8:4

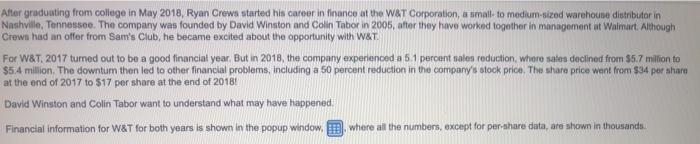

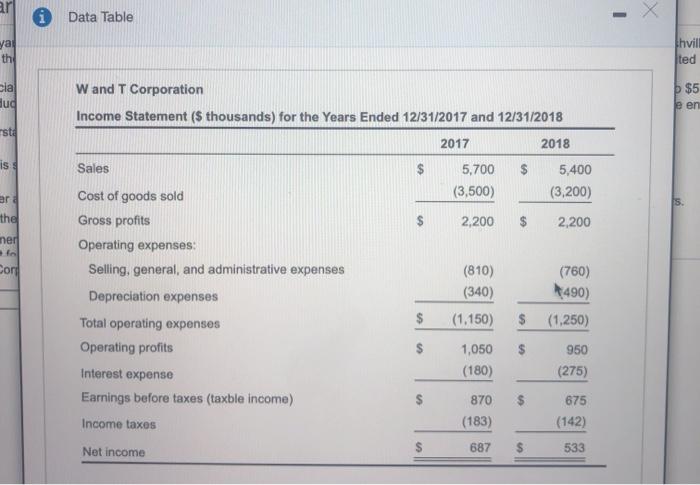

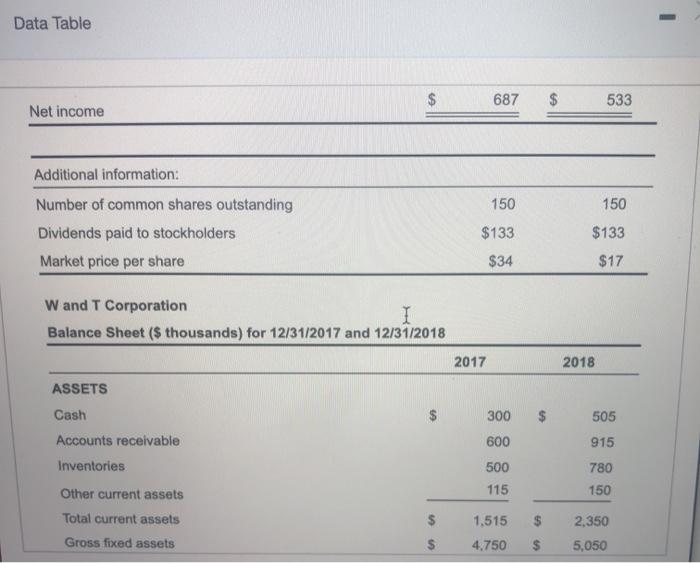

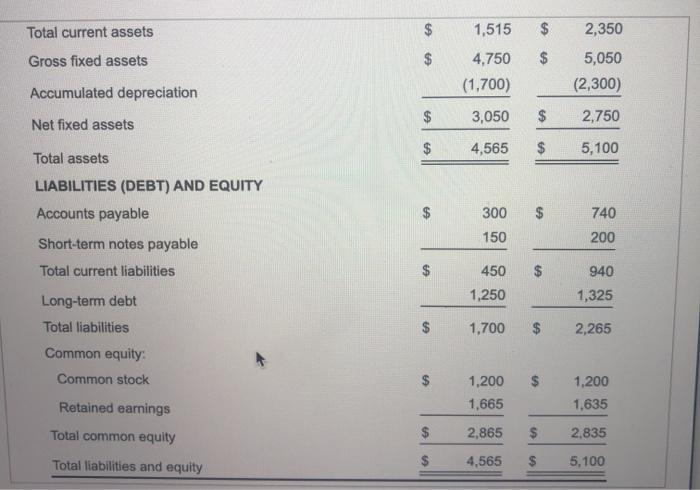

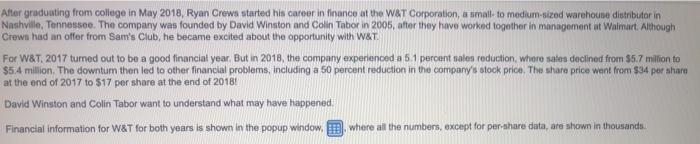

After graduating from college in May 2018, Ryan Crews started his career in finance at the W&T Corporation, a small to medium-sized warehouse distributor in Nashville, Tennessee. The company was founded by David Winston and Colin Tabor in 2005, after they have worked together in management at Walmart. Although Crews had an offer from Sam's Club, he became excited about the opportunity with W&T. For W&T, 2017 turned out to be a good financiat year. But in 2018, the company experienced a 5.1 percent sales reduction, where sales declined from $5.7 million to $5.4 million. The downturn then led to other financial problems, including a 50 percent reduction in the company's stock price. The share price went from $34 per share at the end of 2017 to $17 per share at the end of 2018! David Winston and Colin Tabor want to understand what may have happened. Financial information for W&T for both years is shown in the popup window, where all the numbers, except for per-share data are shown in thousands ar Data Table yal th hvill ted W and T Corporation $5 Sia lug e en Income Statement (s thousands) for the Years Ended 12/31/2017 and 12/31/2018 sta 2017 2018 is 5,700 (3,500) 5,400 (3,200) S. ere the ner $ 2,200 $ 2,200 Coro Sales Cost of goods sold Gross profits Operating expenses: Selling, general, and administrative expenses Depreciation expenses Total operating expenses Operating profits Interest expense Earnings before taxes (taxble income) Income taxes (810) (340) (1.150) (760) 490) $ $ (1,250) $ $ 950 1,050 (180) (275) $ 870 675 (142) (183) Net income $ 687 $ 533 Data Table $ 687 $ 533 Net income Additional information: 150 Number of common shares outstanding Dividends paid to stockholders Market price per share 150 $133 $133 $34 $17 W and T Corporation I Balance Sheet ($ thousands) for 12/31/2017 and 12/31/2018 2017 2018 ASSETS Cash $ 505 300 600 Accounts receivable 915 Inventories 500 115 780 150 Other current assets Total current assets $ 1,515 4.750 Gross fixed assets 2,350 5,050 $ Total current assets $ 1,515 $ 2,350 Gross fixed assets $ $ 4,750 (1,700) 5,050 (2,300) Accumulated depreciation $ Net fixed assets 3,050 $ 2,750 4,565 $ 5,100 Total assets $ $ 740 LIABILITIES (DEBT) AND EQUITY Accounts payable Short-term notes payable Total current liabilities 300 150 200 $ 450 $ 940 1,250 1,325 $ 1,700 2,265 Long-term debt Total liabilities Common equity: Common stock $ $ 1,200 1,665 1,200 1,635 Retained earnings Total common equity $ 2,865 $ 2.835 Total liabilities and equity 4,565 5,100 a. Using what you have learned in this chapter and Chapter 3, prepare a financial analysis of W&T, comparing the firm's financial performance between the two years, (1) Compute the financial ratios as shown in the popup window, for 2017 and 2018 (2) Complete a common-sized income statement for 2017 and 2018 (3) Complete a common-sized balance sheet for 2017 and 2018 (4) Compute the pricelearnings and prica/book ratios for 2017 and 2018 b. What conclusions can you make from your analysis? c. What recommendations would you make to management? a. (1) Compute the financial ratios for W&T Corporation 2018 2017 EX Current ratio (Round to two decimal places)