7.5% compounded semiannually, while that for the corporate bond Y will be 8.5% compounded semiannually after 5 years. you can re-invest coupons at 3.5% per half-year in the coming 5 years, what bond would you choose over an investment horizon of 5 years? 8.20 Consider a portfolio of fixed-income securities, the yield rate of each is the same. Let , D", and cle) be the proportion of the value, the mod ified duration, and the convexity of the kth security. Show that the modified duration and convexity of the portfolio are Calculate the weight of in the portfolio of assets at t = 1 year, assuming a buy-and-old racey in the first year and that the coupons are reinvested in the same bond. (b) Calculate the Macaulay durations of the liability and the portfolio of assets at t = 1 year, assuming a buy-and-hold strategy in the first year and that the coupons camed in the first year are reinvested in the same bond. Are these durations still the same (c) In (b) is there a mismatch between the duration of the asset and liability att 1? If yes, how do you re-balance the portfolio? 823 You are given the following forward rates observed in the market: if 1%. is 5% and if=5.5%. If you believe that the yield curve will be flat after 2 years at 6% and your investment horizon is 3 years, which of the following two bonds would you purchase (assume the bonds are default-free and non-callable)? Bond M: 3-year bond with annual coupon, redeemable at 1035 Bond N: 4-year bond with 4.5% annual coupons, redeemable ar por " and CM respectively 8.21 You have a liability of S10,000 due in 10 years and you want to construct a portfolio using two bonds, X and Y to meet the obligation. The following table shows the information of X and Y: * A company needs to pay a yearly cash flow stream as pension to a group of beneficiaries for 20 years. The first payment is $100 due 1 year from now, and subsequent payments increase by 3% per year. The company has to its choice two bonds: A and B. Bond A is a 12-year semiannual coupon bond with coupon rate of 6. Bond B is a 20-year semiannual coupon bond with coupon rate of 49. The current yield rate in the market is 356 compounded semiannually for all maturities XY Semiannual coupon rate 6 0 Face value $100 $100 Redemption value S104 S100 Time to maturity 7 years 14 years (a) Calculate the Macaulay duration and convexity of the ability and the two bonds, using half-year as one period of Use the spreadsheet developed in Exercise 8.17 for the liability (b) Construct the cheapest portfolio consisting of Bonds A and B such that the Malay durations of the asset and liability are equal. Can socha portfolio minimize interest rate risk? The prevailing yield to maturity in the market is 95 compounded semia ally for all maturities. How much should you invest in Boods X and you employ a target-date immunization strategy? Bond Management 285 8.22 Revisit Exercises derived in the que the same at 9% com sercise 8.21 and assume that the target-date immunization strategy in the question was employed at t = 0. Suppose interest rate stayed 9% compounded semiannually for all maturities after 1 year. Calculate the weight of bond X in the portfolio of assets at t = 1 year, assuming a buy-and-hold strategy in the first year and that the coupons are reinvested in the same bond. (b) Calculate the Macaulay durations of the liability and the portfolio of assets at t = 1 year, assuming a buy-and-hold strategy in the first year and that the coupons earned in the first year are reinvested in the same bond. Are these durations still the same? (c) In (b) is there a mismatch between the duration of the asset and liability at t = 1? If yes, how do you re-balance the portfolio? 8.23 You are given the following forward rates observed in the market i = 4%, i = if = 5% and if = 5.5%. If you believe that the yield curve will be flat after 2 years at 6% and your investment horizon is 3 years, which of the following two bonds would you purchase (assume the bonds are default-free and non-callable)? Bond M: Bond N: 3-year bond with 4% annual coupon, redeemable at 103%, 4-year bond with 4.5% annual coupons, redeemable at par. A company needs to pay a yearly cash-flow stream as pension to a group of beneficiaries for 20 years. The first payment is $100 due 1 year from now, and subsequent payments increase by 3% per year. The company has to its ce two bonds: A and B. Bond A is a 12-year semiannual coupon bond coupon rate of 6%. Bond B is a 20-year semiannual coupon bond with pon rate of 4%. The current vield rate in the market is 5.5% compounded coupon rate of 4%. The current yiel semiannually for all maturities. (a) Calculate the Macaulay du two bonds, using half-year as ate the Macaulay duration and convexity of the liability and the s, using half-year as one period. [Hint: Use the spreadsheet developed in Exercise 8.17 for the liability.] heapest portfolio consisting of Bonds A and B such that acaulay durations of the asset and liability are equal. Can such a (b) Construct the cheapest portfolio consist the Macaulay durations of portfolio minimize interest rate risk? orporate bond selling 8.19 You have a choice of two bonds 30-year 8% semiannual coupon government bond selling at $920. Bond a $1.000 par value 20-year 10% semiannual coupon corporate bond sell: at $1.057. You believe that the yield curve for government securities will be flat after 5 years at 7.5% compounded semiannually, while that for corporate bond Y will be 8.5% compounded semiannually after 5 years you can re-invest coupons at 3.5% per half-year in the coming 5 years who bond would you choose over an investment horizon of 5 years? 8.20 Consider a portfolio of m fixed-income securities, the yield rate of each the same. Let wk. Delle, and C ) be the proportion of the value, the mod. ified duration, and the convexity of the kth security. Show that the modified duration and convexity of the portfolio are w.D*(k) and wc(k), respectively. 8.21 You have a liability of $10,000 due in 10 years and you want to construct a portfolio using two bonds, X and Y, to meet the obligation. The following table shows the information of X and Y: Y Semiannual coupon rate Face value Redemption value Time to maturity 6% $100 $104 7 years 0% $100 $100 14 years The prevailing yield to maturity in the market is 9% compounded semiannt ally for all maturities. How much should you invest in Bonds X and you employ a target-date immunization strategy? CHAPTER 285 tion and convexity of the & Revisit Exer Exercise 8.21 and assume that the farget-date immunization strategy in the question was employed at . Suppose interest rate stayed met 99 compunded semiannually for all maturities after 1 year derived in the questi (a) Calculate the present value, Macaulay duration and convexi retirement benefit entitled to Dick. (b) Harry wants to use a $100 par value 5-year coupon bond with coupon rate of 4 and a 100 par value 10-year bond with coupon rate of to construct an immunized portfolio. Find th value of each of the two bonds. bond with a folie. Find the face 8.19 You have a choice of two bonds X and Y. Bond X is a $1,000 per 30-year 86 semiannual coupon government bond selling at $920 Bondy a $1,000 par value 20-year 10% semiannual coupon corporate bond selling a $1057. You believe that the yield curve for government securities will be flat after 5 years at 7.5% compounded semiannually, while that for the corporate bond Y will be 8.5% compounded semiannually after 5 years. you can re-invest coupons at 3.5% per half-year in the coming 5 years, what bond would you choose over an investment horizon of 5 years? 8.20 Consider a portfolio of fixed-income securities, the yield rate of each is the same. Let , D", and cle) be the proportion of the value, the mod ified duration, and the convexity of the kth security. Show that the modified duration and convexity of the portfolio are Calculate the weight of in the portfolio of assets at t = 1 year, assuming a buy-and-old racey in the first year and that the coupons are reinvested in the same bond. (b) Calculate the Macaulay durations of the liability and the portfolio of assets at t = 1 year, assuming a buy-and-hold strategy in the first year and that the coupons camed in the first year are reinvested in the same bond. Are these durations still the same (c) In (b) is there a mismatch between the duration of the asset and liability att 1? If yes, how do you re-balance the portfolio? 823 You are given the following forward rates observed in the market: if 1%. is 5% and if=5.5%. If you believe that the yield curve will be flat after 2 years at 6% and your investment horizon is 3 years, which of the following two bonds would you purchase (assume the bonds are default-free and non-callable)? Bond M: 3-year bond with annual coupon, redeemable at 1035 Bond N: 4-year bond with 4.5% annual coupons, redeemable ar por " and CM respectively 8.21 You have a liability of S10,000 due in 10 years and you want to construct a portfolio using two bonds, X and Y to meet the obligation. The following table shows the information of X and Y: * A company needs to pay a yearly cash flow stream as pension to a group of beneficiaries for 20 years. The first payment is $100 due 1 year from now, and subsequent payments increase by 3% per year. The company has to its choice two bonds: A and B. Bond A is a 12-year semiannual coupon bond with coupon rate of 6. Bond B is a 20-year semiannual coupon bond with coupon rate of 49. The current yield rate in the market is 356 compounded semiannually for all maturities XY Semiannual coupon rate 6 0 Face value $100 $100 Redemption value S104 S100 Time to maturity 7 years 14 years (a) Calculate the Macaulay duration and convexity of the ability and the two bonds, using half-year as one period of Use the spreadsheet developed in Exercise 8.17 for the liability (b) Construct the cheapest portfolio consisting of Bonds A and B such that the Malay durations of the asset and liability are equal. Can socha portfolio minimize interest rate risk? The prevailing yield to maturity in the market is 95 compounded semia ally for all maturities. How much should you invest in Boods X and you employ a target-date immunization strategy? Bond Management 285 8.22 Revisit Exercises derived in the que the same at 9% com sercise 8.21 and assume that the target-date immunization strategy in the question was employed at t = 0. Suppose interest rate stayed 9% compounded semiannually for all maturities after 1 year. Calculate the weight of bond X in the portfolio of assets at t = 1 year, assuming a buy-and-hold strategy in the first year and that the coupons are reinvested in the same bond. (b) Calculate the Macaulay durations of the liability and the portfolio of assets at t = 1 year, assuming a buy-and-hold strategy in the first year and that the coupons earned in the first year are reinvested in the same bond. Are these durations still the same? (c) In (b) is there a mismatch between the duration of the asset and liability at t = 1? If yes, how do you re-balance the portfolio? 8.23 You are given the following forward rates observed in the market i = 4%, i = if = 5% and if = 5.5%. If you believe that the yield curve will be flat after 2 years at 6% and your investment horizon is 3 years, which of the following two bonds would you purchase (assume the bonds are default-free and non-callable)? Bond M: Bond N: 3-year bond with 4% annual coupon, redeemable at 103%, 4-year bond with 4.5% annual coupons, redeemable at par. A company needs to pay a yearly cash-flow stream as pension to a group of beneficiaries for 20 years. The first payment is $100 due 1 year from now, and subsequent payments increase by 3% per year. The company has to its ce two bonds: A and B. Bond A is a 12-year semiannual coupon bond coupon rate of 6%. Bond B is a 20-year semiannual coupon bond with pon rate of 4%. The current vield rate in the market is 5.5% compounded coupon rate of 4%. The current yiel semiannually for all maturities. (a) Calculate the Macaulay du two bonds, using half-year as ate the Macaulay duration and convexity of the liability and the s, using half-year as one period. [Hint: Use the spreadsheet developed in Exercise 8.17 for the liability.] heapest portfolio consisting of Bonds A and B such that acaulay durations of the asset and liability are equal. Can such a (b) Construct the cheapest portfolio consist the Macaulay durations of portfolio minimize interest rate risk? orporate bond selling 8.19 You have a choice of two bonds 30-year 8% semiannual coupon government bond selling at $920. Bond a $1.000 par value 20-year 10% semiannual coupon corporate bond sell: at $1.057. You believe that the yield curve for government securities will be flat after 5 years at 7.5% compounded semiannually, while that for corporate bond Y will be 8.5% compounded semiannually after 5 years you can re-invest coupons at 3.5% per half-year in the coming 5 years who bond would you choose over an investment horizon of 5 years? 8.20 Consider a portfolio of m fixed-income securities, the yield rate of each the same. Let wk. Delle, and C ) be the proportion of the value, the mod. ified duration, and the convexity of the kth security. Show that the modified duration and convexity of the portfolio are w.D*(k) and wc(k), respectively. 8.21 You have a liability of $10,000 due in 10 years and you want to construct a portfolio using two bonds, X and Y, to meet the obligation. The following table shows the information of X and Y: Y Semiannual coupon rate Face value Redemption value Time to maturity 6% $100 $104 7 years 0% $100 $100 14 years The prevailing yield to maturity in the market is 9% compounded semiannt ally for all maturities. How much should you invest in Bonds X and you employ a target-date immunization strategy