Answered step by step

Verified Expert Solution

Question

1 Approved Answer

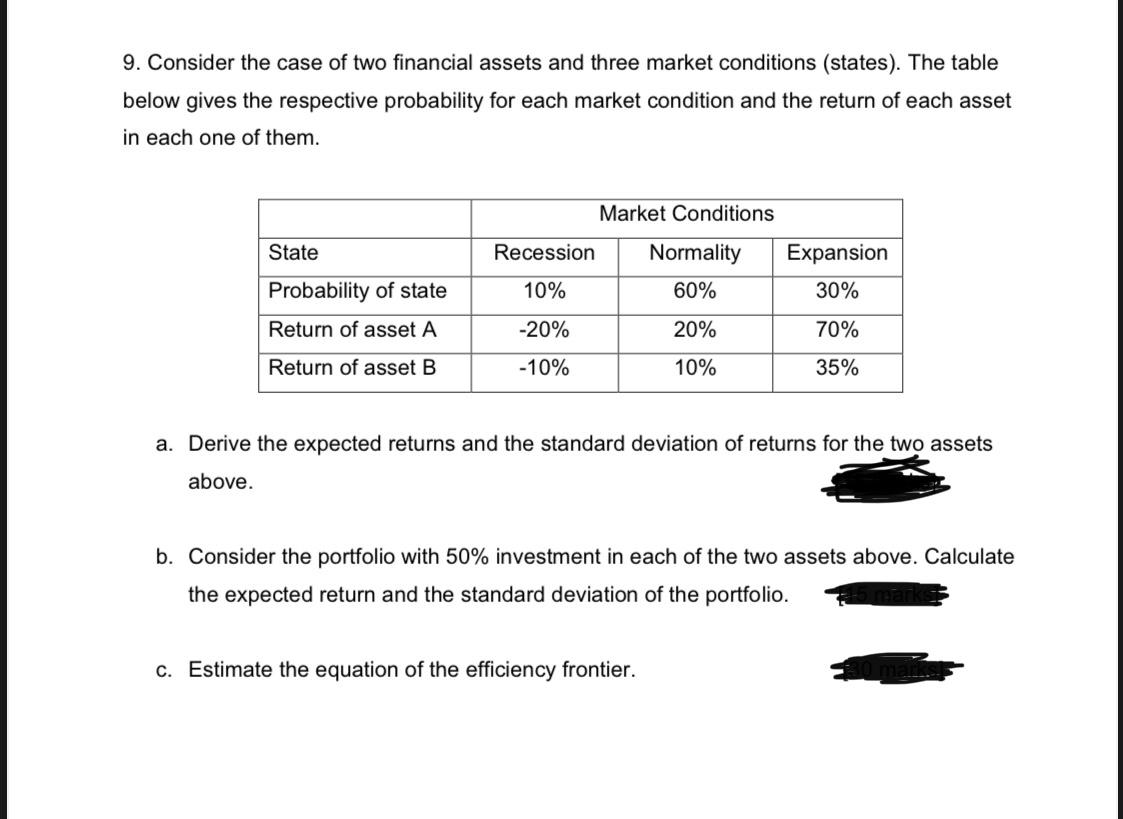

9. Consider the case of two financial assets and three market conditions (states). The table below gives the respective probability for each market condition

9. Consider the case of two financial assets and three market conditions (states). The table below gives the respective probability for each market condition and the return of each asset in each one of them. Market Conditions State Recession Normality Expansion Probability of state 10% 60% 30% Return of asset A -20% 20% 70% Return of asset B -10% 10% 35% a. Derive the expected returns and the standard deviation of returns for the two assets above. b. Consider the portfolio with 50% investment in each of the two assets above. Calculate the expected return and the standard deviation of the portfolio. c. Estimate the equation of the efficiency frontier.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The question is related Portfolio Management The expected return is calculated with the help of following formula Erp Retun Probability Calculation of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started