Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. a. Generate a monthly production and inventory schedule in units. Beginning inventory in January is 5,000 units. (Note: To do part a, you

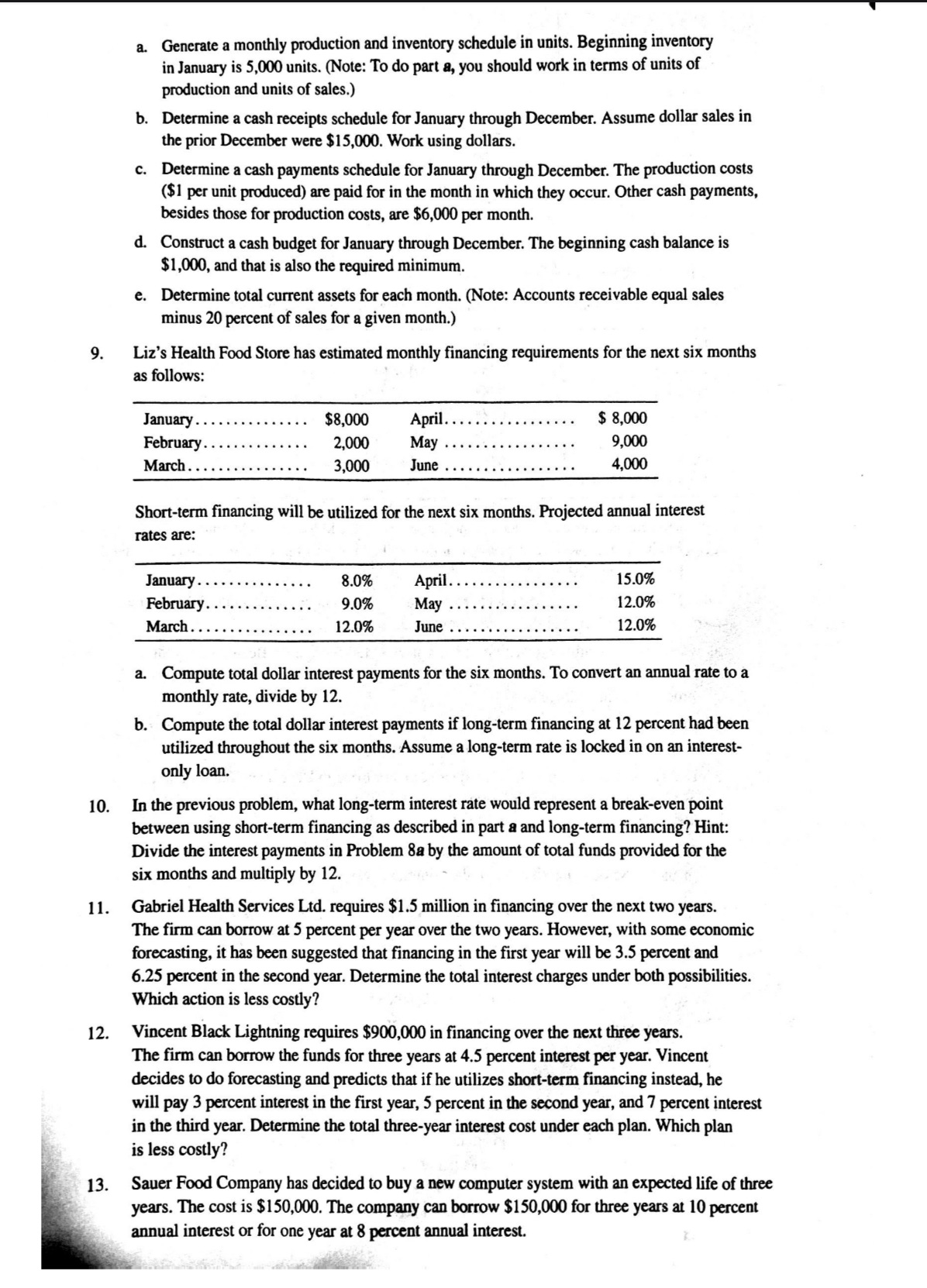

9. a. Generate a monthly production and inventory schedule in units. Beginning inventory in January is 5,000 units. (Note: To do part a, you should work in terms of units of production and units of sales.) b. Determine a cash receipts schedule for January through December. Assume dollar sales in the prior December were $15,000. Work using dollars. c. Determine a cash payments schedule for January through December. The production costs ($1 per unit produced) are paid for in the month in which they occur. Other cash payments, besides those for production costs, are $6,000 per month. d. Construct a cash budget for January through December. The beginning cash balance is $1,000, and that is also the required minimum. e. Determine total current assets for each month. (Note: Accounts receivable equal sales minus 20 percent of sales for a given month.) Liz's Health Food Store has estimated monthly financing requirements for the next six months as follows: January... February. March.. $8,000 April.. 2,000 May 3,000 June $ 8,000 9,000 4,000 Short-term financing will be utilized for the next six months. Projected annual interest rates are: January.. February.. March. 8.0% April. 9.0% May 12.0% June 15.0% 12.0% 12.0% 10. 11. 12. 13. a. Compute total dollar interest payments for the six months. To convert an annual rate to a monthly rate, divide by 12. b. Compute the total dollar interest payments if long-term financing at 12 percent had been utilized throughout the six months. Assume a long-term rate is locked in on an interest- only loan. In the previous problem, what long-term interest rate would represent a break-even point between using short-term financing as described in part a and long-term financing? Hint: Divide the interest payments in Problem 8a by the amount of total funds provided for the six months and multiply by 12. Gabriel Health Services Ltd. requires $1.5 million in financing over the next two years. The firm can borrow at 5 percent per year over the two years. However, with some economic forecasting, it has been suggested that financing in the first year will be 3.5 percent and 6.25 percent in the second year. Determine the total interest charges under both possibilities. Which action is less costly? Vincent Black Lightning requires $900,000 in financing over the next three years. The firm can borrow the funds for three years at 4.5 percent interest per year. Vincent decides to do forecasting and predicts that if he utilizes short-term financing instead, he will pay 3 percent interest in the first year, 5 percent in the second year, and 7 percent interest in the third year. Determine the total three-year interest cost under each plan. Which plan is less costly? Sauer Food Company has decided to buy a new computer system with an expected life of three years. The cost is $150,000. The company can borrow $150,000 for three years at 10 percent annual interest or for one year at 8 percent annual interest.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To generate a monthly production and inventory schedule in units we need to consider the beginning inventory in January and the units of production ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started