(8MARKS) Q.1 Manhood Company owns 60% of the outstanding voting stock of Killer Mall at book value. Manhood sells merchandise to Killer Mall at

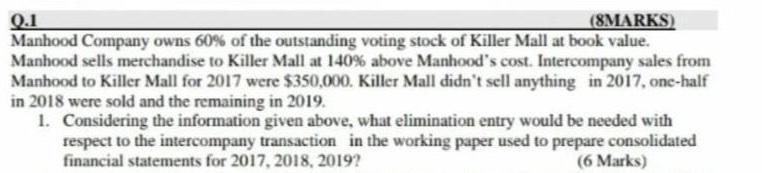

(8MARKS) Q.1 Manhood Company owns 60% of the outstanding voting stock of Killer Mall at book value. Manhood sells merchandise to Killer Mall at 140% above Manhood's cost. Intercompany sales from Manhood to Killer Mall for 2017 were $350,000. Killer Mall didn't sell anything in 2017, one-half in 2018 were sold and the remaining in 2019. 1. Considering the information given above, what elimination entry would be needed with respect to the intercompany transaction in the working paper used to prepare consolidated financial statements for 2017, 2018, 2019? (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Description The given question to ask the elimination entries for 2017 2018 and 2019 To prepare consolidated financial statements for Manhood Company ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started