Answered step by step

Verified Expert Solution

Question

1 Approved Answer

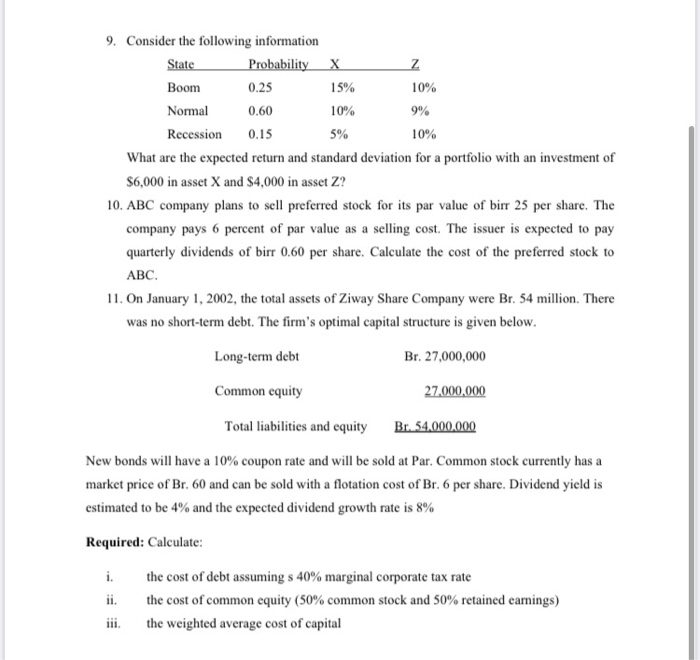

9. Consider the following information State Boom Normal Recession Probability X Z 0.25 15% 10% 0.60 10% 9% 0.15 5% 10% What are the expected

9. Consider the following information

State Boom Normal Recession

Probability X Z 0.25 15% 10% 0.60 10% 9% 0.15 5% 10%

What are the expected return and standard deviation for a portfolio with an investment of

$6,000 in asset X and $4,000 in asset Z?

10. ABC company plans to sell preferred stock for its par value of birr 25 per share. The

company pays 6 percent of par value as a selling cost. The issuer is expected to pay quarterly dividends of birr 0.60 per share. Calculate the cost of the preferred stock to ABC.

11. On January 1, 2002, the total assets of Ziway Share Company were Br. 54 million. There was no short-term debt. The firms optimal capital structure is given below.

Long-term debt Common equity

Total liabilities and equity

Br. 27,000,000 27,000,000

Br. 54,000,000

New bonds will have a 10% coupon rate and will be sold at Par. Common stock currently has a market price of Br. 60 and can be sold with a flotation cost of Br. 6 per share. Dividend yield is estimated to be 4% and the expected dividend growth rate is 8%

Required: Calculate:

i. the cost of debt assuming s 40% marginal corporate tax rate

ii. the cost of common equity (50% common stock and 50% retained earnings)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started