Question

8.Write out the Security Market Line (SML) equation and use it to calculate the required rate of return on each alternative. Compare the expected rates

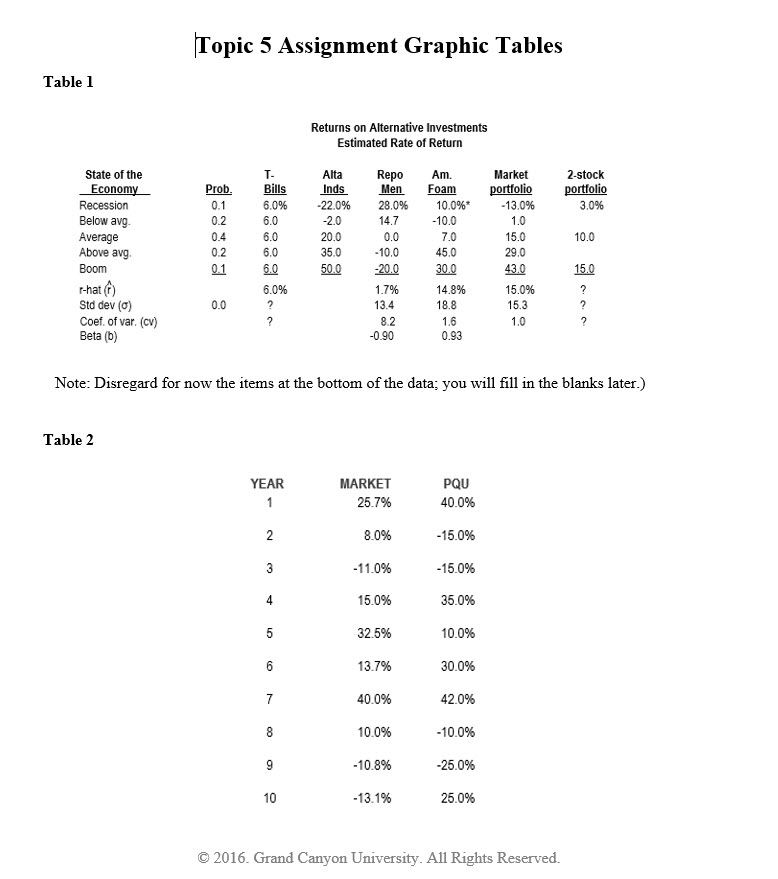

8.Write out the Security Market Line (SML) equation and use it to calculate the required rate of return on each alternative. Compare the expected rates of return with the required rates of return. How do these perform against your predictions?

9.Does the fact that Repo Men has an expected rate of return less than the T-bill rate of return make any sense? Why or why not?

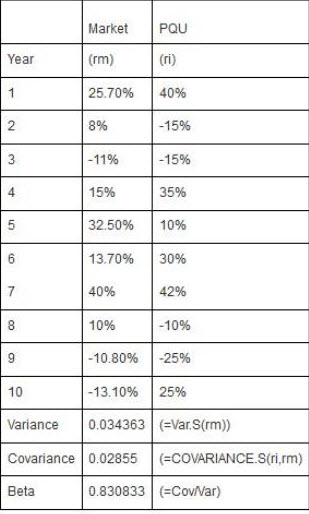

10.What would be the market risk and the required return of a 50-50 portfolio of Alta Industries and Repo Men? Or of Alta Industries and American Foam? Based on your analysis and conclusions, which would you recommend to your client?

Just need help with these 3 questions. I've attached the PQU

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started