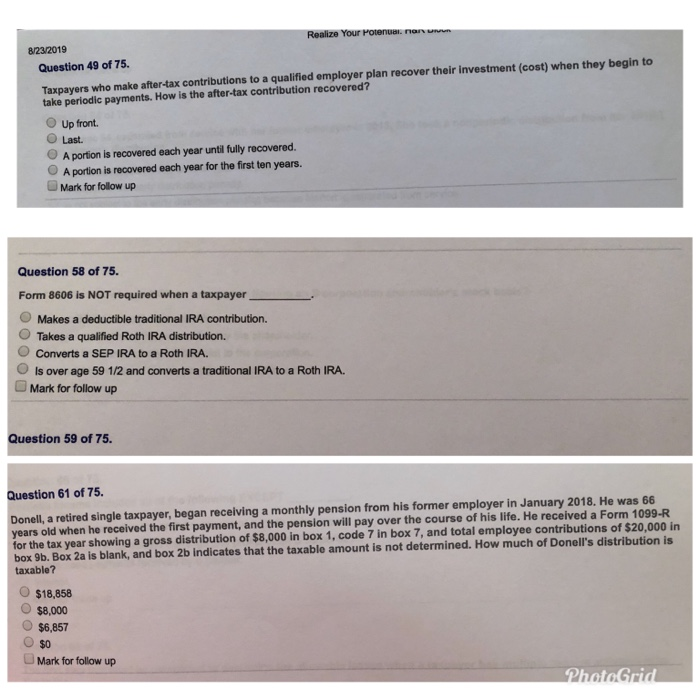

8/23/2019 Realize Your Potenus non Question 49 of 75. Taxpayers who make after-tax contributions to a qualified employer plan recover their investment (cost) when they begin to take periodic payments. How is the after-tax contribution recovered? Up front. Last. A portion is recovered each year until fully recovered. A portion is recovered each year for the first ten years. Mark for follow up Question 58 of 75. Form 8606 is NOT required when a taxpayer Makes a deductible traditional IRA contribution. Takes a qualified Roth IRA distribution. Converts a SEP IRA to a Roth IRA. Is over age 59 1/2 and converts a traditional IRA to a Roth IRA. Mark for follow up Question 59 of 75. Question 61 of 75. Donell, a retired single taxpayer, began receiving a monthly pension from his former employer in January 2018. He was 66 years old when he received the first payment, and the pension will pay over the course of his life. He received a Form 1099-R for the tax year showing a gross distribution of $8,000 in box 1. code 7 in box 7, and total employee contributions of $20,000 in box 9b. Box 2a is blank, and box 2b indicates that the taxable amount is not determined. How much of Donell's distribution is taxable? $18,858 $8,000 $6,857 $0 Mark for follow up PhotoGrid 8/23/2019 Realize Your Potenus non Question 49 of 75. Taxpayers who make after-tax contributions to a qualified employer plan recover their investment (cost) when they begin to take periodic payments. How is the after-tax contribution recovered? Up front. Last. A portion is recovered each year until fully recovered. A portion is recovered each year for the first ten years. Mark for follow up Question 58 of 75. Form 8606 is NOT required when a taxpayer Makes a deductible traditional IRA contribution. Takes a qualified Roth IRA distribution. Converts a SEP IRA to a Roth IRA. Is over age 59 1/2 and converts a traditional IRA to a Roth IRA. Mark for follow up Question 59 of 75. Question 61 of 75. Donell, a retired single taxpayer, began receiving a monthly pension from his former employer in January 2018. He was 66 years old when he received the first payment, and the pension will pay over the course of his life. He received a Form 1099-R for the tax year showing a gross distribution of $8,000 in box 1. code 7 in box 7, and total employee contributions of $20,000 in box 9b. Box 2a is blank, and box 2b indicates that the taxable amount is not determined. How much of Donell's distribution is taxable? $18,858 $8,000 $6,857 $0 Mark for follow up PhotoGrid