Answered step by step

Verified Expert Solution

Question

1 Approved Answer

865600188 snapshotid=1838805 MINDTAP 15 and 16) Section 1 Q Search this course 3 (Chapter 15 and 16) Section 1 ning: 1:06:32 Save Submit Test for

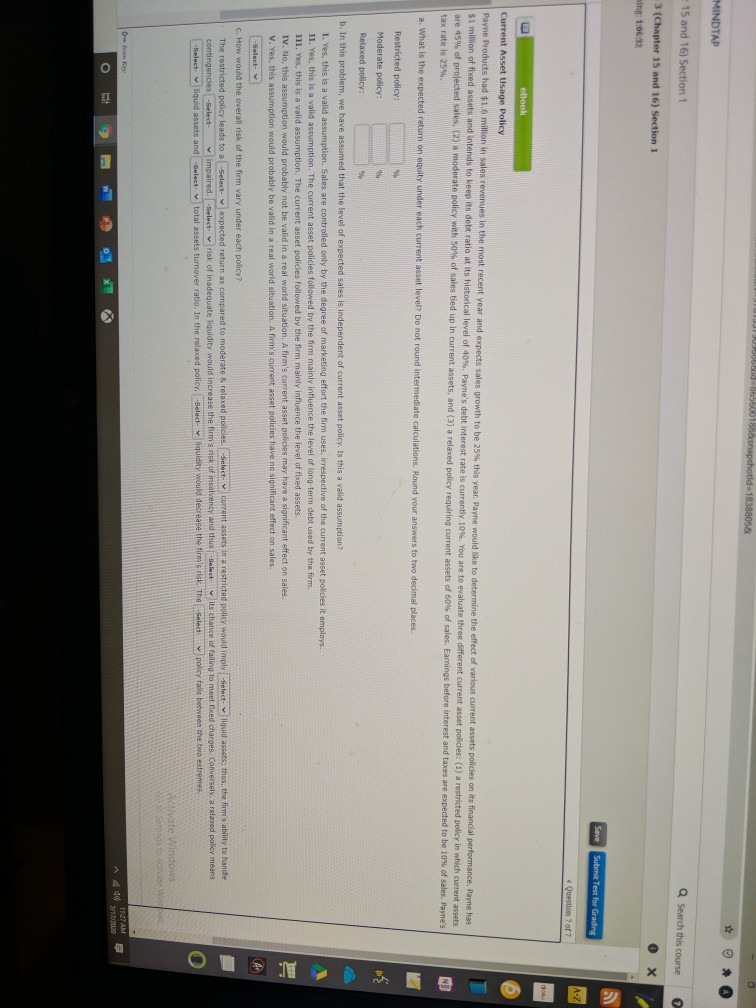

865600188 snapshotid=1838805 MINDTAP 15 and 16) Section 1 Q Search this course 3 (Chapter 15 and 16) Section 1 ning: 1:06:32 Save Submit Test for Grading A-Z Question 7 of 7 eBook Current Asset Usage Policy Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 40%. Payne's debt interest rate is currently 10%. u are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, 2) a moderate polley with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 10% of sales. Payne's tax rate is 25% NI a. What is the expected return on equity under each current asset level? Do not round intermediate calculations. Round your answers to two decimal places Restricted policy: 9 Moderate policy: Relaxed policy b. In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? 1. Yes, this is a valid assumption Sales are controlled only by the degree of marketing effort the firm uses, irrespective of the current asset policies it employs. II. Yes, this is a valid assumption. The current asset policies followed by the firm mainly influence the level of long-term debt used by the firm III. Yes, this is a valid assumption. The current asset policies followed by the firm mainly influence the level of fixed assets IV. No, this assumption would probably not be valid in a real world situation. A firm's current asset policies may have a significant effect on sales. V. Yes, this assumption would probably be valid in a real world situation. A firm's current asset policies have no significant effect on sales. Select How would the overall risk of the firm vary under each policy? The restricted policy leads to a -Select- expected return compared to moderate & relaxed policies Select current assets in a restricted policy would imply -Select-liquid assets; thus, the firm's ability to handle contingencies Select impaired. -Select risk of inadequate liquidity would increase the firm's risk of insolvency and thus Select its chance of failing to meet fixed charges. Conversely, a relaxed policy means Select liquid assets and Select total assets tumover ratio. In the relaxed policy. Select- v liquidity would decrease the firm's risk the select policy falls between the two extremes A ate Windows Hot Seite Oleon 11:27 AM A 1000 w P x 865600188 snapshotid=1838805 MINDTAP 15 and 16) Section 1 Q Search this course 3 (Chapter 15 and 16) Section 1 ning: 1:06:32 Save Submit Test for Grading A-Z Question 7 of 7 eBook Current Asset Usage Policy Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 40%. Payne's debt interest rate is currently 10%. u are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, 2) a moderate polley with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 10% of sales. Payne's tax rate is 25% NI a. What is the expected return on equity under each current asset level? Do not round intermediate calculations. Round your answers to two decimal places Restricted policy: 9 Moderate policy: Relaxed policy b. In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? 1. Yes, this is a valid assumption Sales are controlled only by the degree of marketing effort the firm uses, irrespective of the current asset policies it employs. II. Yes, this is a valid assumption. The current asset policies followed by the firm mainly influence the level of long-term debt used by the firm III. Yes, this is a valid assumption. The current asset policies followed by the firm mainly influence the level of fixed assets IV. No, this assumption would probably not be valid in a real world situation. A firm's current asset policies may have a significant effect on sales. V. Yes, this assumption would probably be valid in a real world situation. A firm's current asset policies have no significant effect on sales. Select How would the overall risk of the firm vary under each policy? The restricted policy leads to a -Select- expected return compared to moderate & relaxed policies Select current assets in a restricted policy would imply -Select-liquid assets; thus, the firm's ability to handle contingencies Select impaired. -Select risk of inadequate liquidity would increase the firm's risk of insolvency and thus Select its chance of failing to meet fixed charges. Conversely, a relaxed policy means Select liquid assets and Select total assets tumover ratio. In the relaxed policy. Select- v liquidity would decrease the firm's risk the select policy falls between the two extremes A ate Windows Hot Seite Oleon 11:27 AM A 1000 w P x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started