Question

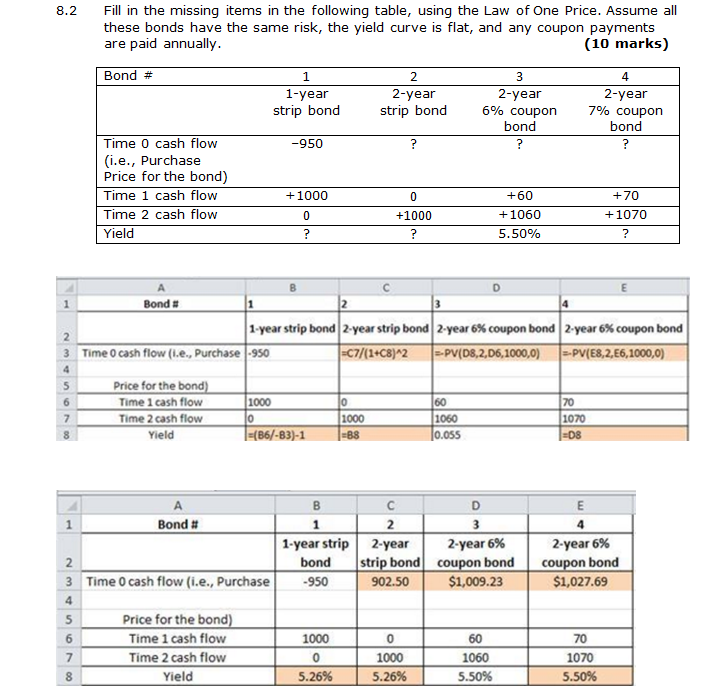

8.3 A. You are considering two investments from the bonds listed in question 8.2. Show that the cash flows from the following two investments would

8.3 A. You are considering two investments from the bonds listed in question 8.2. Show that the cash flows from the following two investments would be identical.

i. 60 units of Bond #1 + 1060 units of Bond #2, and

ii. 1000 units of Bond #3.

B. How many units of Bond #1 and #2 would you need to replicate the cash flows of 1000 units of Bond #4?

C. i. If the yield of Bond #3 is 5.5%, what would it cost to buy 1000 units of Bond #3?

ii. What would it cost to buy 60 units of Bond #1?

iii. From part A. above, infer the value of 1060 units of Bond #2.

iv. What is the value of one unit of Bond #2? Yield of Bond #2?

D. What's the value of 1000 units of Bond #4? Yield?

E. What have you learned about the Law of One Price from questions 8.2 and 8.3?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started