Question

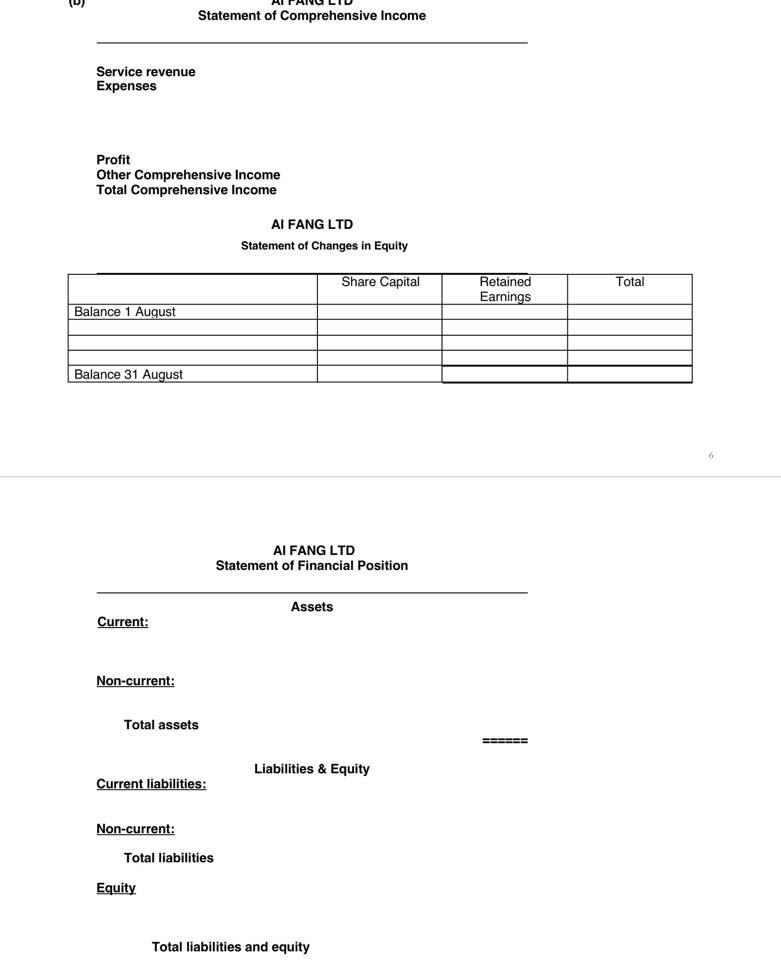

8657 Prepare P1.2 on page 1-42, but for b., instead of a retained earnings statement, write a Statement of Changes in Equity. Use Appendix 12A

8657

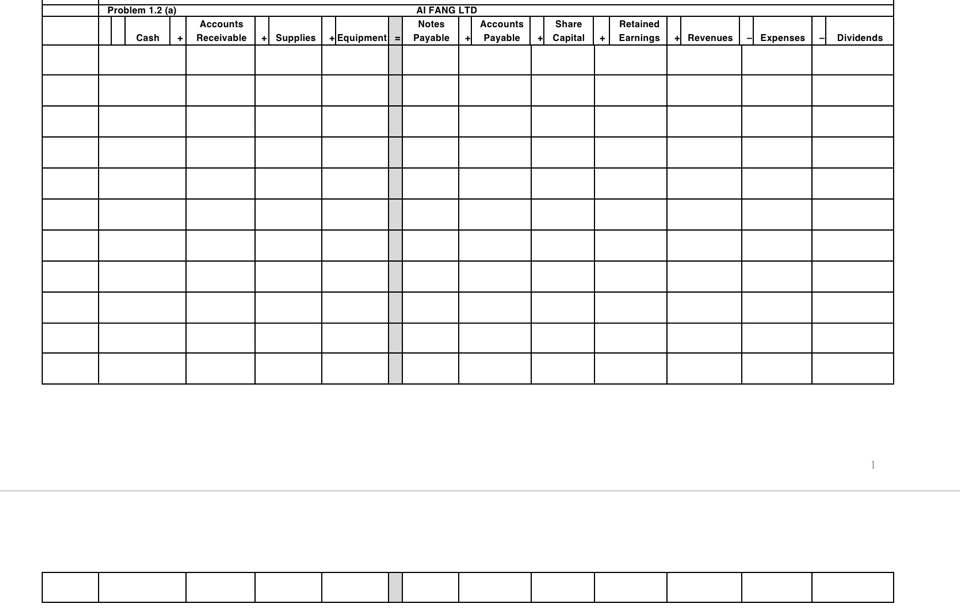

Prepare P1.2 on page 1-42, but for b., instead of a retained earnings statement, write a Statement of Changes in Equity. Use Appendix 12A on page 12-28 as a guide. You may assume the Note Payable is due on 1 December 2021. In addition, before preparing the tabular analysis required by (a), write a residual analysis of each event, as discussed in class. For the balance sheet, divide assets and liabilities into current and non-current, with a sub-total for each. List liabilities before equity.

(a)

Residual Analysis

1. The asset Cash increased, increasing assets. Cash is an asset because____________________________ ___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________The asset Accounts Receivable decreased because ______________________________________________________________________________________________________________________________________________________________________________________________________________There is no effect on liabilities. Net assets? __________________

__________________________________________________________________________________________________________________________________________________________________________________

2. The asset Cash decreased because____________________________, _________ assets. Effect on other assets?____________________________ The liability Accounts Payable decreased because_____________ __________________________________________________________________________________________________________________________________________________________________________________Net assets?________________________________________________________________________________

3. The asset Cash increased (see 1. above), as did the asset____________________________. This asset increased because_______________________________________________________________________

__________________________________________________________________________________________________________________________________________________________________________________Liabilities?___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________Net assets?________________________________________________________________________________ __________________________________________________________________________________________________________________________________________________________________________________

4. The asset_____________ increased because__________________________________________________

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ ___________The difference of $1,600___________________________________________________________ ___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________Net assets? _______________________________

5. The asset cash decreased because its purchasing power was realised. Resources purchased?___________ _____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________Liabilities?_________________________________________________________________________________Net assets?________________________________________________________________________________

6. The asset _______________________________________________________________________________ ___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________Net assets?________________________________________________________________________________ __________________________________________________________________________________________________________________________________________________________________________________

7. The asset cash increased--see 1.above_______________________________________________________

________________________________________________Liabilities?_________________________________

____________________________________________________________________________________________________________________________________________________________________________________________________Net assets?______________________________________________________________

8. Assets?_________________________________________________________________________________

__________________________________________________________________________________________________________________________________________________________________________________

Liabilities?_________________________________________________________________________________ __________________________________________________________________________________________________________________________________________________________________________________

Net assets? _______________________________________________________________________________ _________________________________________________________________________________________

_________________________________________________________________________________________

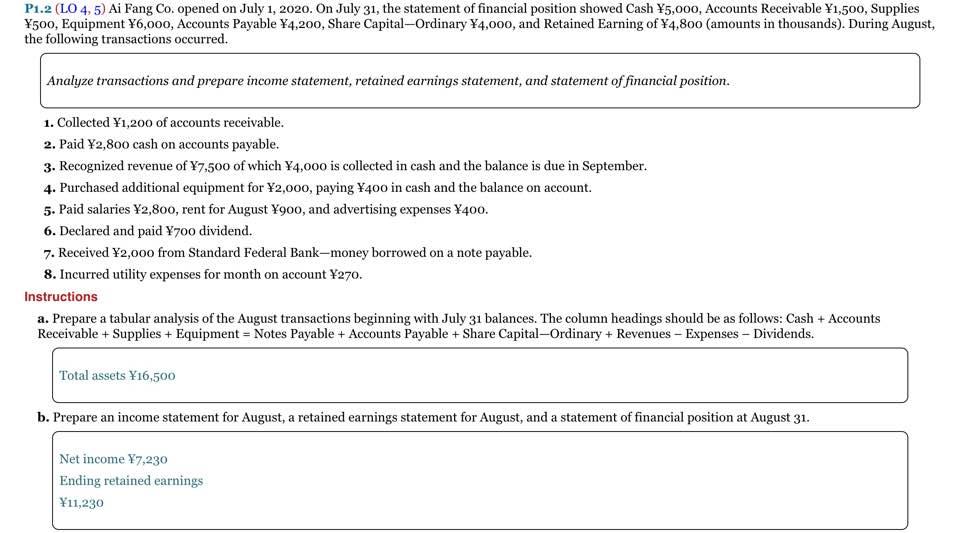

P1.2 (LO 4, 5) Ai Fang Co. opened on July 1, 2020. On July 31, the statement of financial position showed Cash 5,000, Accounts Receivable 1,500, Supplies 500, Equipment 6,000, Accounts Payable 4,200, Share Capital-Ordinary 4,000, and Retained Earning of 4,800 (amounts in thousands). During August, the following transactions occurred. Analyze transactions and prepare income statement, retained earnings statement, and statement of financial position. 1. Collected 1,200 of accounts receivable. 2. Paid 2,800 cash on accounts payable. 3. Recognized revenue of 7,500 of which 4,000 is collected in cash and the balance is due in September. 4. Purchased additional equipment for 2,000, paying 400 in cash and the balance on account. 5. Paid salaries 2,800, rent for August 900, and advertising expenses 400. 6. Declared and paid 700 dividend. 7. Received 2,000 from Standard Federal Bank-money borrowed on a note payable. 8. Incurred utility expenses for month on account 270. Instructions a. Prepare a tabular analysis of the August transactions beginning with July 31 balances. The column headings should be as follows: Cash + Accounts Receivable + Supplies + Equipment Notes Payable + Accounts Payable + Share Capital-Ordinary + Revenues - Expenses - Dividends. Total assets 16,500 b. Prepare an income statement for August, a retained earnings statement for August, and a statement of financial position at August 31. Net income 7,230 Ending retained earnings 11,230

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Heres a tabular analysis of the August transactions for Ai Fang Co Share Transaction Accounts Date D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started