Answered step by step

Verified Expert Solution

Question

1 Approved Answer

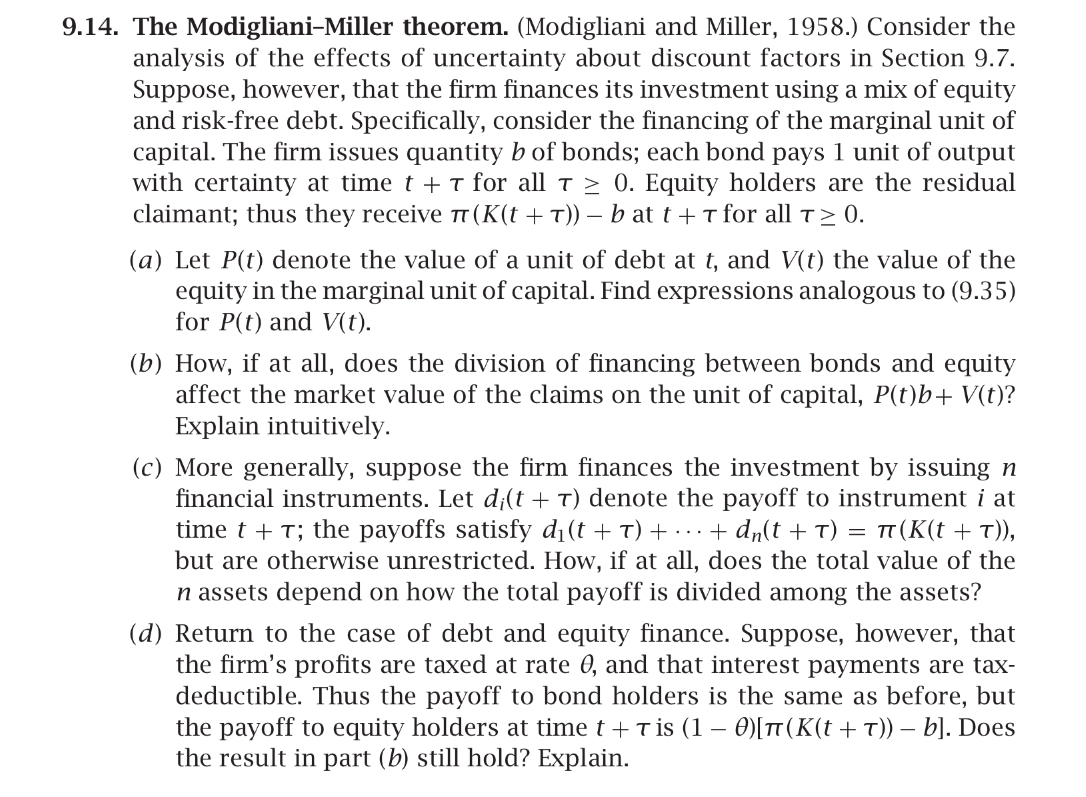

9 . 1 4 . The Modigliani - Miller theorem. ( Modigliani and Miller, 1 9 5 8 . ) Consider the analysis of the

The ModiglianiMiller theorem. Modigliani and Miller, Consider the analysis of the effects of uncertainty about discount factors in Section Suppose, however, that the firm finances its investment using a mix of equity and riskfree debt. Specifically, consider the financing of the marginal unit of capital. The firm issues quantity of bonds; each bond pays unit of output with certainty at time for all Equity holders are the residual claimant; thus they receive at for all

a Let denote the value of a unit of debt at and the value of the equity in the marginal unit of capital. Find expressions analogous to for and

b How, if at all, does the division of financing between bonds and equity affect the market value of the claims on the unit of capital, Explain intuitively.

c More generally, suppose the firm finances the investment by issuing financial instruments. Let denote the payoff to instrument at time ; the payoffs satisfy cdots but are otherwise unrestricted. How, if at all, does the total value of the assets depend on how the total payoff is divided among the assets?

d Return to the case of debt and equity finance. Suppose, however, that the firm's profits are taxed at rate and that interest payments are taxdeductible. Thus the payoff to bond holders is the same as before, but the payoff to equity holders at time is Does the result in part b still hold? Explain.

Help me to solve and derice and expain more detail step by step, im poor sorry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started