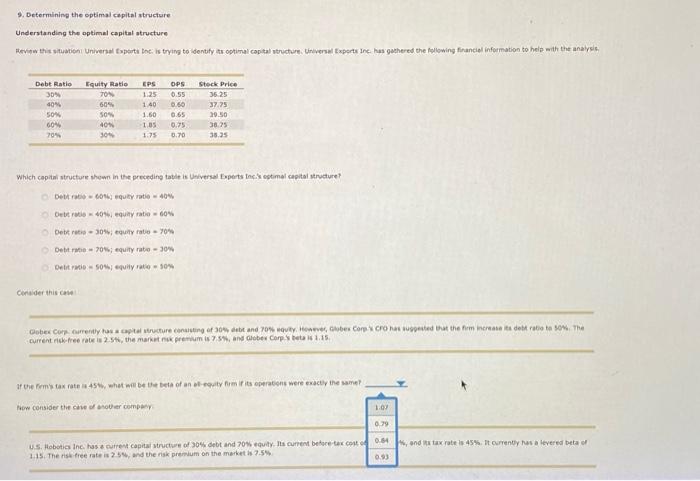

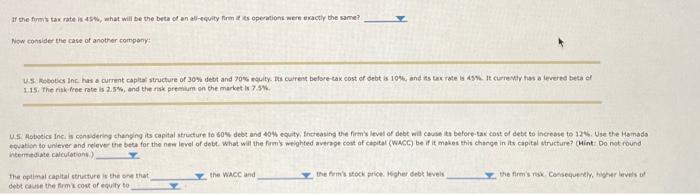

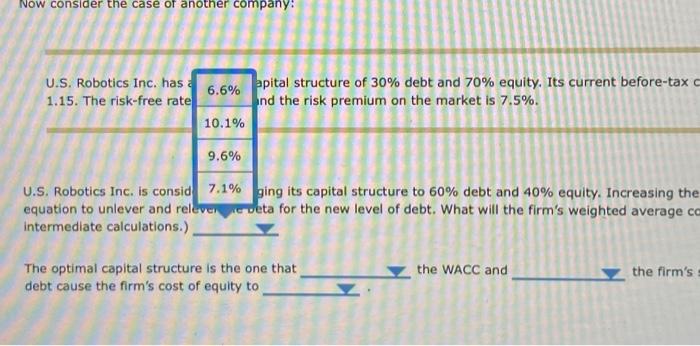

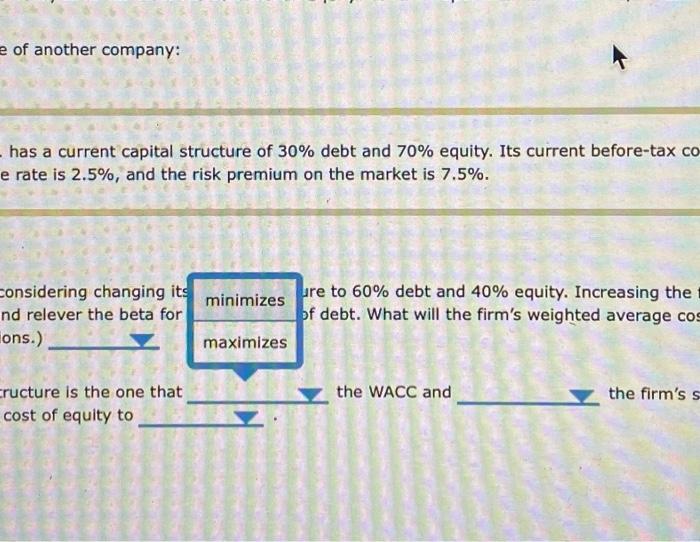

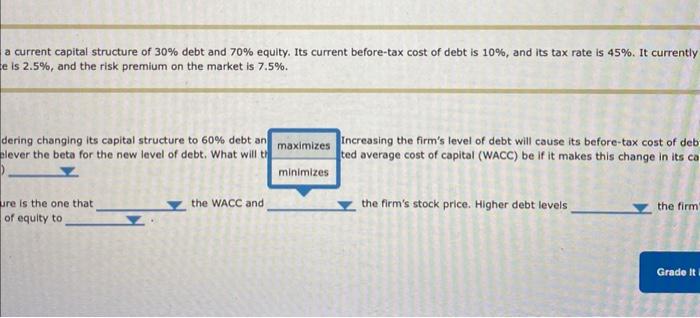

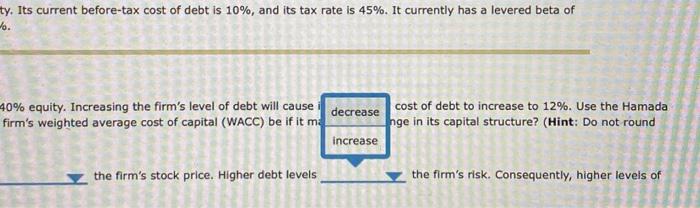

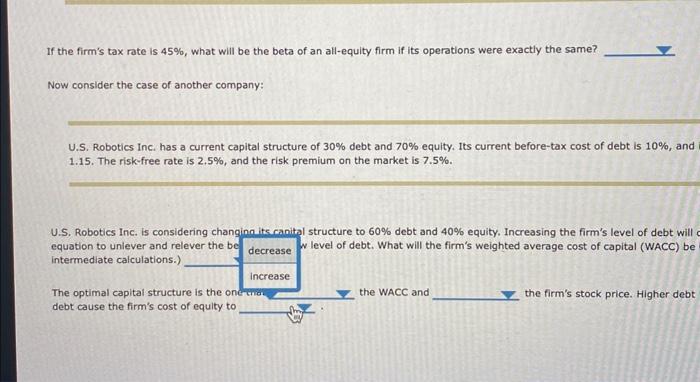

9. Determining the optimal capital atructure Understanding the optimal capital atructure Deth intis w esecy iqutiontio =40% Oete retis =4046, equiny ratio =60% Detit rate =70 s; ; equiry rate =30w Consider this cale 1.15. The risk free rate is 25%, and the risk premium on the markt is 7.5% U.S. Robotics Inc. has : 1.15. The risk-free rate U.S. Robotics Inc. is consid equation to unlever and relever intermediate calculations.) apital structure of 30% debt and 70% equity. Its current before-tax ind the risk premium on the market is 7.5%. ging its capital structure to 60% debt and 40% equity. Increasing the for the new level of debt. What will the firm's weighted average for the new level of debt. What will the firm's weighted average ce cc The optimal capital structure is the one that the WACC and the firm's debt cause the firm's cost of equity to of another company: has a current capital structure of 30% debt and 70% equity. Its current before-tax co e rate is 2.5%, and the risk premium on the market is 7.5%. considering changing its nd relever the beta for are to 60% debt and 40% equity. Increasing the ons.) f debt. What will the firm's weighted average cos ructure is the one that the WACC and the firm's s cost of equity to a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 10%, and its tax rate is 45%. It currently e is 2.5%, and the risk premium on the market is 7.5%. dering changing its capital structure to 60% debt an lever the beta for the new level of debt. What will t ) ure is the one that the WACC and of equity to Increasing the firm's level of debt will cause its before-tax cost of deb ied average cost of capital (WACC) be if it makes this change in its ca the firm's stock price. Higher debt levels the firm's stock price. Higher debt levels the firm ty. Its current before-tax cost of debt is 10%, and its tax rate is 45%. It currently has a levered beta of \%. 40% equity. Increasing the firm's level of debt will cause firm's weighted average cost of capital (WACC) be if it m cost of debt to increase to 12%. Use the Hamada nge in its capital structure? (Hint: Do not round the firm's stock price. Higher debt levels the firm's risk. Consequently, higher levels of If the firm's tax rate is 45%, what will be the beta of an all-equity firm if its operations were exactly the same? Now consider the case of another company: U.S. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 10%, and 1.15. The risk-free rate is 2.5%, and the risk premium on the market is 7.5%. U.S. Robotics Inc. is considering changina its canital structure to 60% debt and 40% equity. Increasing the firm's level of debt will equation to uniever and relever the be intermediate calculations.) w level of debt. What will the firm's weighted average cost of capital (WACC) be The optimal capital structure is the on the WACC and the firm's stock price. Higher debt debt cause the firm's cost of equity to