Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8E Rizio Co. purchases a machine for $14,800, terms 2/10,n/60, FOB shipping point. Rizio paid within the discount period and took the $296 discount. Transportation

8E

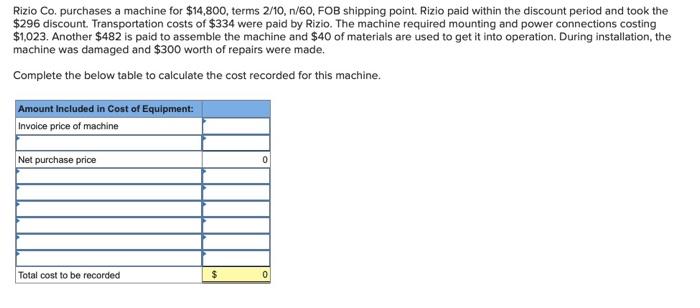

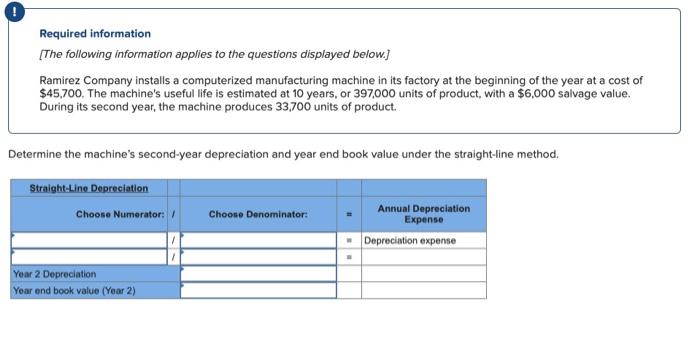

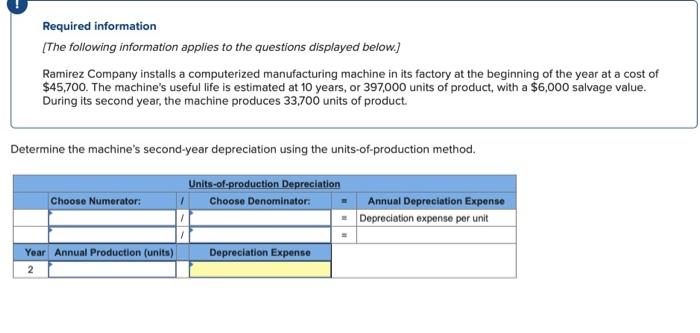

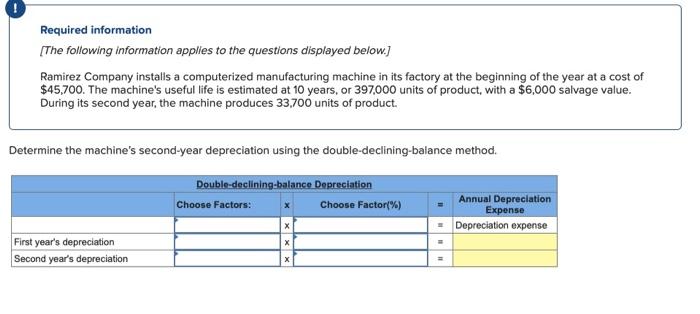

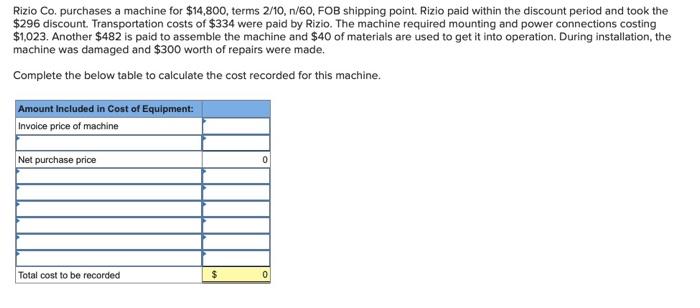

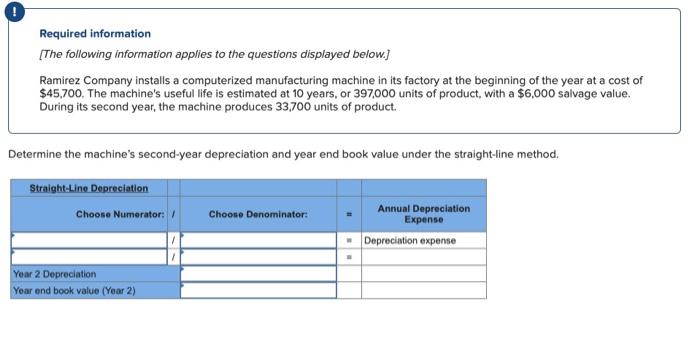

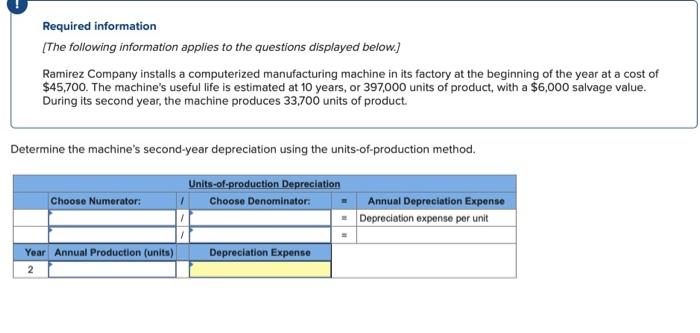

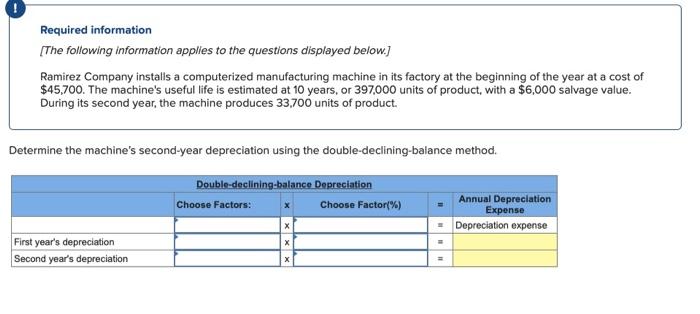

Rizio Co. purchases a machine for $14,800, terms 2/10,n/60, FOB shipping point. Rizio paid within the discount period and took the $296 discount. Transportation costs of $334 were paid by Rizio. The machine required mounting and power connections costing $1,023. Another $482 is paid to assemble the machine and $40 of materials are used to get it into operation. During installation, the machine was damaged and $300 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine. Amount included in Cost of Equipment: Invoice price of machine Net purchase price 0 Total cost to be recorded $ Required information (The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,700. The machine's useful life is estimated at 10 years, or 397,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 33,700 units of product. Determine the machine's second-year depreciation and year end book value under the straight-line method. Straight-Lino Depreciation Choose Numerator: Choose Denominator Annual Depreciation Expense Depreciation expense Year 2 Depreciation Your end book value (Year 2) Required information [The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,700. The machine's useful life is estimated at 10 years, or 397,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 33,700 units of product Determine the machine's second-year depreciation using the units-of-production method. Choose Numerator: Units-of-production Depreciation Choose Denominator Annual Depreciation Expense = Depreciation expense per unit Depreciation Expense Year Annual Production (units) 2 Required information (The following information applies to the questions displayed below.) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,700. The machine's useful life is estimated at 10 years, or 397,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 33,700 units of product. Determine the machine's second-year depreciation using the double-declining-balance method. Double-declining-balance Depreciation Choose Factors: Choose Factor%) Annual Depreciation Expense Depreciation expense X First year's depreciation Second year's depreciation X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started