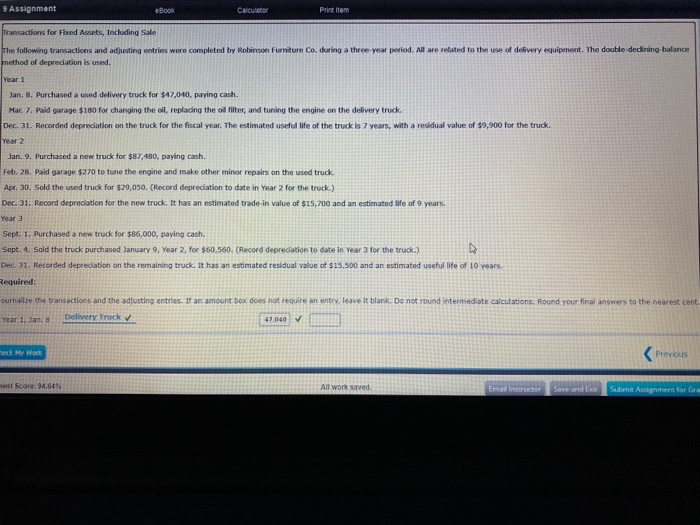

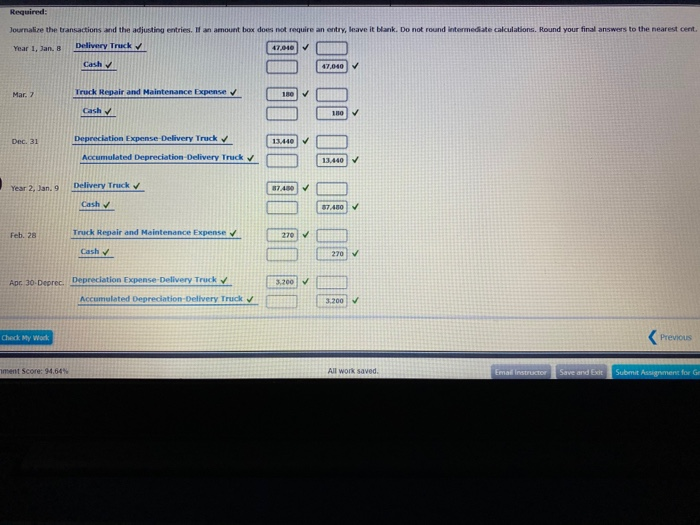

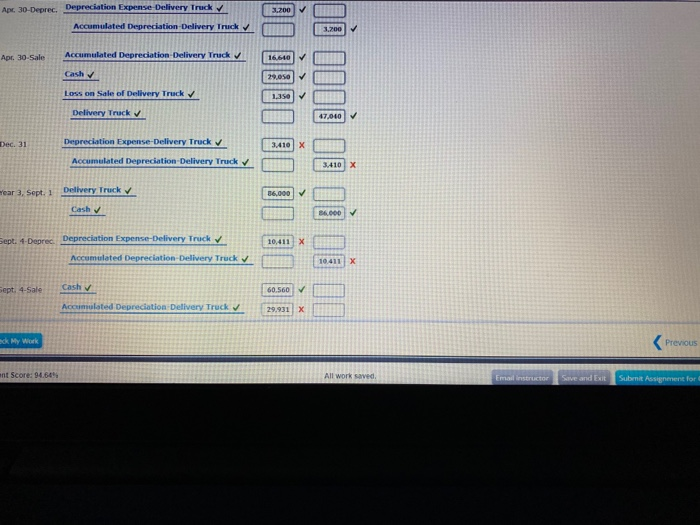

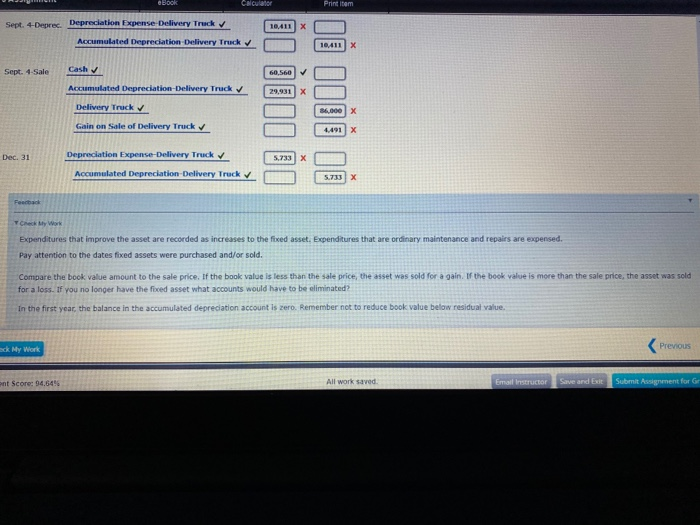

9 Assignment eBook Calculator Print item Transactions for Fred Assets, including Sale The following transactions and adjusting entries were completed method of depredation is used. Robinson Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double dedining-balance Year 1 Jan. 8. Purchased a used delivery truck for $47,010, paying cash. Mar. 7. Paid garage $180 for changing the oil, replacing the oil filter, and tuning the engine on the delivery truck. Dec. 31. Recorded depreciation on the truck for the fiscal year. The estimated useful life of the truck is 7 years, with a residual value of $9,900 for the truck. Year 2 Jan. 9. Purchased a new truck for $87,480, paying cash. Feb. 28. Paid garage $270 to tune the engine and make other minor repairs on the used truck Apt. 30. Sold the used truck for $20,050. (Record depreciation to date in Year 2 for the truck.) Dec. 31. Record depreciation for the new truck. It has an estimated trade-in value of $15,700 and an estimated life of 9 years. Sept. 1. Purchased a new truck for $85,000, paying cash. Sept. 4. Sold the truck purchased January 9, Year 2 for $60,560. (Record depreciation to date in Year 3 for the truck.) Dec. 31. Recorded depreciation on the remaining truck. It has an estimated residual value of $15.500 and an estimated useful life of 10 years. Required: ournalize the transactions and the adjusting entries. If an amount box does not require an entry leave it blank. Do not round intermediate calculations. Round your final answers to the nearest cent. Delivery Truck 47,040 V Year 1, Jan. weck My Work Previous ent Score: 94.64% All work saved Emad Instructor Save and Submit Anment for Grm Required Journalize the transactions and the adjusting entries. If an amount box does not require an entry, leave it blank. Do not round Intermediate calculations. Round your final answers to the nearest cent. Year 1, Jan. 8 Delivery Truck 47.010 Cash 47,040 Mar. 7 Truck Repair and Maintenance Expense 180 Cash 10 Dec. 31 13440 Depreciation Expense-Delivery Truck Accumulated Depreciation Delivery Truck 13.440 Year 2, Jan. 9 Delivery Truck 37450 Cash 87.480 Feb. 28 Truck Repair and Maintenance Expense 270 Cash 2707 3.2007 Apr 30.Deprec. Depreciation Expense-Delivery Track Accumulated Depreciation-Delivery Truck 3.200 Check My Work Previous ment Score: 94.64 All work saved. Emal instructor Save and Edit Submit Assignment for G Apc 30-Deprec. Depreciation Expense Delivery Truck 1.700 Accumulated Depreciation Delivery Truck 1.200 Apr. 30-Sale Accumulated Depreciation-Delivery Truck 16.610 Cash 29.050 1.350 Loss on Sale of Delivery Truck Delivery Truck 47,040 Dec. 31 Depreciation Expense-Delivery Truck 3.410 X Accumulated Depreciation-Delivery Truck 3.410X wear 3, Sept. 1 Delivery Truck 36.000 Cash BA000 10,411 X Sept. 4 Deprec. Depreciation Expense-Delivery Truck Accumulated Depreciation-Delivery Truck 10.411X Sept. 4-Sale Cash 60.560 Accumulated Depreciation Delivery Truck v 29.931 sck My Work Previous ant Score: 94.64 All work saved Email instructor Save and Exit Submit Assignment for eBook Calculator Print item 10411 Sept. 4-Deprec. Depreciation Expense Delivery Truck Accumulated Depreciation Delivery Truck 10411 X Sept. 4-Sale Cash 60,560 29,931 x Accumulated Depreciation-Delivery Truck Delivery Truck Gain on Sale of Delivery Truck 84.000 x 4491 x Dec. 31 Depreciation Expense-Delivery Truck 5.733 X Accumulated Depreciation Delivery Truck 5.733 X Feedback Check My Work Expenditures that improve the asset are recorded as increases to the fixed asset. Expenditures that are ordinary maintenance and repairs are expenses. Pay attention to the dates fixed assets were purchased and/or sold. Compare the book value amount to the sale price. If the book value is less than the sale price, the asset was sold for a gain. If the book value is more than the sale price, the asset was sold for a loss. If you no longer have the fixed asset what accounts would have to be eliminated? In the first year the balance in the accumulated depreciation account is zero. Remember not to reduce book value below residual value. sck My Work