Answered step by step

Verified Expert Solution

Question

1 Approved Answer

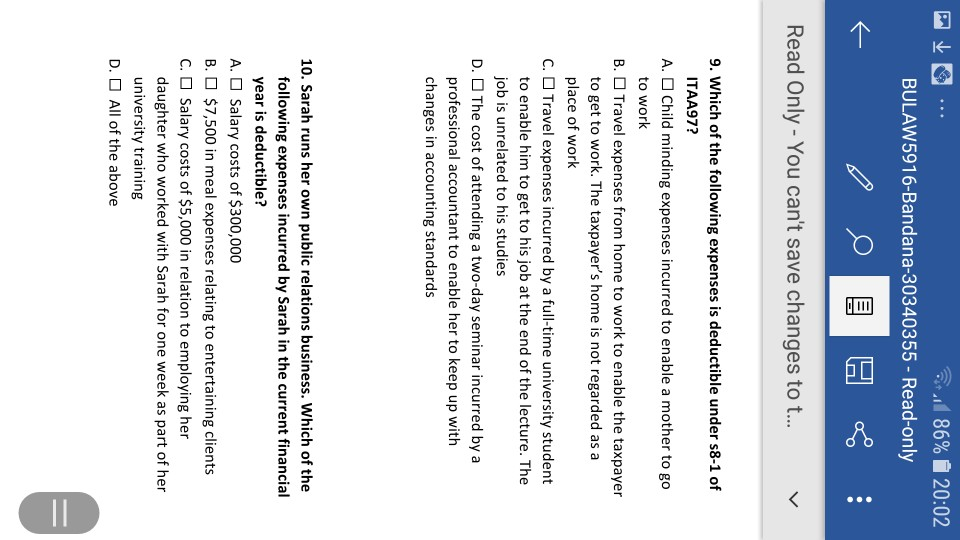

86% 20:02 BULAW5916-Bandana-30340355 - Read-only Read Only - You can't save changes to t... 9. Which of the following expenses is deductible under s8-1 of

86% 20:02 BULAW5916-Bandana-30340355 - Read-only Read Only - You can't save changes to t... 9. Which of the following expenses is deductible under s8-1 of ITAA97? A. Child minding expenses incurred to enable a mother to go to work B. Travel expenses from home to work to enable the taxpayer to get to work. The taxpayer's home is not regarded as a place of work C. O Travel expenses incurred by a full-time university student to enable him to get to his job at the end of the lecture. The job is unrelated to his studies D. The cost of attending a two-day seminar incurred by a professional accountant to enable her to keep up with changes in accounting standards 10. Sarah runs her own public relations business. Which of the following expenses incurred by Sarah in the current financial year is deductible? A. O Salary costs of $300,000 B. O $7,500 in meal expenses relating to entertaining clients C. O Salary costs of $5,000 in relation to employing her daughter who worked with Sarah for one week as part of her university training D. O All of the above =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started