Question: 9. (15 points) A company is considering a new project that requires an investment of $5 million. The project is expected to generate cash flows

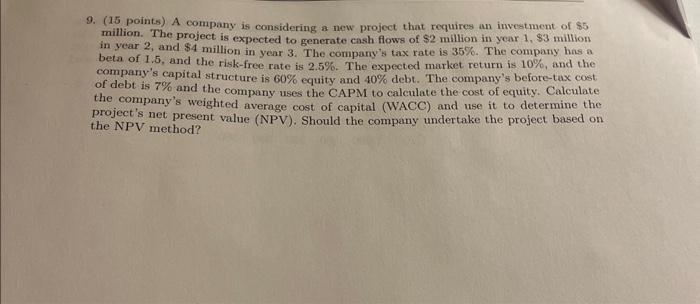

9. (15 points) A company is considering a new project that requires an investment of \$5 million. The project is expected to generate cash flows of $2 million in year 1,$3 million in year 2, and $4 million in year 3 . The company's tax rate is 35%. The company has a beta of 1.5 , and the risk-free rate is 2.5\%. The expected market return is 10%, and the company's capital structure is 60% equity and 40% debt. The company's before-tax cost of debt is 7% and the company uses the CAPM to calculate the cost of equity. Calculate the company's weighted average cost of capital (WACC) and use it to determine the project's net present value (NPV). Should the company undertake the project based on the NPV method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts