Answered step by step

Verified Expert Solution

Question

1 Approved Answer

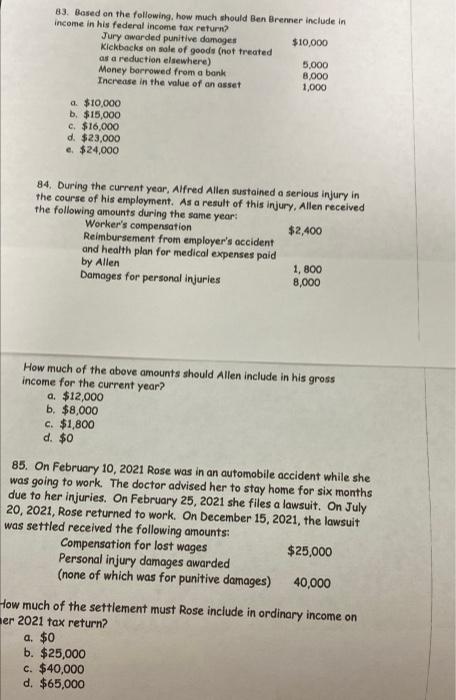

83. Based on the following, how much should Ben Brenner include in income in his federal income tax return? Jury awarded punitive damages Kickbacks

83. Based on the following, how much should Ben Brenner include in income in his federal income tax return? Jury awarded punitive damages Kickbacks on sale of goods (not treated as a reduction elsewhere) Money borrowed from a bank Increase in the value of an asset a. $10,000 $10,000 5,000 8,000 1,000 b. $15,000 c. $16,000 d. $23,000 e. $24,000 84. During the current year, Alfred Allen sustained a serious injury in the course of his employment. As a result of this injury, Allen received the following amounts during the same year: Worker's compensation Reimbursement from employer's accident and health plan for medical expenses paid $2,400 by Allen Damages for personal injuries 1,800 8,000 How much of the above amounts should Allen include in his gross income for the current year? a. $12,000 b. $8,000 c. $1,800 d. $0 85. On February 10, 2021 Rose was in an automobile accident while she was going to work. The doctor advised her to stay home for six months due to her injuries. On February 25, 2021 she files a lawsuit. On July 20, 2021, Rose returned to work. On December 15, 2021, the lawsuit was settled received the following amounts: Compensation for lost wages Personal injury damages awarded $25,000 (none of which was for punitive damages) 40,000 How much of the settlement must Rose include in ordinary income on er 2021 tax return? a. $0 b. $25,000 c. $40,000 d. $65,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started