Answered step by step

Verified Expert Solution

Question

1 Approved Answer

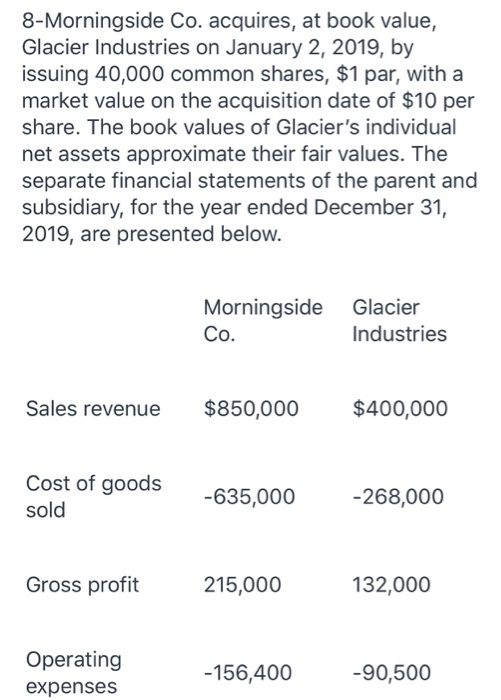

8-Morningside Co. acquires, at book value, Glacier Industries on January 2, 2019, by issuing 40,000 common shares, $1 par, with a market value on

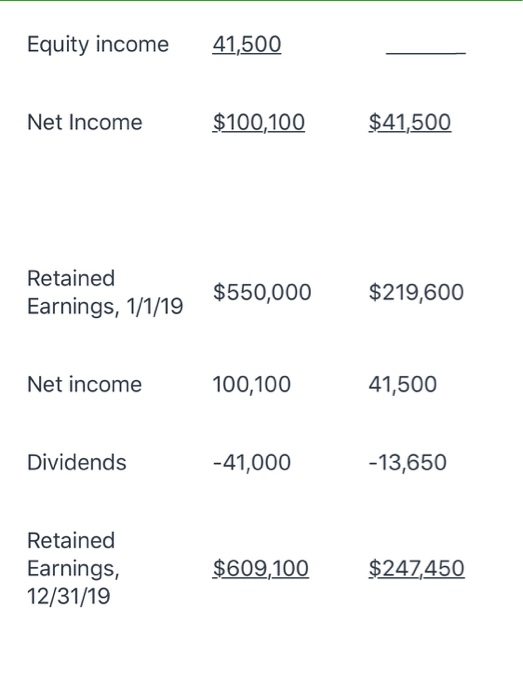

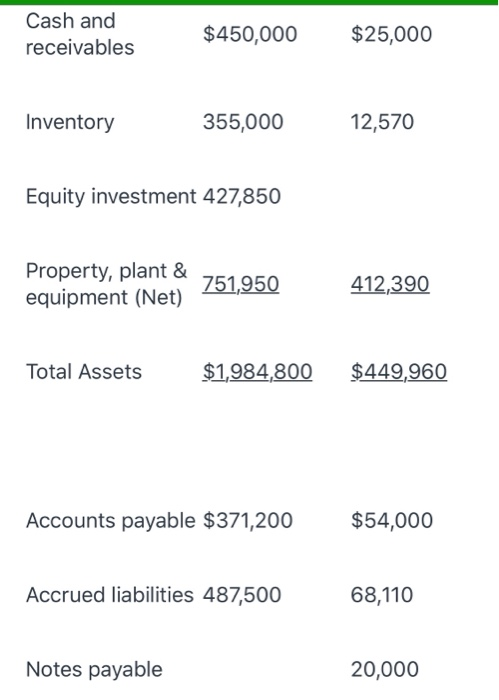

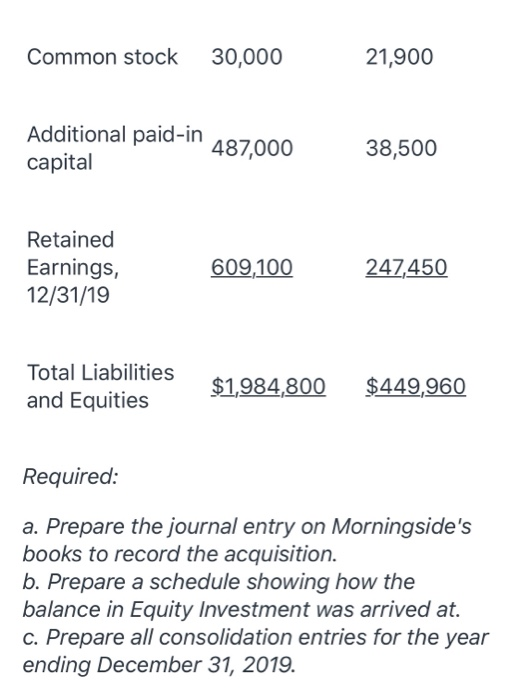

8-Morningside Co. acquires, at book value, Glacier Industries on January 2, 2019, by issuing 40,000 common shares, $1 par, with a market value on the acquisition date of $10 per share. The book values of Glacier's individual net assets approximate their fair values. The separate financial statements of the parent and subsidiary, for the year ended December 31, 2019, are presented below. Sales revenue Cost of goods sold Gross profit Operating expenses Morningside Glacier Co. $850,000 -635,000 215,000 -156,400 Industries $400,000 -268,000 132,000 -90,500 Equity income Net Income Retained Earnings, 1/1/19 Net income Dividend Retained Earnings, 12/31/19 41,500 $100,100 $550,000 100,100 -41,000 $609,100 $41,500 $219,600 41,500 -13,650 $247,450 Cash and receivables Inventory Property, plant & equipment (Net) Equity investment 427,850 Total Assets $450,000 355,000 Notes payable 751,950 Accounts payable $371,200 Accrued liabilities 487,500 $25,000 12,570 $1,984,800 $449,960 412,390 $54,000 68,110 20,000 Common stock 30,000 Additional paid-in 487,000 capital Retained Earnings, 12/31/19 Total Liabilities and Equities 609,100 21,900 38,500 247,450 $1,984,800 $449,960 Required: a. Prepare the journal entry on Morningside's books to record the acquisition. b. Prepare a schedule showing how the balance in Equity Investment was arrived at. c. Prepare all consolidation entries for the year ending December 31, 2019.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started