Answered step by step

Verified Expert Solution

Question

1 Approved Answer

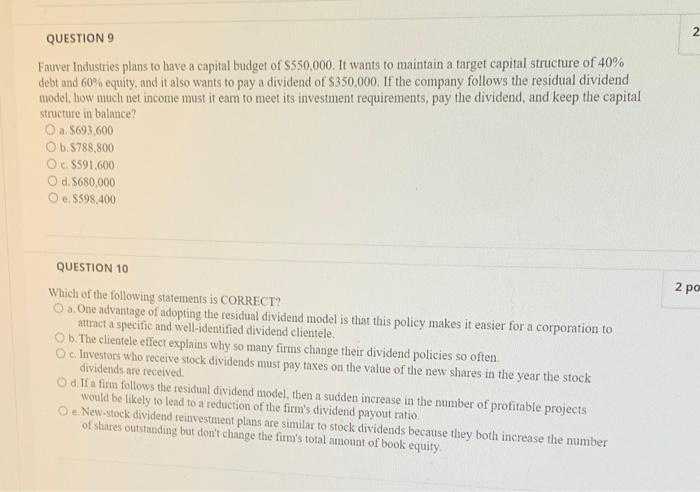

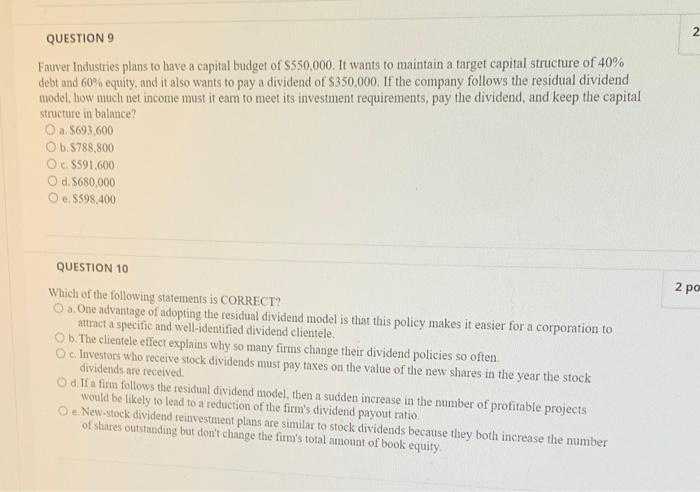

9 and 10 2 QUESTION 9 Fauver Industries plans to have a capital budget of $550,000. It wants to maintain a target capital structure of

9 and 10

2 QUESTION 9 Fauver Industries plans to have a capital budget of $550,000. It wants to maintain a target capital structure of 40% debt and 60% equity, and it also wants to pay a dividend of S350,000. If the company follows the residual dividend model, bow much net income must it earn to meet its investment requirements, pay the dividend, and keep the capital structure in balance? O a 5693,600 O b. 5788,800 O c. 591.600 O d. 5680,000 O $598,400 2 po QUESTION 10 Which of the following statements is CORRECT? O a One advantage of adopting the residual dividend model is that this policy makes it easier for a corporation to attract a specific and well-identified dividend clientele. O b. The clientele effect explains why so many firms change their dividend policies so often Oc. Investors who receive stock dividends must pay taxes on the value of the new shares in the year the stock dividends are received Od If a firm follows the residun dividend model, then a sudden increase in the number of profitable projects would be likely to lead to a reduction of the firm's dividend payout ratio. O e New-stock dividend reinvestment plans are similar to stock dividends because they both increase the number of shares outstanding but don't change the firm's total amount of book equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started