Answered step by step

Verified Expert Solution

Question

1 Approved Answer

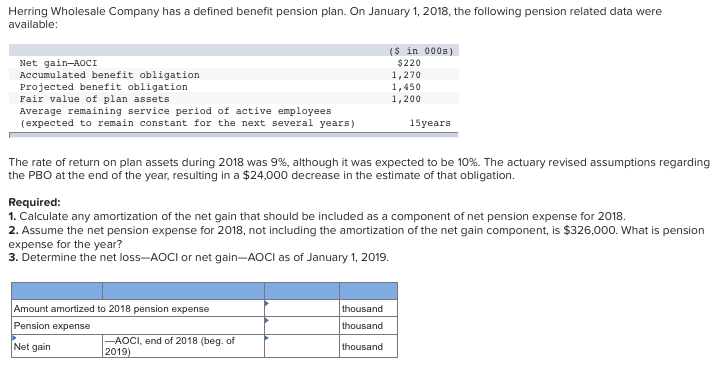

89 Herring Wholesale Company has a defined benefit pension plan. On January 1, 2018, the following pension related data were available: (S in 000s) $220

89

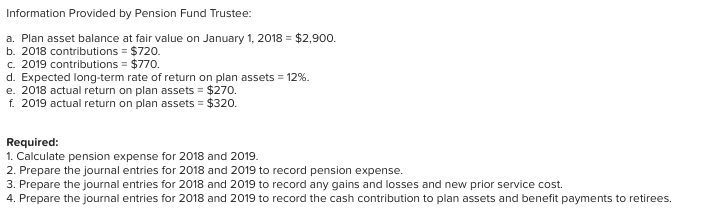

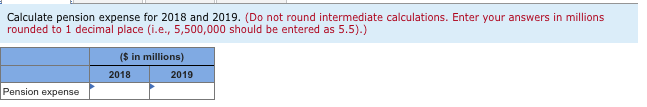

Herring Wholesale Company has a defined benefit pension plan. On January 1, 2018, the following pension related data were available: (S in 000s) $220 1,270 1,450 1,200 Net gain-AOCI Accumulated benefit obligation Projected benefit obligation Fair value of plan assets Average remaining service period of active employees (expected to remain constant for the next several years) 15years The rate of return on plan assets during 2018 was 9%, although it was expected to be 10%. The actuary revised assumptions regarding the PBO at the end of the year, resulting in a $24,000 decrease in the estimate of that obligation Required: 1. Calculate any amortization of the net gain that should be included as a component of net pension expense for 2018. 2. Assume the net pension expense for 2018, not including the amortization of the net gain component, is $326,000. What is pension expense for the year? 3. Determine the net loss-AOCI or net gain-AOCI as of January 1, 2019. Amount amortized to 2018 pension expense thousand Pension expense thousand -AOCI, end of 2018 (beg. of 2019) Net gain thousand Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2018 $2,900. b. 2018 contributions $720. c. 2019 contributions $770. d. Expected long-term rate of return on plan assets 12 %. e. 2018 actual return on plan assets $270. f. 2019 actual return on plan assets $320. Required: 1. Calculate pension expense for 2018 and 2019 2. Prepare the journal entries for 2018 and 2019 to record pension expense. 3. Prepare the journal entries for 2018 and 2019 to record any gains and losses and new prior service cost. 4. Prepare the journal entries for 2018 and 2019 to record the cash contribution to plan assets and benefit payments to retirees. Calculate pension expense for 2018 and 2019. (Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) ($ in millions) 2018 2019 Pension expense Prepare the journal entries for 2018 and 2019 to record pension expense. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list View journalentry worksheet No Date General Journal Debit Credit Pension expense 1 2018 Plan assets Amortization of net gain-OCI PBO Amortization of prior service cost-OCI 2 2019 Pension expense Plan assets PBO Amortization of prior service cost-OCI Prepare the journal entries for 2018 and 2019 to record any gains and losses and new prior service cost. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list View journal entry worksheet . General Journal No Date Debit Credit 2018 Loss-OCI Plan assets 2 2018 Prior service cost-OCI PBO Loss-OCI 3 2019 Plan assets Prepare the journal entries for 2018 and 2019 to record the cash contribution to plan assets and benefit payments to retirees. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10).) View transaction list View journalentry worksheet ..uru General Journal No Date Debit Credit Plan assets 1 2018 Cash Plan assets 2 2019 Cash PBO 3 2018 Plan assets PBO 4 2019 Plan assets Herring Wholesale Company has a defined benefit pension plan. On January 1, 2018, the following pension related data were available: (S in 000s) $220 1,270 1,450 1,200 Net gain-AOCI Accumulated benefit obligation Projected benefit obligation Fair value of plan assets Average remaining service period of active employees (expected to remain constant for the next several years) 15years The rate of return on plan assets during 2018 was 9%, although it was expected to be 10%. The actuary revised assumptions regarding the PBO at the end of the year, resulting in a $24,000 decrease in the estimate of that obligation Required: 1. Calculate any amortization of the net gain that should be included as a component of net pension expense for 2018. 2. Assume the net pension expense for 2018, not including the amortization of the net gain component, is $326,000. What is pension expense for the year? 3. Determine the net loss-AOCI or net gain-AOCI as of January 1, 2019. Amount amortized to 2018 pension expense thousand Pension expense thousand -AOCI, end of 2018 (beg. of 2019) Net gain thousand Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2018 $2,900. b. 2018 contributions $720. c. 2019 contributions $770. d. Expected long-term rate of return on plan assets 12 %. e. 2018 actual return on plan assets $270. f. 2019 actual return on plan assets $320. Required: 1. Calculate pension expense for 2018 and 2019 2. Prepare the journal entries for 2018 and 2019 to record pension expense. 3. Prepare the journal entries for 2018 and 2019 to record any gains and losses and new prior service cost. 4. Prepare the journal entries for 2018 and 2019 to record the cash contribution to plan assets and benefit payments to retirees. Calculate pension expense for 2018 and 2019. (Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) ($ in millions) 2018 2019 Pension expense Prepare the journal entries for 2018 and 2019 to record pension expense. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list View journalentry worksheet No Date General Journal Debit Credit Pension expense 1 2018 Plan assets Amortization of net gain-OCI PBO Amortization of prior service cost-OCI 2 2019 Pension expense Plan assets PBO Amortization of prior service cost-OCI Prepare the journal entries for 2018 and 2019 to record any gains and losses and new prior service cost. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) View transaction list View journal entry worksheet . General Journal No Date Debit Credit 2018 Loss-OCI Plan assets 2 2018 Prior service cost-OCI PBO Loss-OCI 3 2019 Plan assets Prepare the journal entries for 2018 and 2019 to record the cash contribution to plan assets and benefit payments to retirees. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10).) View transaction list View journalentry worksheet ..uru General Journal No Date Debit Credit Plan assets 1 2018 Cash Plan assets 2 2019 Cash PBO 3 2018 Plan assets PBO 4 2019 Plan assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started