Question

9. 10. 11. Interest Rate Annuity: You are financing a new car purchase with a loan of $10,000 to be repaid in 5 annual

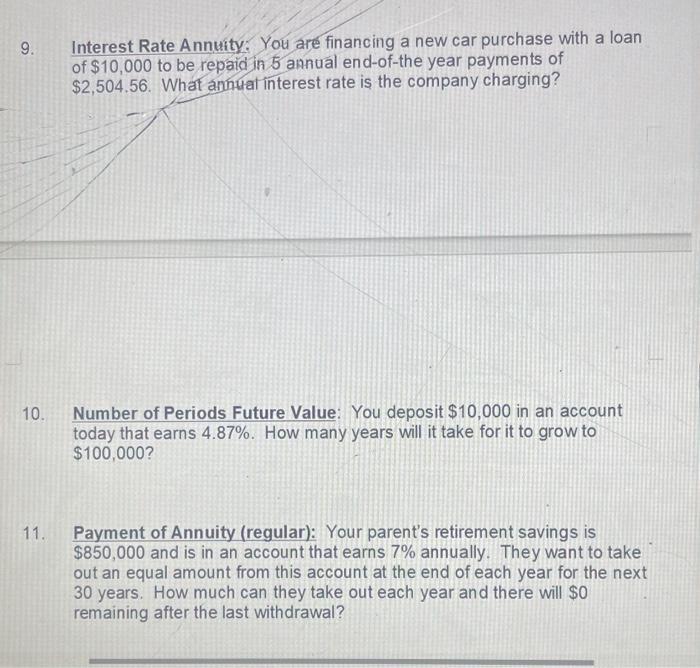

9. 10. 11. Interest Rate Annuity: You are financing a new car purchase with a loan of $10,000 to be repaid in 5 annual end-of-the year payments of $2,504.56. What annual interest rate is the company charging? Number of Periods Future Value: You deposit $10,000 in an account today that earns 4.87%. How many years will it take for it to grow to $100,000? Payment of Annuity (regular): Your parent's retirement savings is $850,000 and is in an account that earns 7% annually. They want to take out an equal amount from this account at the end of each year for the next 30 years. How much can they take out each year and there will $0 remaining after the last withdrawal?

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Solution The formula for calculating the interest rate of an annuity is r PVA 1 Where r annual inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economic Analysis

Authors: Donald Newnan, Ted Eschanbach, Jerome Lavelle

9th Edition

978-0195168075, 9780195168075

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App