Answered step by step

Verified Expert Solution

Question

1 Approved Answer

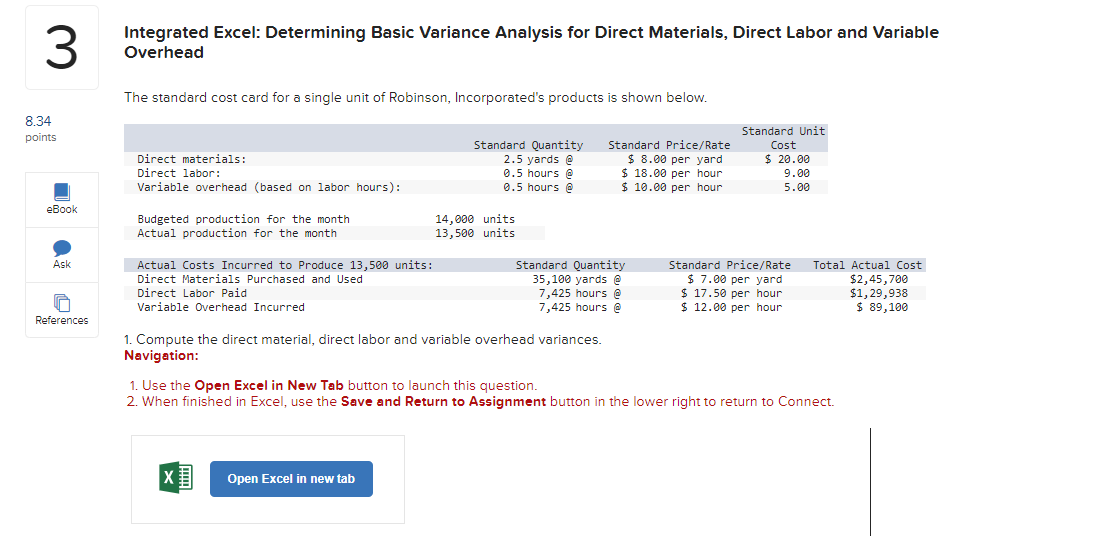

8.34 3 Integrated Excel: Determining Basic Variance Analysis for Direct Materials, Direct Labor and Variable Overhead The standard cost card for a single unit

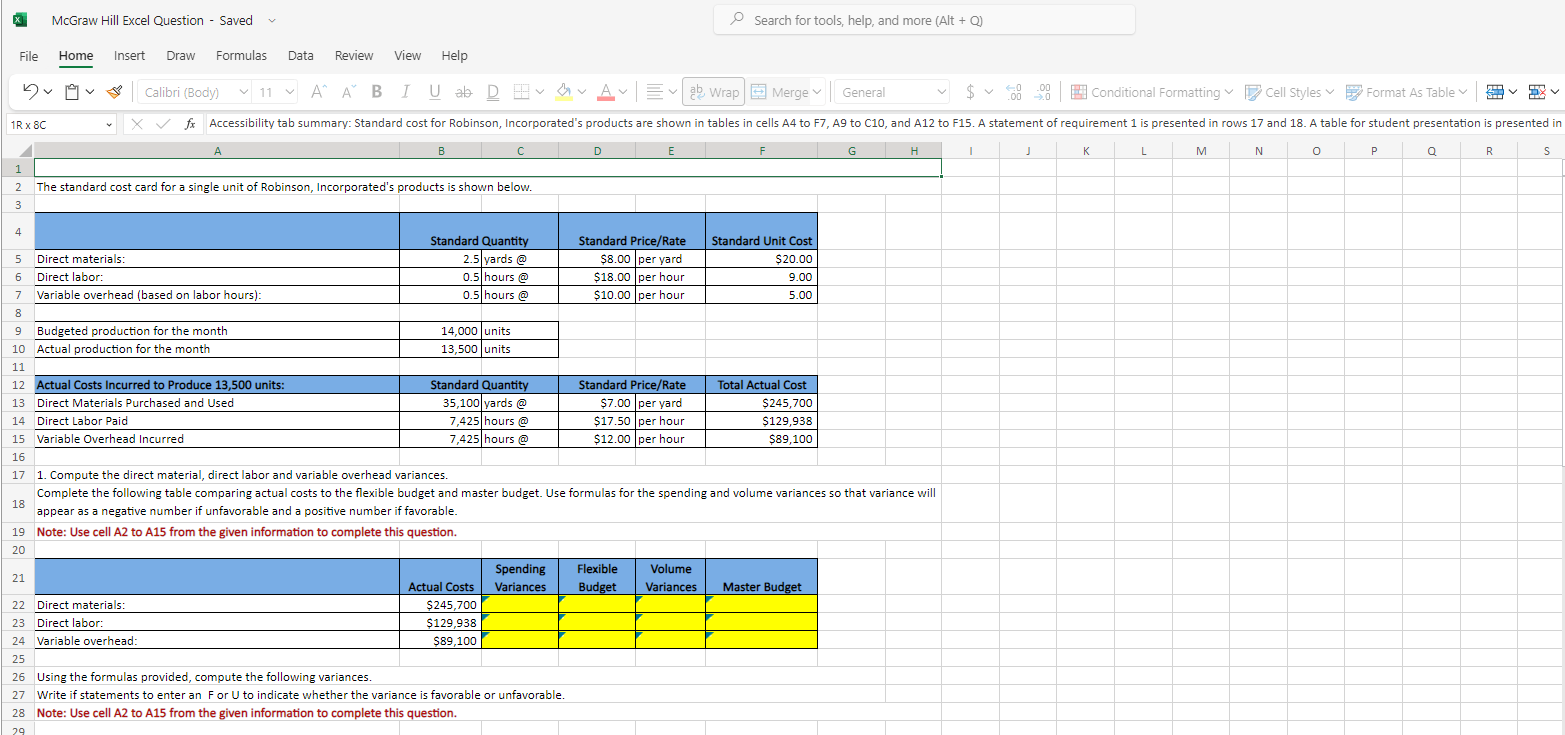

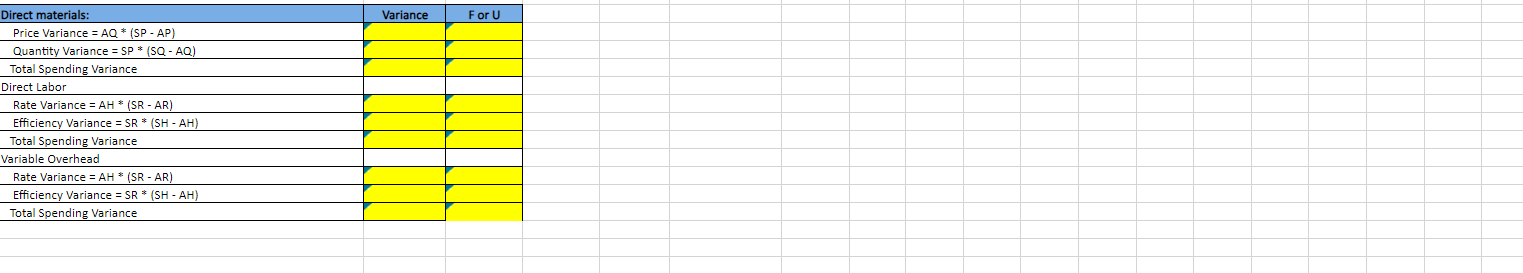

8.34 3 Integrated Excel: Determining Basic Variance Analysis for Direct Materials, Direct Labor and Variable Overhead The standard cost card for a single unit of Robinson, Incorporated's products is shown below. points Standard Quantity Direct materials: Direct labor: Variable overhead (based on labor hours): 2.5 yards @ 0.5 hours @ 0.5 hours @ Standard Price/Rate $ 8.00 per yard $ 18.00 per hour $ 10.00 per hour Standard Unit Cost $ 20.00 9.00 5.00 eBook Budgeted production for the month 14,000 units Actual production for the month 13,500 units Ask Actual Costs Incurred to Produce 13,500 units: Direct Materials Purchased and Used Direct Labor Paid Variable Overhead Incurred Standard Quantity 35,100 yards @ 7,425 hours @ 7,425 hours @ Standard Price/Rate $ 7.00 per yard $ 17.50 per hour Total Actual Cost $2,45,700 $1,29,938 $ 89,100 $ 12.00 per hour References 1. Compute the direct material, direct labor and variable overhead variances. Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. X Open Excel in new tab McGraw Hill Excel Question - Saved Search for tools, help, and more (Alt + Q) File Home Insert Draw Formulas Data Review View Help Calibri (Body) A A BIU ab D= 1R x 8C Aab Wrap Merge General .00 .00 Conditional Formatting Cell Styles Format As Table fx Accessibility tab summary: Standard cost for Robinson, Incorporated's products are shown in tables in cells A4 to F7, A9 to C10, and A12 to F15. A statement of requirement 1 is presented in rows 17 and 18. A table for student presentation is presented in A B D E F G H J K L M N P Q R S 1 2 The standard cost card for a single unit of Robinson, Incorporated's products is shown below. 3 4 5 Direct materials: 6 Direct labor: 7 Variable overhead (based on labor hours): Standard Quantity Standard Price/Rate Standard Unit Cost 2.5 yards@ 0.5 hours @ 0.5 hours @ $8.00 per yard $18.00 per hour $10.00 per hour $20.00 9.00 5.00 8 9 Budgeted production for the month 10 Actual production for the month 11 12 Actual Costs Incurred to Produce 13,500 units: 13 Direct Materials Purchased and Used 14 Direct Labor Paid 15 Variable Overhead Incurred 14,000 units 13,500 units Standard Quantity 35,100 yards @ 7,425 hours @ Standard Price/Rate Total Actual Cost 7,425 hours @ $7.00 per yard $17.50 per hour $12.00 per hour $245,700 $129,938 $89,100 16 17 1. Compute the direct material, direct labor and variable overhead variances. 18 Complete the following table comparing actual costs to the flexible budget and master budget. Use formulas for the spending and volume variances so that variance will appear as a negative number if unfavorable and a positive number if favorable. 19 Note: Use cell A2 to A15 from the given information to complete this question. 20 21 22 Direct materials: 23 Direct labor: Actual Costs Spending Variances Flexible Budget Volume Variances Master Budget $245,700 $129,938 $89,100 24 Variable overhead: 25 26 Using the formulas provided, compute the following variances. 27 Write if statements to enter an F or U to indicate whether the variance is favorable or unfavorable. 28 Note: Use cell A2 to A15 from the given information to complete this question. 29 Direct materials: Price Variance = AQ * (SP - AP) Quantity Variance = SP * (SQ - AQ) Total Spending Variance Direct Labor Rate Variance = AH * (SR - AR) Efficiency Variance = SR * (SH - AH) Total Spending Variance Variable Overhead Rate Variance = AH * (SR - AR) Efficiency Variance = SR * (SH-AH) Total Spending Variance Variance For U

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started