Answered step by step

Verified Expert Solution

Question

1 Approved Answer

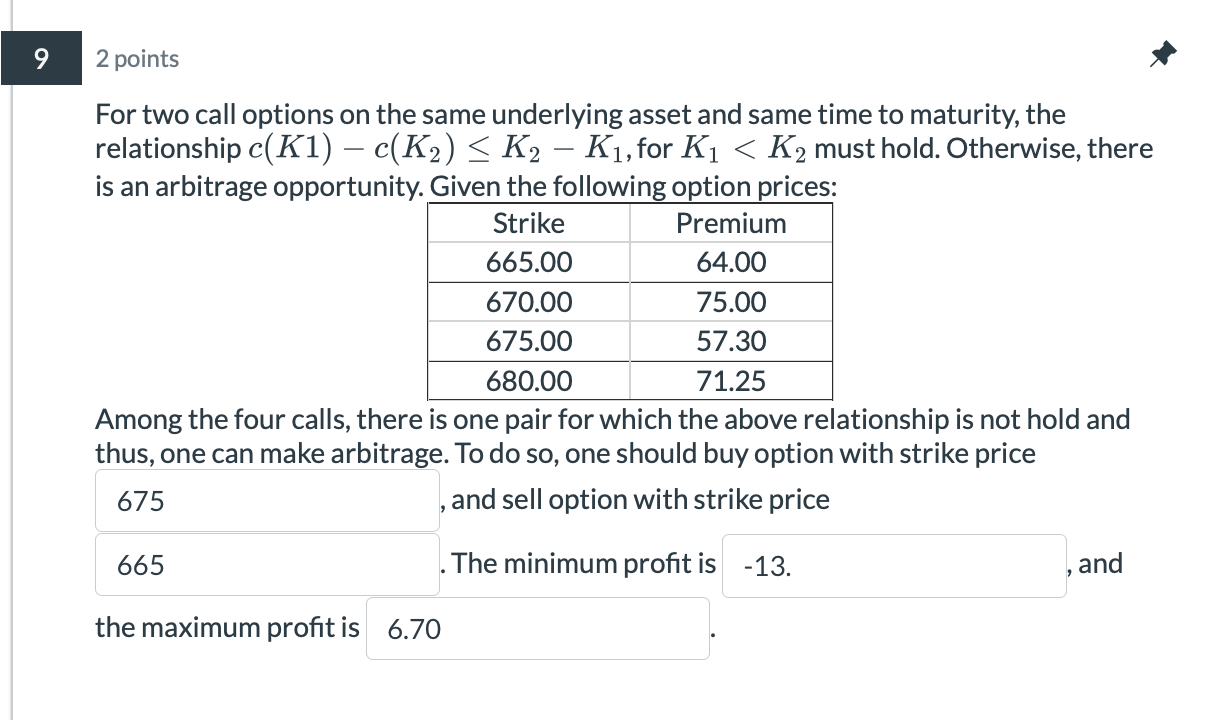

9 2 points For two call options on the same underlying asset and same time to maturity, the relationship c(K1) c(K2) K2 K, for

9 2 points For two call options on the same underlying asset and same time to maturity, the relationship c(K1) c(K2) K2 K, for K < K2 must hold. Otherwise, there is an arbitrage opportunity. Given the following option prices: Strike Premium 665.00 64.00 670.00 75.00 675.00 57.30 680.00 71.25 Among the four calls, there is one pair for which the above relationship is not hold and thus, one can make arbitrage. To do so, one should buy option with strike price 675 and sell option with strike price 665 The minimum profit is -13. the maximum profit is 6.70 and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started