Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. 10. 11. 12. 13. You observe a stock price of $18.75. You expect a dividend growth rate of 5%, and the most recent

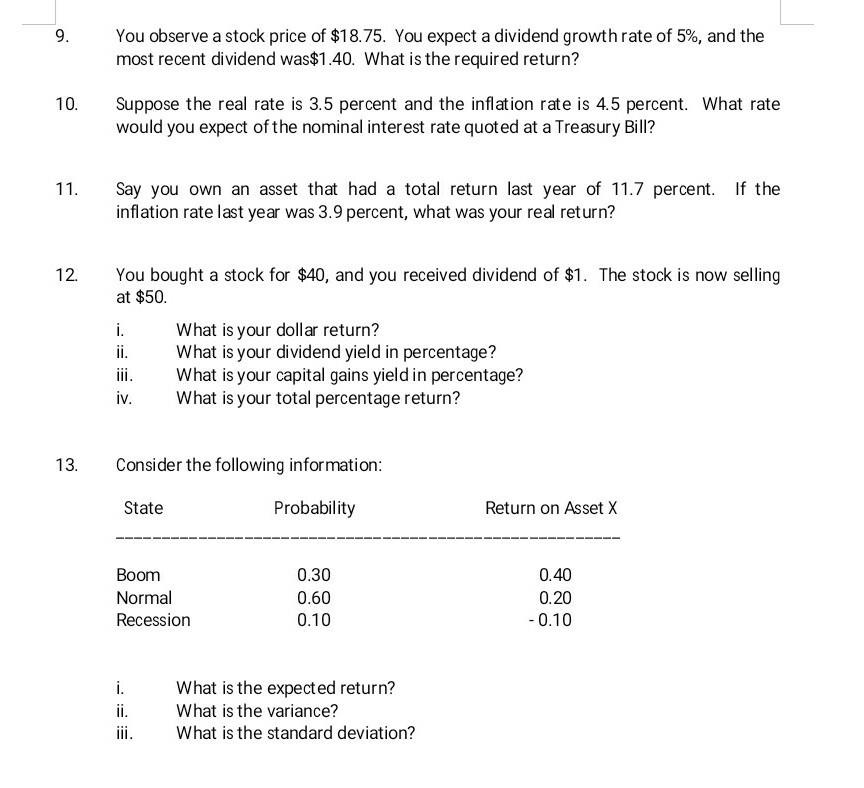

9. 10. 11. 12. 13. You observe a stock price of $18.75. You expect a dividend growth rate of 5%, and the most recent dividend was$1.40. What is the required return? Suppose the real rate is 3.5 percent and the inflation rate is 4.5 percent. What rate would you expect of the nominal interest rate quoted at a Treasury Bill? Say you own an asset that had a total return last year of 11.7 percent. If the inflation rate last year was 3.9 percent, what was your real return? You bought a stock for $40, and you received dividend of $1. The stock is now selling at $50. i. ii. iii. iv. Consider the following information: State Probability What is your dollar return? What is your dividend yield in percentage? What is your capital gains yield in percentage? What is your total percentage return? Boom Normal Recession i. iii. 0.30 0.60 0.10 What is the expected return? What is the variance? What is the standard deviation? Return on Asset X 0.40 0.20 - 0.10

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the required return we can use the dividend discount model DDM formula Required Return Dividend Stock Price Dividend Growth Rate Given Dividend 140 Stock Price 1875 Dividend Growth Rate 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started