Answered step by step

Verified Expert Solution

Question

1 Approved Answer

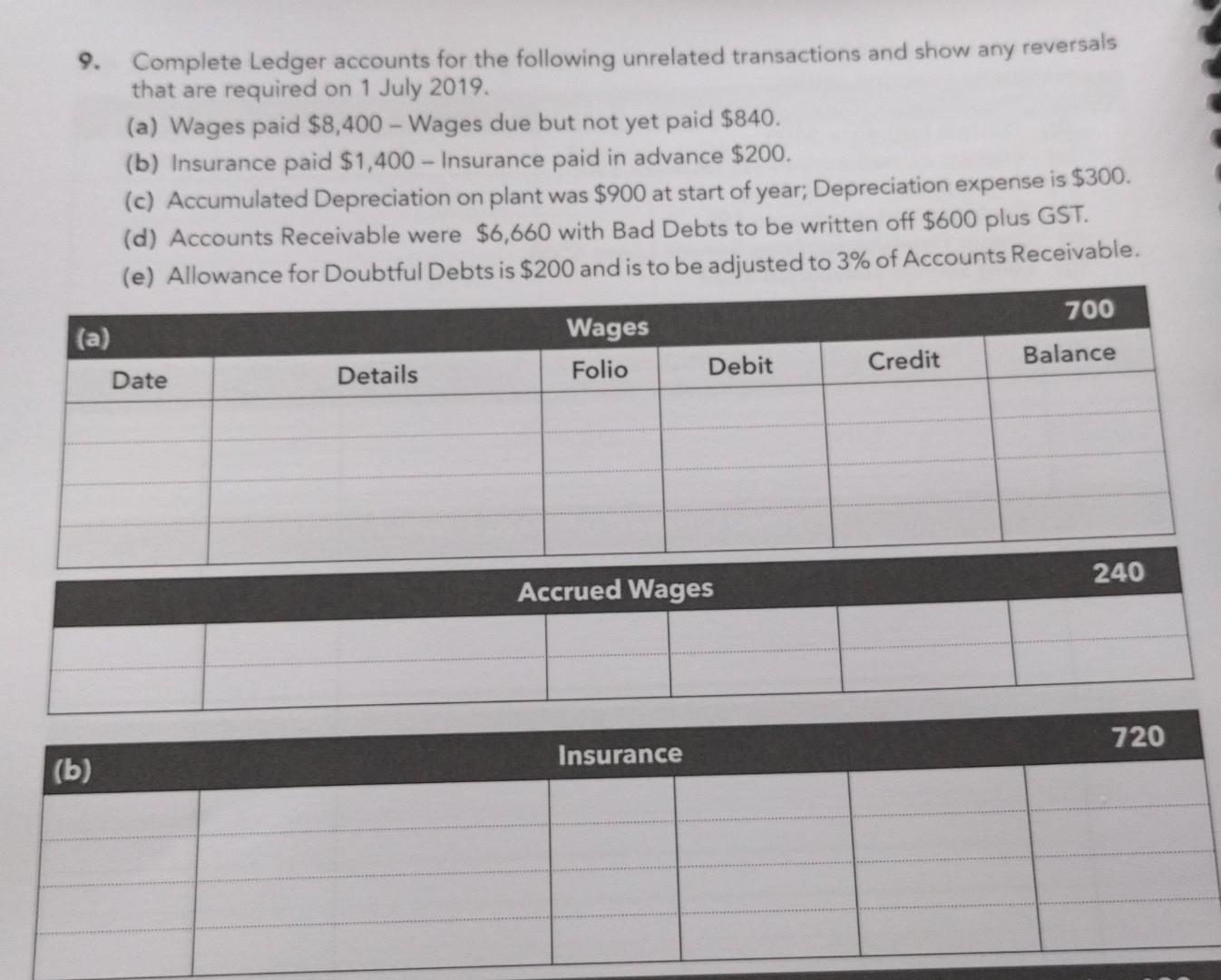

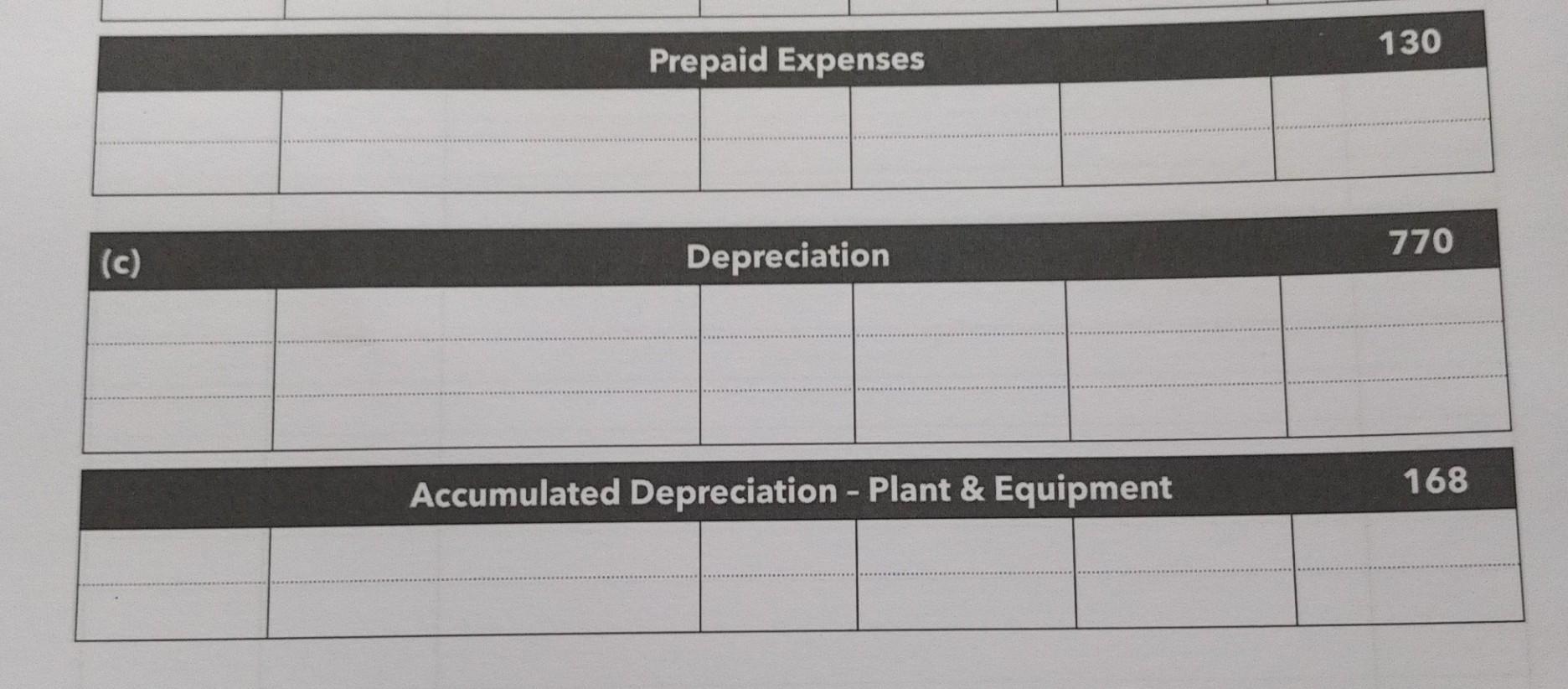

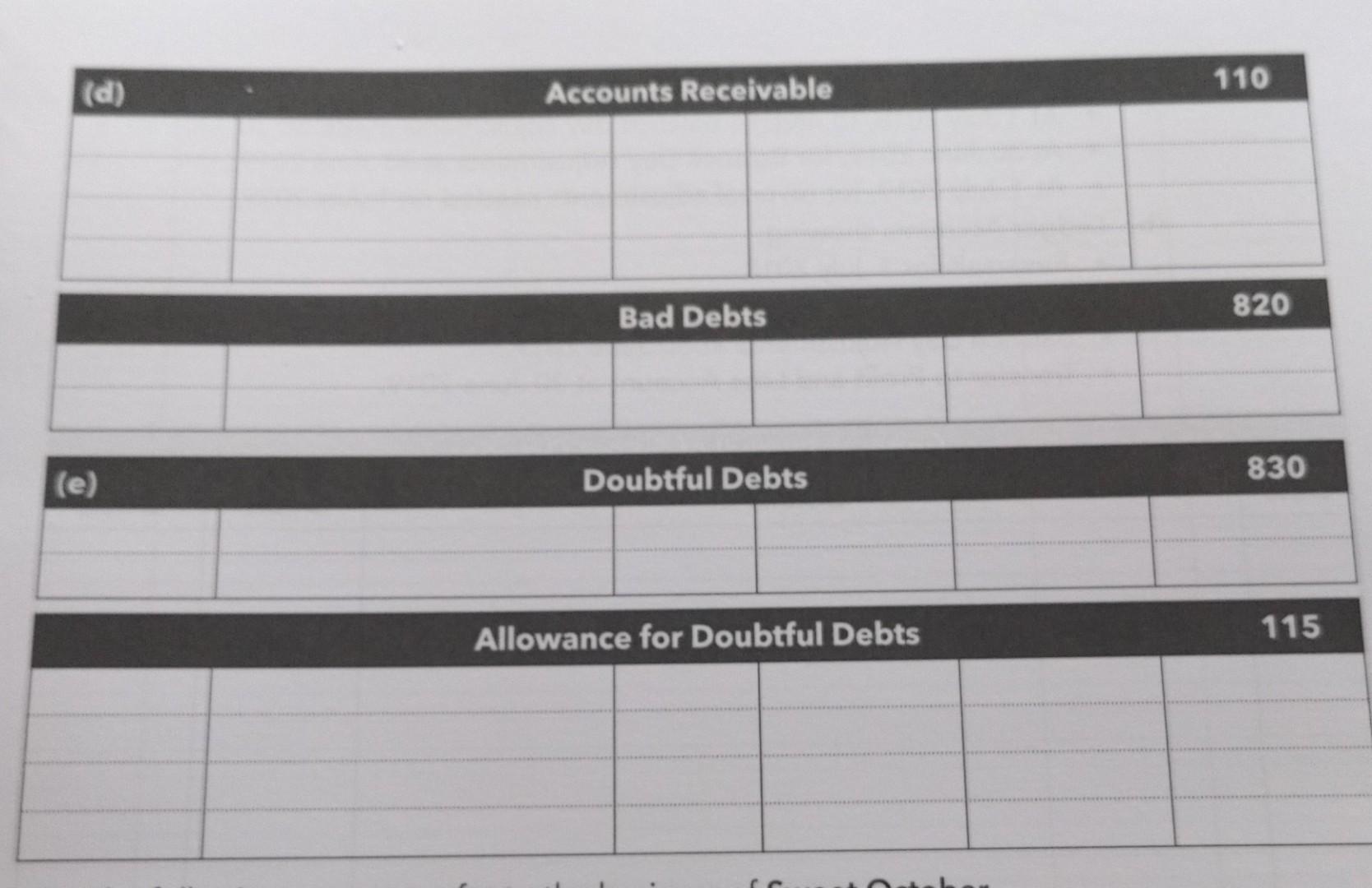

9. Complete Ledger accounts for the following unrelated transactions and show any reversals that are required on 1 July 2019. (a) Wages paid ( $

9. Complete Ledger accounts for the following unrelated transactions and show any reversals that are required on 1 July 2019. (a) Wages paid \\( \\$ 8,400 \\) - Wages due but not yet paid \\( \\$ 840 \\). (b) Insurance paid \\( \\$ 1,400 \\) - Insurance paid in advance \\( \\$ 200 \\). (c) Accumulated Depreciation on plant was \\( \\$ 900 \\) at start of year; Depreciation expense is \\( \\$ 300 \\). (d) Accounts Receivable were \\( \\$ 6,660 \\) with Bad Debts to be written off \\( \\$ 600 \\) plus GST. (e) Allowance for Doubtful Debts is \\( \\$ 200 \\) and is to be adjusted to \3 of Accounts Receivable. \\begin{tabular}{|l|l|l|l|l|l|} \\hline \\multicolumn{3}{|c|}{ Prepaid Expenses 130} \\\\ \\hline & & & & & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|l|l|l|l|} \\hline (c) & \\multicolumn{3}{|c|}{ Depreciation } & \\\\ \\hline & & & & & \\\\ \\hline & & & & & \\\\ \\hline \\end{tabular} Accumulated Depreciation - Plant \\& Equipment 168 \\begin{tabular}{|l|l|l|l|} \\hline (d) & Accounts Receivable & 110 \\\\ \\hline & & & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|l|l|l|} \\hline & \\multicolumn{3}{|c|}{ Bad Debts } & \\( \\mathbf{8 2 0} \\) \\\\ \\hline & & & & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|l|l|l|l|} \\hline \\multicolumn{2}{|c|}{ Allowance for Doubtful Debts } & 115 \\\\ \\hline & & & & & \\\\ \\hline \\end{tabular} 9. Complete Ledger accounts for the following unrelated transactions and show any reversals that are required on 1 July 2019. (a) Wages paid \\( \\$ 8,400 \\) - Wages due but not yet paid \\( \\$ 840 \\). (b) Insurance paid \\( \\$ 1,400 \\) - Insurance paid in advance \\( \\$ 200 \\). (c) Accumulated Depreciation on plant was \\( \\$ 900 \\) at start of year; Depreciation expense is \\( \\$ 300 \\). (d) Accounts Receivable were \\( \\$ 6,660 \\) with Bad Debts to be written off \\( \\$ 600 \\) plus GST. (e) Allowance for Doubtful Debts is \\( \\$ 200 \\) and is to be adjusted to \3 of Accounts Receivable. \\begin{tabular}{|l|l|l|l|l|l|} \\hline \\multicolumn{3}{|c|}{ Prepaid Expenses 130} \\\\ \\hline & & & & & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|l|l|l|l|} \\hline (c) & \\multicolumn{3}{|c|}{ Depreciation } & \\\\ \\hline & & & & & \\\\ \\hline & & & & & \\\\ \\hline \\end{tabular} Accumulated Depreciation - Plant \\& Equipment 168 \\begin{tabular}{|l|l|l|l|} \\hline (d) & Accounts Receivable & 110 \\\\ \\hline & & & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|l|l|l|} \\hline & \\multicolumn{3}{|c|}{ Bad Debts } & \\( \\mathbf{8 2 0} \\) \\\\ \\hline & & & & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|l|l|l|l|} \\hline \\multicolumn{2}{|c|}{ Allowance for Doubtful Debts } & 115 \\\\ \\hline & & & & & \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started