Answered step by step

Verified Expert Solution

Question

1 Approved Answer

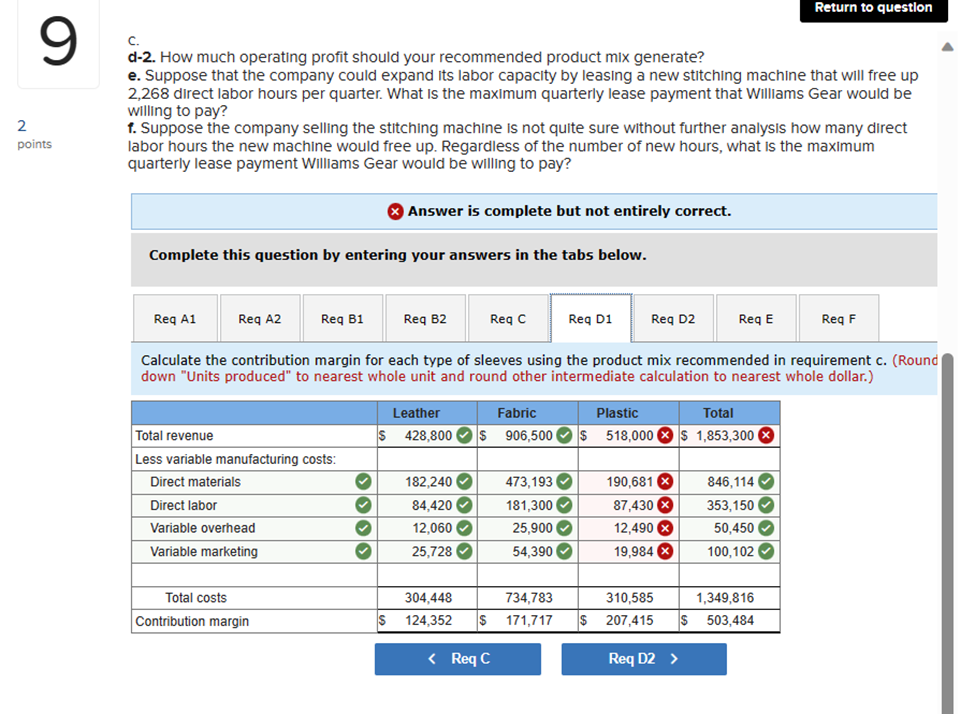

9 C. 2 points Return to question d-2. How much operating profit should your recommended product mix generate? e. Suppose that the company could

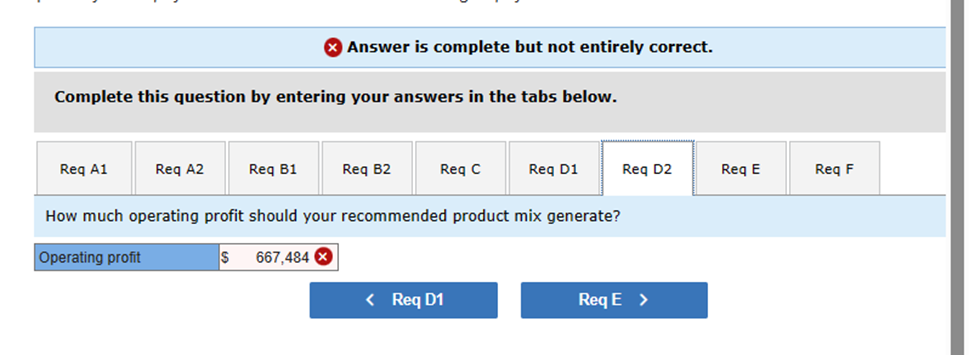

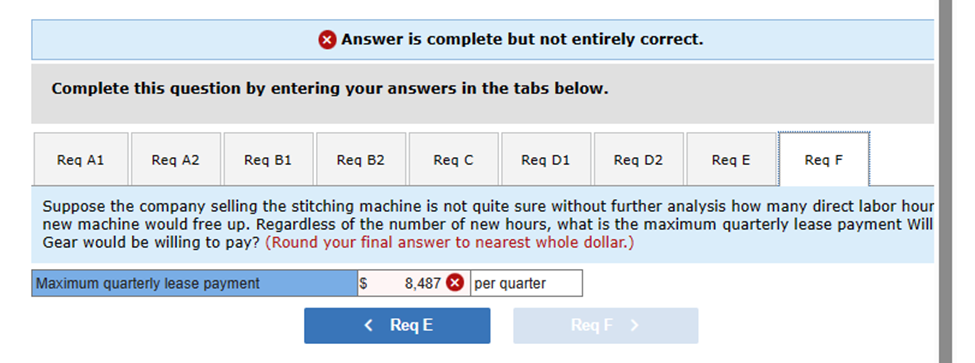

9 C. 2 points Return to question d-2. How much operating profit should your recommended product mix generate? e. Suppose that the company could expand its labor capacity by leasing a new stitching machine that will free up 2,268 direct labor hours per quarter. What is the maximum quarterly lease payment that Williams Gear would be willing to pay? f. Suppose the company selling the stitching machine is not quite sure without further analysis how many direct labor hours the new machine would free up. Regardless of the number of new hours, what is the maximum quarterly lease payment Williams Gear would be willing to pay? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B1 Req B2 Req C Req D1 Req D2 Req E Req F Calculate the contribution margin for each type of sleeves using the product mix recommended in requirement c. (Round down "Units produced" to nearest whole unit and round other intermediate calculation to nearest whole dollar.) Leather Fabric Plastic Total Total revenue $ 428,800 $ 906,500 $ 518,000 $ 1,853,300 Less variable manufacturing costs: Direct materials Direct labor 182,240 473,193 190,681 846,114 84,420 181,300 87,430 x 353,150 Variable overhead 12,060 25,900 12,490 50,450 Variable marketing 25,728 54,390 19,984 x 100,102 Total costs Contribution margin 304,448 734,783 $ 124,352 $ 171,717 < Req C 310,585 1,349,816 $ 207,415 $ 503,484 Req D2 > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B1 Req B2 Req C Req D1 Req D2 Req E Req F How much operating profit should your recommended product mix generate? Operating profit 667,484 < Req D1 ReqE > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B1 Req B2 Req C Req D1 Req D2 Req E Req F Suppose the company selling the stitching machine is not quite sure without further analysis how many direct labor hour new machine would free up. Regardless of the number of new hours, what is the maximum quarterly lease payment Will Gear would be willing to pay? (Round your final answer to nearest whole dollar.) Maximum quarterly lease payment $ 8,487 per quarter < Req E Req F >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started