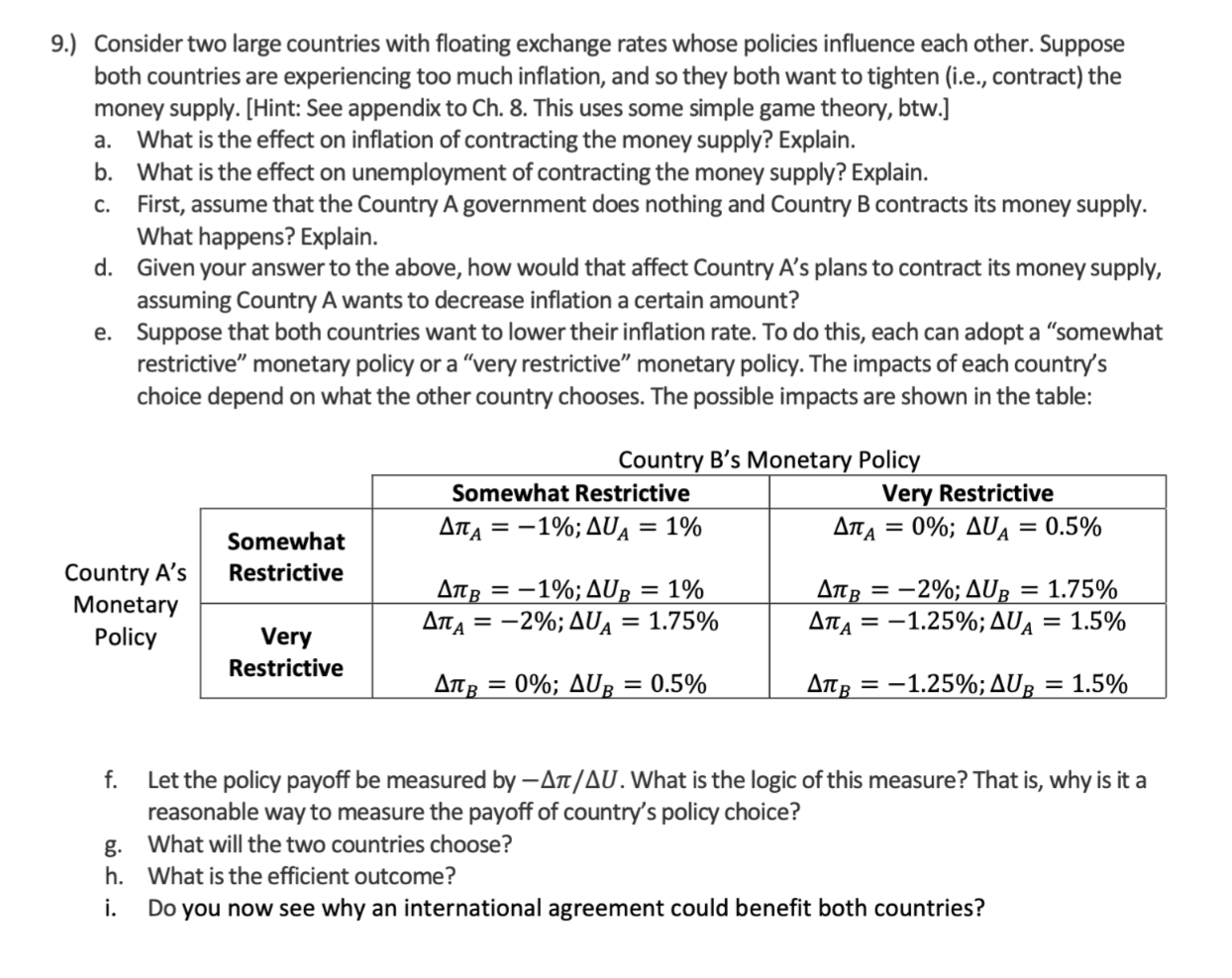

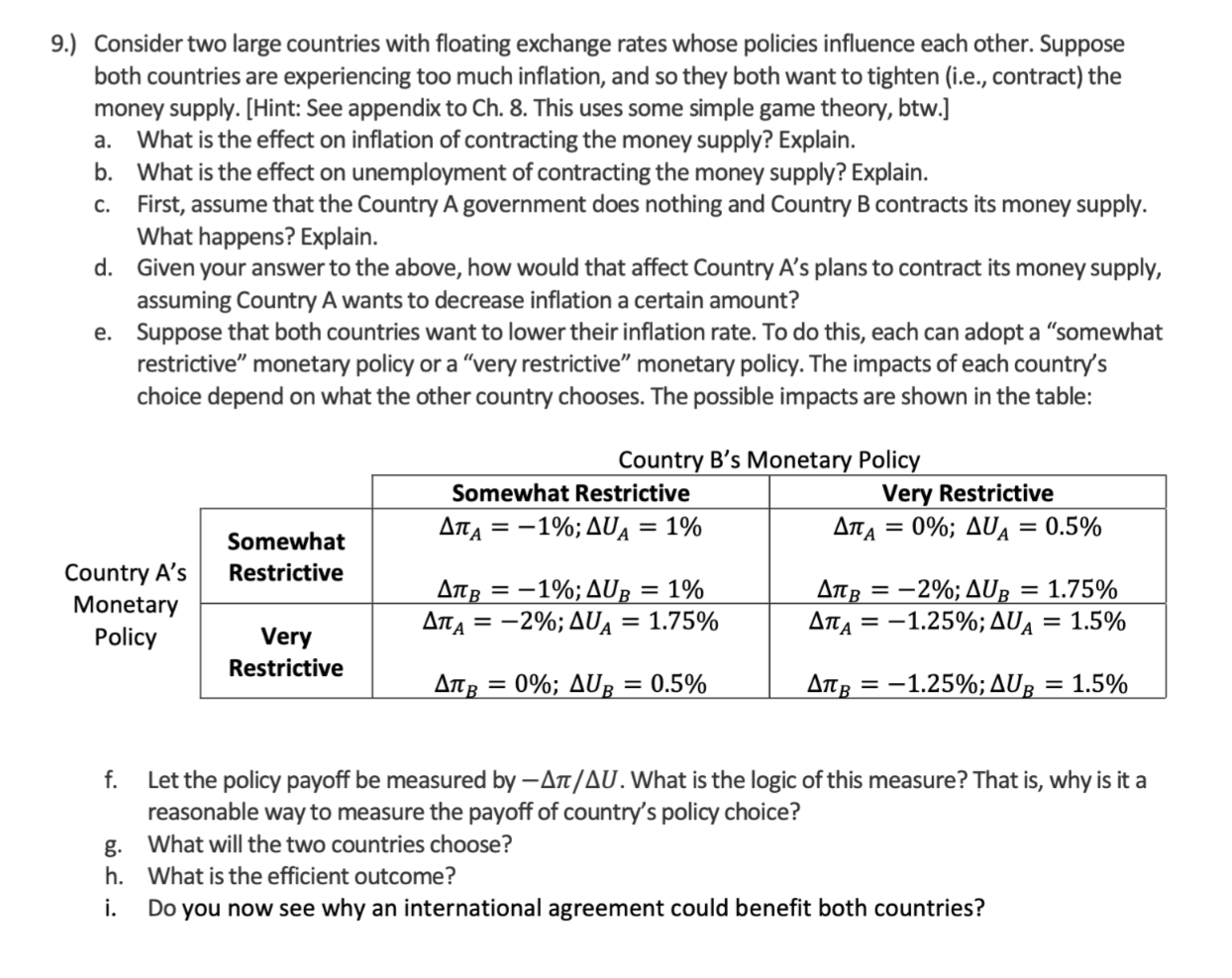

9.) Consider two large countries with floating exchange rates whose policies influence each other. Suppose both countries are experiencing too much inflation, and so they both want to tighten (i.e., contract) the money supply. (Hint: See appendix to Ch. 8. This uses some simple game theory, btw.] a. What is the effect on inflation of contracting the money supply? Explain. b. What is the effect on unemployment of contracting the money supply? Explain. C. First, assume that the Country A government does nothing and Country B contracts its money supply. What happens? Explain. d. Given your answer to the above, how would that affect Country A's plans to contract its money supply, assuming Country A wants to decrease inflation a certain amount? e. Suppose that both countries want to lower their inflation rate. To do this, each can adopt a somewhat restrictive monetary policy or a very restrictive monetary policy. The impacts of each country's choice depend on what the other country chooses. The possible impacts are shown in the table: Country Bs Monetary Policy Somewhat Restrictive Very Restrictive Anta = -1%;AUA = 1% 0%; UA = 0.5% = Somewhat Restrictive Country A's Monetary Policy Altb = -1%; AUB = 1% = -2%; UA = 1.75% Anto = -2%; AUB = 1.75% = -1.25%; UA = 1.5% Very Restrictive B = 0%; UR = 0.5% Ang = -1.25%; AUR = 1.5% f. Let the policy payoff be measured by -AM/AU. What is the logic of this measure? That is, why is it a reasonable way to measure the payoff of country's policy choice? g. What will the two countries choose? h. What is the efficient outcome? i. Do you now see why an international agreement could benefit both countries? 9.) Consider two large countries with floating exchange rates whose policies influence each other. Suppose both countries are experiencing too much inflation, and so they both want to tighten (i.e., contract) the money supply. (Hint: See appendix to Ch. 8. This uses some simple game theory, btw.] a. What is the effect on inflation of contracting the money supply? Explain. b. What is the effect on unemployment of contracting the money supply? Explain. C. First, assume that the Country A government does nothing and Country B contracts its money supply. What happens? Explain. d. Given your answer to the above, how would that affect Country A's plans to contract its money supply, assuming Country A wants to decrease inflation a certain amount? e. Suppose that both countries want to lower their inflation rate. To do this, each can adopt a somewhat restrictive monetary policy or a very restrictive monetary policy. The impacts of each country's choice depend on what the other country chooses. The possible impacts are shown in the table: Country Bs Monetary Policy Somewhat Restrictive Very Restrictive Anta = -1%;AUA = 1% 0%; UA = 0.5% = Somewhat Restrictive Country A's Monetary Policy Altb = -1%; AUB = 1% = -2%; UA = 1.75% Anto = -2%; AUB = 1.75% = -1.25%; UA = 1.5% Very Restrictive B = 0%; UR = 0.5% Ang = -1.25%; AUR = 1.5% f. Let the policy payoff be measured by -AM/AU. What is the logic of this measure? That is, why is it a reasonable way to measure the payoff of country's policy choice? g. What will the two countries choose? h. What is the efficient outcome? i. Do you now see why an international agreement could benefit both countries